Breakout trading is one of the most popular strategies used by futures traders. When a futures contract moves outside of a defined support or resistance level, it can signal the start of a new trend. These moves often come with a surge in volume and volatility, which makes them attractive for short-term traders and swing traders alike.

In this article, we’ll break down what a breakout is, how to spot one, and the key strategies used by futures traders to take advantage of breakout opportunities. Whether you’re trading crude oil, equity index futures, or micro contracts, understanding how to trade breakouts can give you a major edge.

Key Takeaways

- A breakout in trading is when the price moves beyond key support or resistance levels, often signaling the start of a new trend. Futures traders look for breakouts to identify strong directional moves and capitalize on early momentum.

- Breakout trading strategies work well in futures markets due to high volatility, leverage, and consistent liquidity. These market conditions amplify price movement, making breakout setups more impactful and tradable.

- Successful breakout trading relies on confirmation signals like volume, retests, and indicator support. Confirming the breakout helps filter out false moves and improves entry timing and trade reliability.

- Futures traders can apply various breakout strategies using technical patterns, risk management rules, and demo testing. From triangle breakouts to opening range plays, having a structured plan and practicing with a demo account are key to long-term success.

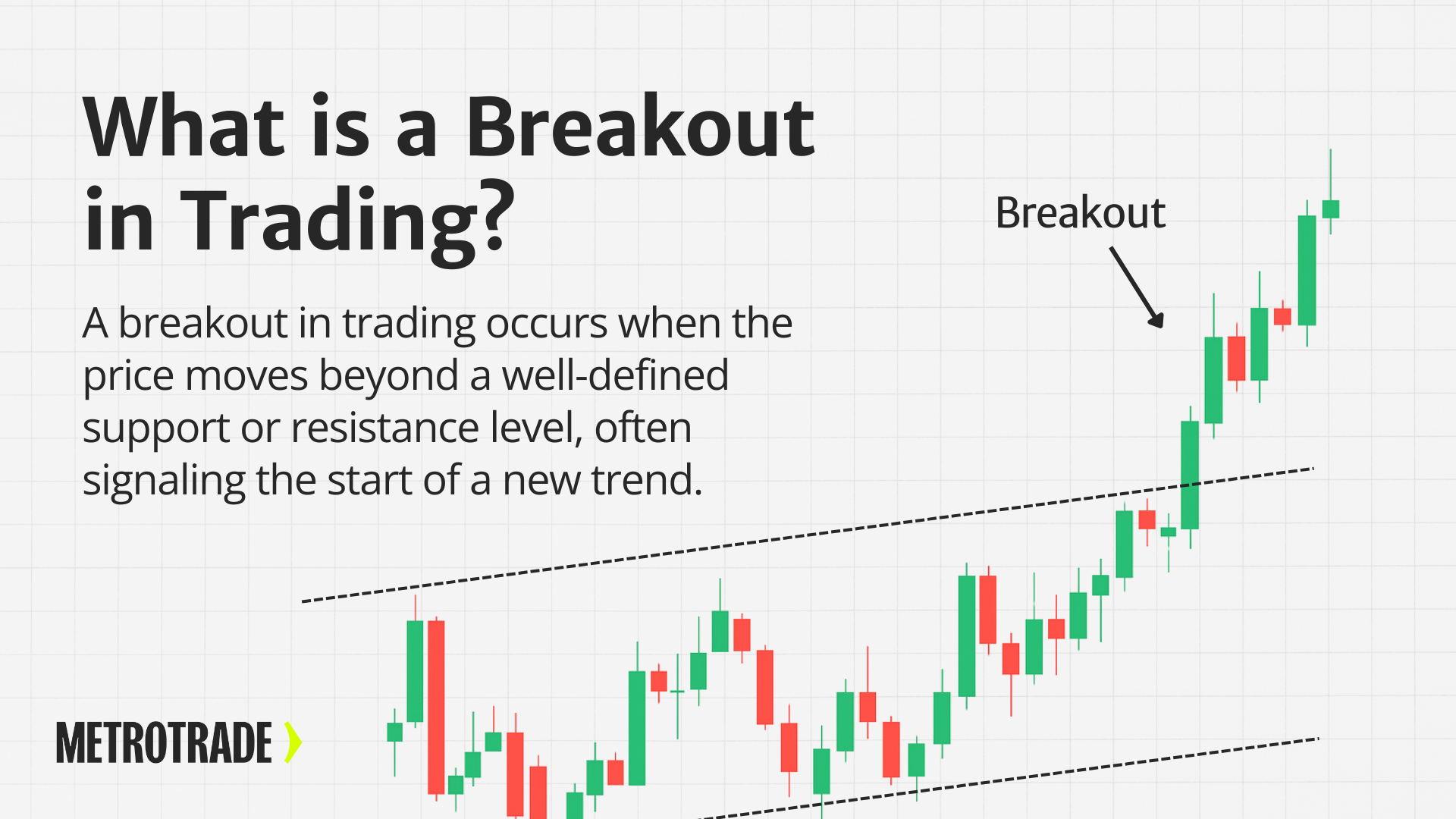

What Is a Breakout in Trading?

A breakout in trading happens when the price of an asset moves outside of a clearly defined range. In most cases, this means price pushes above a resistance level or falls below a support level. When this happens, it often marks the beginning of a new trend, as buyers or sellers gain control of the market.

In the context of futures trading, breakouts are especially important because they can lead to sharp price movements over a short period. Since futures contracts are often leveraged and highly liquid, even a small breakout can result in meaningful gains or losses.

Understanding Support and Resistance

To understand breakouts, you first need to understand support and resistance:

- Support is a price level where buying tends to come in and stop prices from falling further. It acts like a floor.

- Resistance is a level where selling tends to increase, preventing the price from rising. It acts like a ceiling.

When price “breaks” through either of these levels, it signals a shift in market sentiment. For example, if the price breaks through resistance, it may mean that demand is strong enough to overcome selling pressure. This could signal the start of a bullish trend. If price breaks down through support, it may indicate that sellers have overwhelmed buyers, kicking off a bearish move.

Breakouts and Trend Formation

Breakouts are often used as entry signals for traders who want to trade the start of a trend. For example, a breakout trader may buy a futures contract when it moves above a key resistance level and sell it when it reaches a target price. The logic is that once price escapes a range, it has room to run.

In this way, breakouts help traders avoid getting stuck in sideways or “choppy” markets. Instead of guessing when the market will move, breakout traders wait for a clear signal that momentum is building.

Upside vs Downside Breakouts

There are two main types of breakouts:

- Upside Breakout: Price breaks above a resistance level. This may signal the start of a bullish trend or a continuation of an existing one.

- Downside Breakout: Price falls below a support level. This may trigger a bearish move or a trend reversal.

In both cases, the breakout is considered more reliable when it’s accompanied by high volume, strong price movement, and confirmation from other technical indicators.

Breakouts in Futures Markets

Breakouts happen across all futures markets, from equity index futures like the E-mini S&P 500 to commodity futures like crude oil, gold, and natural gas. Currency futures and interest rate futures also respond strongly to breakout setups, especially around economic news and data releases.

Because futures are often traded with leverage, breakout moves can result in quick profits or steep losses. This makes risk management and confirmation signals critical parts of any breakout trading strategy.

Why Breakouts Matter in Futures Trading

Futures markets are known for their speed, leverage, and volatility. These conditions make them ideal for breakout trading strategies. Breakouts allow traders to enter early in a potential trend, where the price movement can be fast and substantial.

Key reasons breakout trading works well in futures:

- Leverage magnifies price movements, making small breakouts potentially profitable.

- Liquidity in popular futures contracts allows for quick entries and exits.

- News events and economic data can trigger sharp breakouts, especially in energy, equity index, or currency futures.

Common Breakout Patterns to Know

Many breakout trading strategies are built around specific price patterns that appear on charts. These patterns often signal that a market is coiling, consolidating, or building pressure — and that a breakout may be coming soon. Recognizing these patterns can help futures traders plan their entries and avoid being caught off guard by sudden moves.

Here are some of the most common breakout patterns used by traders in the futures markets.

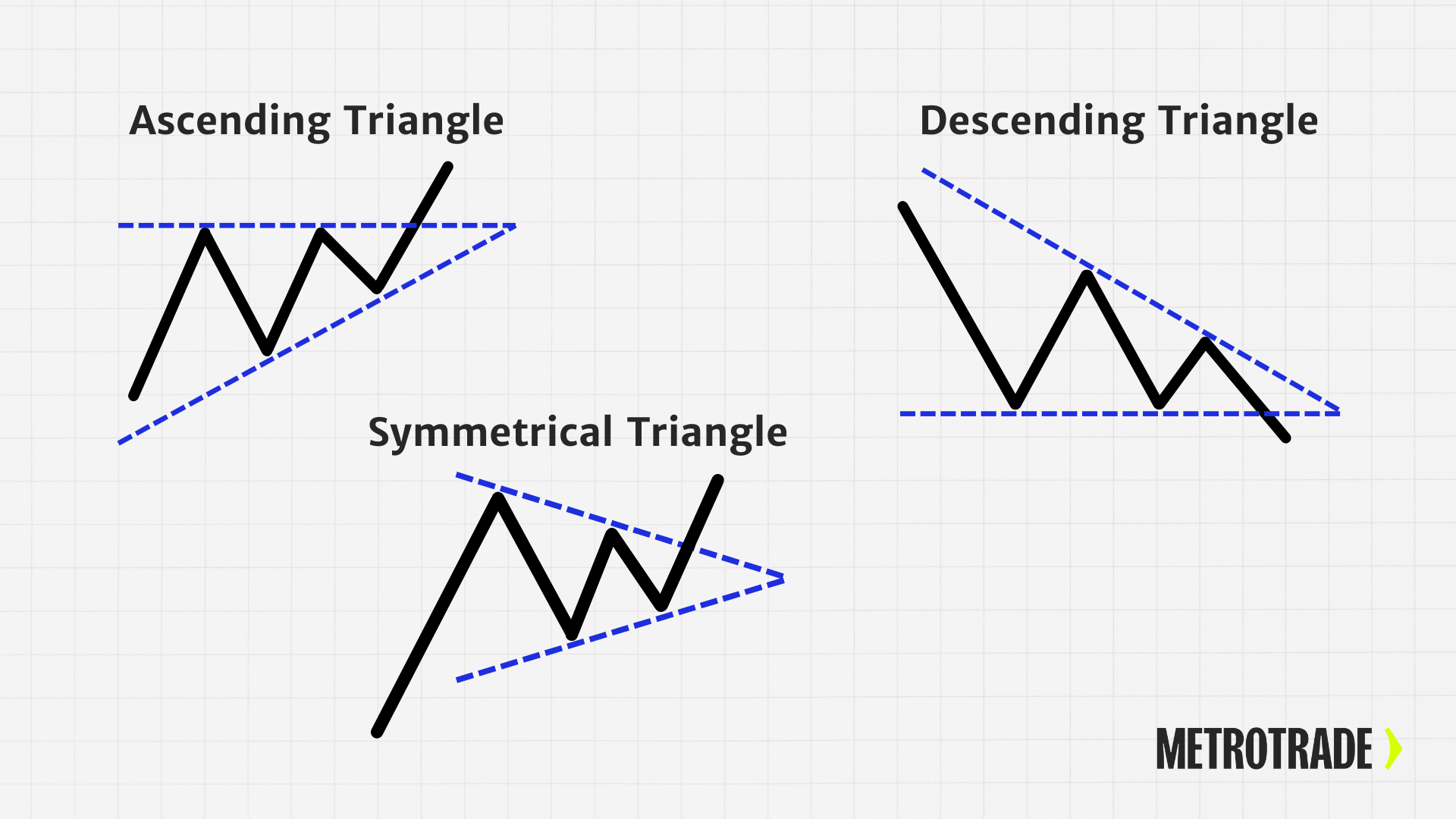

Triangle Patterns

Triangle patterns form when price action becomes compressed between converging trendlines. As the range narrows, it builds pressure, which often leads to a breakout once one side takes control.

Symmetrical Triangle

- Description: Both the upper and lower trendlines are sloping inward. Price is making lower highs and higher lows.

- Breakout Potential: The breakout can go in either direction, depending on which side breaks first.

- Use in Futures: Useful in neutral or indecisive markets. Wait for a volume surge and candle close before entry.

Ascending Triangle

- Description: Flat resistance at the top, with higher lows forming below.

- Breakout Potential: Typically breaks to the upside as buying pressure builds.

- Use in Futures: Great for identifying bullish setups in contracts like equity index futures or crude oil during uptrends.

Descending Triangle

- Description: Flat support at the bottom, with lower highs forming above.

- Breakout Potential: Typically breaks to the downside as selling pressure increases.

- Use in Futures: Often found in bearish setups, especially in volatile markets like natural gas or copper.

Rectangle or Range Breakout

A rectangle pattern forms when price trades within a horizontal range, bouncing between support and resistance levels. This shows consolidation — a pause in market direction.

- Description: Price moves sideways in a well-defined range.

- Breakout Potential: Price breaks out above resistance or below support.

- Use in Futures: Common during overnight sessions or before major news events. Watch for a breakout during market open or economic releases.

Flag and Pennant Patterns

Flags and pennants are short-term continuation patterns that appear after strong directional moves. They signal that the market is briefly consolidating before continuing in the same direction.

Bullish Flag

- Description: A steep upward move followed by a downward-sloping rectangle or channel.

- Breakout Potential: Price breaks out above the flag, continuing higher.

- Use in Futures: Often seen in trending markets like the Nasdaq or Dow futures.

Learn more about the Bull Flag pattern

Bearish Flag

- Description: A steep downward move followed by a small upward-sloping channel.

- Breakout Potential: Price breaks down below the flag and continues lower.

- Use in Futures: Useful for short trades during downtrends, especially in metals or FX futures.

Learn more about the Bear Flag pattern

Pennants

- Description: Small symmetrical triangles that form after a strong move.

- Breakout Potential: Typically breaks in the same direction as the prior move.

- Use in Futures: Good for fast-paced contracts like micro futures or intraday charts.

How to Confirm a Breakout Is Real

One of the biggest challenges in breakout trading is avoiding false breakouts. These occur when the price briefly moves beyond support or resistance but then reverses quickly. To reduce this risk, traders look for confirmation.

Ways to confirm a breakout:

- Volume Spike: A breakout with above-average volume suggests strong participation.

- Candle Close: Wait for a candle to close outside the key level rather than entering on the wick.

- Retest: After a breakout, the price may pull back to the level it broke through. Holding the retest often confirms the breakout.

- Momentum Indicators: RSI or MACD can show whether a breakout has strength or is overextended.

- Trend Filters: Using moving averages to determine trend direction can help you trade only in the direction of the broader trend.

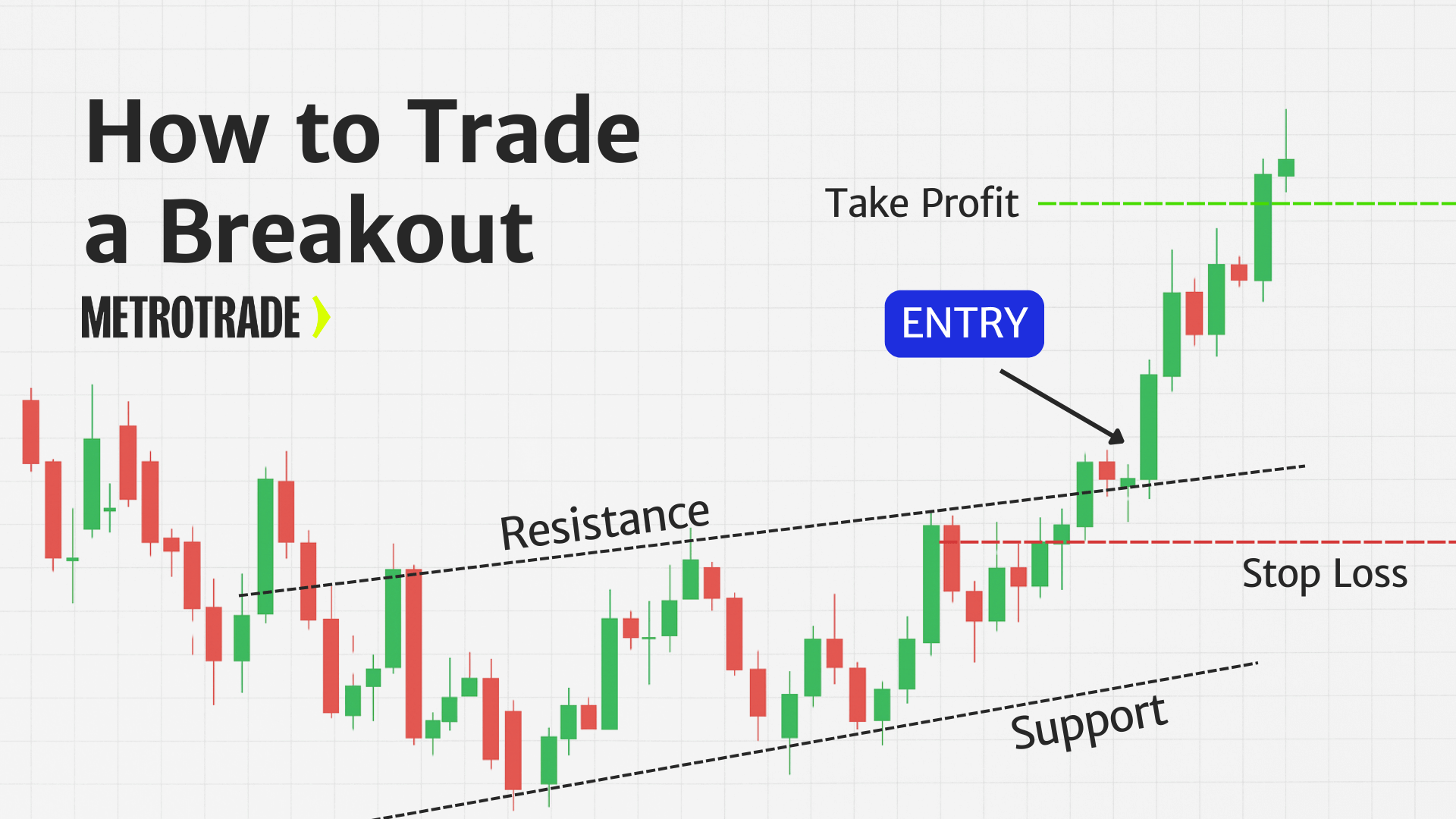

Breakout Trading Strategy: How to Trade a Breakout

Once you understand what a breakout is, the next step is learning how to build a solid breakout trading strategy. While the exact setup may vary based on the futures contract or market conditions, most breakout strategies follow the same core structure: a clear entry point, a well-placed stop loss, a defined profit target, and the right chart timeframe.

Let’s break down each of these key components.

Entry: When to Enter a Breakout Trade

The entry point is where you decide to open your position. In breakout trading, this usually happens when the price moves beyond a key level of support or resistance.

There are two common entry styles:

- Aggressive Entry: Enter as soon as the price breaks through the level. This allows for maximum profit potential but carries more risk of a false breakout.

- Conservative Entry: Wait for the breakout to be confirmed by a candle close or a retest of the level. This reduces the chance of a fakeout but may result in a slightly later entry.

In both cases, using volume confirmation can help filter better entries. A breakout that happens with rising volume is generally more reliable than one with low or flat volume.

Stop Loss Placement: Protecting Against False Breakouts

A breakout strategy is incomplete without a solid risk management plan, and that starts with placing a stop loss.

Here are three common stop placement methods:

- Just beyond the breakout level: For bullish breakouts, place the stop just below the former resistance. For bearish breakouts, place it just above the former support.

- Below or above recent swing highs or lows: Gives the trade more room to breathe, but increases risk exposure.

- Using ATR (Average True Range): Use a multiple of the ATR to size stops based on current market volatility. This helps avoid being stopped out by normal price movement.

The stop loss should always reflect your risk tolerance and account size. Many traders risk no more than 1–2% of their account on a single trade.

Profit Targets: Planning the Exit

Your profit target should be based on both technical levels and risk-reward considerations. Having a clear exit plan helps reduce emotional decision-making.

Here are a few ways to set profit targets:

- Measured Move: Calculate the height of the pattern (like a triangle or flag) and project it from the breakout point.

- Fixed Risk-Reward Ratio: Aim for a minimum 2:1 ratio. If you risk 10 ticks, your target should be at least 20 ticks away.

- Key Levels: Look for nearby support or resistance zones, Fibonacci levels, or round numbers where price may stall or reverse.

You can also scale out of the position in parts — taking some profit early and letting the rest run with a trailing stop.

Timeframes: Matching Strategy to Style

The timeframe you trade on will influence your breakout strategy’s structure. Shorter timeframes offer more trades but also more noise. Longer timeframes provide clearer signals but fewer setups.

Here’s how timeframes typically line up with different trading styles:

- Scalping and Intraday Trading: 1-minute, 5-minute, or 15-minute charts. Common in equity index futures, crude oil, and micro contracts.

- Swing Trading: 1-hour, 4-hour, or daily charts. Suitable for commodity futures or currency futures that trend over multiple days.

- Position Trading: Daily or weekly charts. Ideal for long-term trend-following or breakout strategies based on macroeconomic trends.

Always test your breakout strategy on the timeframe that best suits your availability, account size, and risk tolerance.

Building a strong breakout trading strategy means more than just identifying a price level. You need a complete plan that includes confirmation, entry and exit rules, and risk controls. Whether you’re trading the E-mini S&P 500, gold, or euro futures, having this structure in place gives you a more consistent approach and helps you avoid impulsive decisions when the market starts moving.

Test Your Breakout Trading Strategy

Start your live trading application and begin with margins as low as $80 per contract.

Popular Breakout Trading Strategies

Here are five proven breakout strategies used in futures markets.

Breakout with Retest Strategy

- Setup: Wait for the price to break a key level, then retest it.

- Entry: Enter when the price holds the retest.

- Best for: Traders who want extra confirmation before entering.

Momentum Breakout Strategy

- Setup: Use momentum indicators like RSI or MACD to confirm the price is accelerating.

- Entry: Enter when the price breaks the level with momentum confirmation.

- Best for: Trend traders and those trading fast-moving contracts like crude oil or Nasdaq futures.

Range Breakout Strategy

- Set up: Identify tight consolidation zones or trading ranges.

- Entry: Enter when the price breaks out of the range with volume.

- Best for: Low-volatility periods before economic news or market open.

Opening Range Breakout (ORB)

- Setup: Mark the high and low of the first 15–30 minutes of trading.

- Entry: Enter on a breakout of this range with volume.

- Best for: Intraday traders who want to capitalize on early market volatility.

Volume-Confirmed Breakout

- Set up: Use volume indicators or footprint charts.

- Entry: Only enter breakouts with volume above a 20-day average.

- Best for: Avoiding false breakouts and trading large futures contracts.

Pros and Cons of Breakout Trading

Pros

- Clear entry and exit levels: Breakout strategies are built around defined support and resistance, which makes trade planning more structured and less subjective.

- Strong potential for quick profits: Futures markets can move fast after a breakout, allowing traders to capitalize on sharp price swings in a short time.

- Works across multiple timeframes: Whether you trade 5-minute charts or daily charts, breakout setups can be applied consistently across different markets.

- Easy to automate or systematize: Because breakout trading relies on specific price levels and patterns, it’s easier to turn into a rules-based or algorithmic strategy.

Cons

- High risk of false breakouts: Not every breakout holds, and entering too early or without confirmation can lead to losses.

- Choppy markets reduce reliability: In low-volume or sideways conditions, breakouts are more likely to fail or reverse quickly.

- Emotional trading can sabotage results: Traders may chase price or exit too soon without following their plan, especially during fast moves.

- Requires strict risk management: Because breakout trades often occur during volatile conditions, tight stops and position sizing are essential.

Mistakes to Avoid with Breakout Strategies

- Entering Too Early: Don’t enter before confirmation or candle close.

- Ignoring Volume: Low-volume breakouts are more likely to fail.

- No Risk Management: Always use a stop loss and define your risk.

- Overtrading: Not every breakout is worth taking.

- Fighting the Trend: Avoid trading against the broader market trend.

Breakout Trading Tools and Indicators

To trade breakouts effectively, you need more than just an eye for price levels. The right tools and indicators can help confirm breakout strength, reduce the risk of false signals, and improve overall timing. These tools are essential for both discretionary traders and those building rules-based futures trading systems.

Here are some of the most widely used breakout trading tools and how they can be applied in futures markets:

Volume Profile

- What it does: Shows where the most trading activity has occurred at each price level over a given time period.

- Why it matters: Breakouts above or below high-volume areas tend to be more significant. If price breaks out from a low-volume zone into a high-volume area, it often gains momentum.

VWAP (Volume Weighted Average Price)

- What it does: Plots the average price weighted by volume throughout the day.

- Why it matters: VWAP acts as a dynamic support or resistance level. Breakouts that occur above or below VWAP are often stronger when confirmed by volume.

Learn more about using VWAP for futures trading

Bollinger Bands

- What it does: Creates a price envelope based on standard deviations from a moving average.

- Why it matters: When the bands narrow (a condition called a “squeeze”), it often signals upcoming volatility. A breakout outside the bands with volume can indicate a real move.

Average True Range (ATR)

- What it does: Measures recent market volatility by calculating the average range of price movement.

- Why it matters: ATR helps set stop losses and profit targets in breakout trades. Higher ATR values signal increased volatility and wider breakouts.

Momentum Indicators (MACD, RSI)

- What they do: MACD shows trend strength and direction, while RSI identifies overbought and oversold conditions.

- Why they matter: These indicators can help confirm breakout direction or warn of weakening momentum before a trade entry.

Custom Alerts and Drawing Tools in MetroTrader

- What they do: Help you draw support, resistance, and pattern setups, and create price alerts for breakout levels.

- Why they matter: Tracking breakout zones in real-time is critical, especially when trading multiple futures contracts.

Best Futures Markets for Breakout Trading

Some contracts are more breakout-friendly due to higher volume, volatility, and news sensitivity.

Top picks:

- E-mini S&P 500 (ES): Tight spreads and strong liquidity.

- Crude Oil (CL): Breakouts during inventory reports or geopolitical news.

- Gold (GC): Breaks on inflation data or interest rate shifts.

- Euro FX (6E): Breakouts around ECB or Fed news.

- Micro contracts (MES, MNQ, M2K): Good for small account traders testing breakout strategies.

Breakout Trading vs Other Strategies

Breakout trading is one of several core strategies used by futures traders. To understand how it fits into your overall trading approach, it helps to compare it with other popular methods — especially mean reversion and trend-following strategies. Each approach has a different philosophy, risk profile, and ideal market condition.

Here’s how breakout trading stacks up against the others:

Breakout Trading

Breakout trading focuses on entering positions when the price moves beyond key support or resistance levels. The goal is to capture early momentum as a new trend begins.

- Best used in: Volatile or news-driven markets

- Entry timing: Early in a move, as price breaks out

- Tools often used: Volume analysis, VWAP, chart patterns, MACD

- Risk: Higher chance of false signals without confirmation

Breakout strategies are great for traders who want to catch fast-moving setups and clearly defined entries, but they require strong discipline and confirmation to avoid being trapped by fakeouts.

Mean Reversion

Mean reversion assumes that the price eventually returns to an average or fair value. Traders using this strategy look for overbought or oversold conditions and trade against extreme moves.

- Best used in: Sideways or range-bound markets

- Entry timing: After extended moves, near extremes

- Tools often used: Moving averages, Bollinger Bands, RSI

- Risk: Breakouts can cause trades to fail if the price doesn’t revert

Mean reversion strategies can work well during quiet market periods but tend to struggle during breakouts or strong trending environments.

Trend Following

Trend-following traders aim to join a move once it’s already confirmed and underway. Instead of trading the breakout itself, they enter after signs of trend continuation.

- Best used in: Markets with clear directional momentum

- Entry timing: After trend confirmation, not the initial breakout

- Tools often used: Moving averages, trendlines, ADX

- Risk: Late entries can reduce reward potential

Trend-following strategies are generally more forgiving and slower-paced than breakout setups, but they may miss early profit opportunities.

Each strategy offers a different way to read the market and manage risk.

Conclusion

Breakout trading can be a powerful strategy for futures traders when done correctly. By waiting for strong signals, confirming with volume, and using proper risk management, you can catch early moves and ride developing trends.

Ready to put these breakout strategies to the test?

Open a MetroTrader account today and get 30 days of free simulated trading. Then, when you’re ready, apply for & fund your live account to get trading!

FAQs

What is a breakout in futures trading?

A breakout in futures trading occurs when the price moves above a resistance level or below a support level, often signaling the start of a new trend. These moves are usually confirmed by higher volume and momentum.

How do you confirm a breakout is real?

A real breakout is confirmed by a candle close beyond the key level, a spike in volume, and ideally a retest of the breakout zone that holds. Indicators like RSI and MACD can also support confirmation.

What is the best indicator for breakout trading?

Volume indicators, VWAP, and Bollinger Bands are commonly used for breakout confirmation. ATR can help with setting stops and targets.

Is breakout trading good for beginners?

Yes, breakout trading can be beginner-friendly if you follow a rules-based approach and use a demo account first. Simple patterns and clear levels help reduce decision-making stress.

Which futures markets are best for breakout strategies?

Top markets include the E-mini S&P 500, crude oil, gold, Euro FX, and micro futures. These contracts have strong liquidity and react well to breakout setups.

Can you automate a breakout trading strategy?

Yes. Many traders build algorithmic systems to scan for breakouts and place trades automatically. This helps reduce emotion and ensures consistent execution.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.