Access Global Markets

Trade The Futures

You Want

What are Futures?

Futures are contracts that let you trade the price of an asset like equity indices, oil, gold, crypto, agricultural products, or currencies without owning the asset itself.

They give traders the flexibility to profit from rising or falling markets, manage risk, and gain exposure to global trends. Futures are standardized, highly liquid, and traded on regulated exchanges. If you’re ready to explore the opportunities futures offer, start by choosing the asset class below that fits your interests and objective.

Equity Index Futures

Trade liquid contracts tied to major indexes like the S&P 500 and Nasdaq to manage risk or capture market momentum across the broader U.S. equity landscape.

Energy Futures

Trade vital markets like crude oil and natural gas with high liquidity, real-time pricing, and exposure to key economic and geopolitical drivers.

Metal Futures

Get exposure to metals like gold, silver, and copper with deep liquidity and efficient execution in globally watched commodity markets.

Crypto Futures

Access digital asset markets like Bitcoin with the structure and efficiency of futures, offering greater control, transparency, and capital efficiency than spot crypto trading.

Agricultural Futures

Participate in essential food markets such as corn, wheat, and soybeans with contracts designed for price discovery and seasonal volatility.

Currency Futures

Speculate on global exchange rates through standardized futures contracts that offer transparency and reduced counterparty risk.

Treasury Futures

Express views on interest rates or hedge fixed income exposure with futures linked to U.S. government bonds across the yield curve.

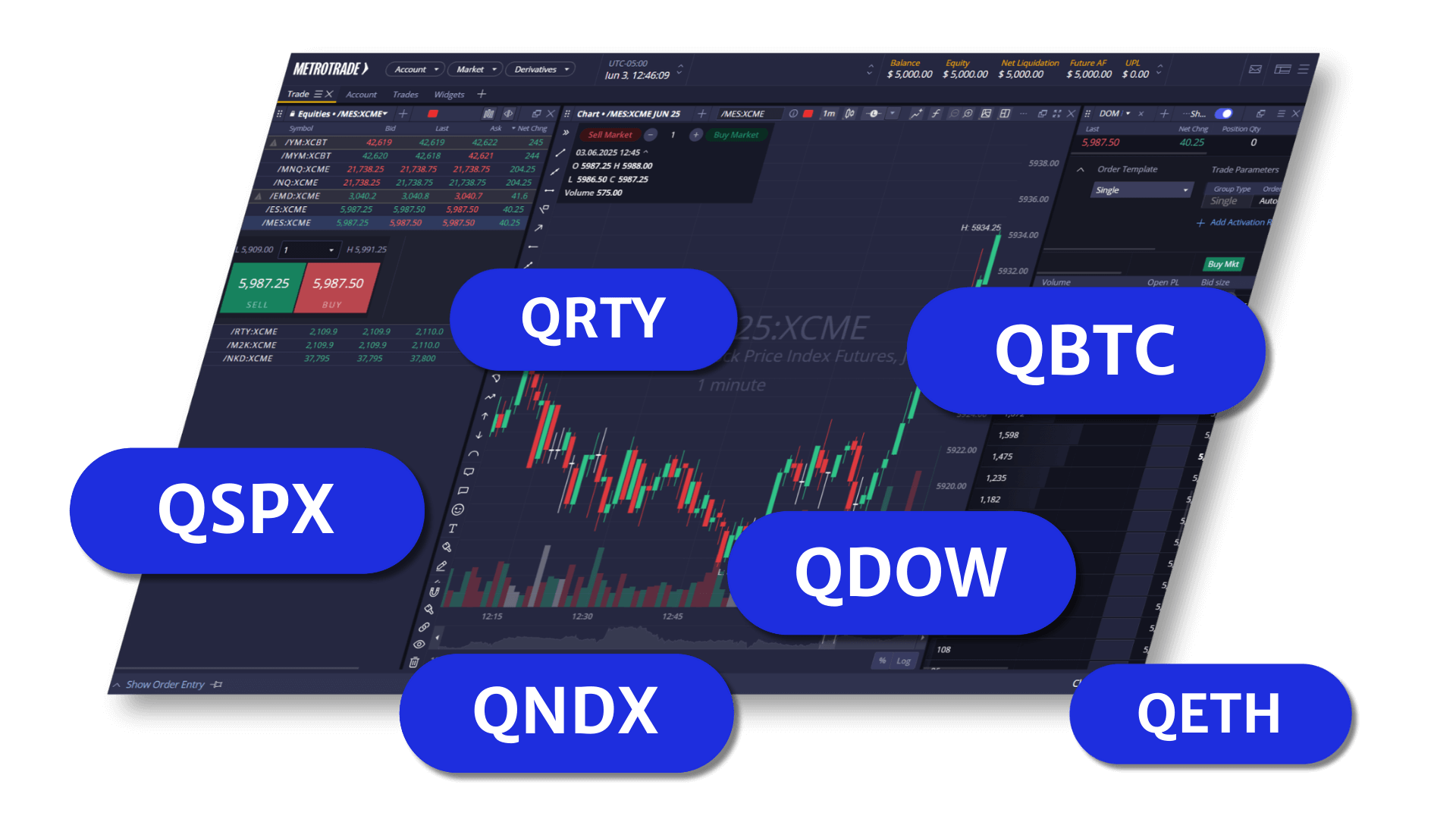

Trade New Spot-Quoted Futures at Exact Market Prices

New Spot-Quoted Futures (SQFs) let you trade index and crypto markets at exact prices, with lower capital requirements and no expiration worries.

Access Contracts of All Sizes

Full Size

Full-size futures contracts represent the standard, complete unit of a financial index or commodity in the futures market. These contracts offer larger position sizes and potentially greater profit (or loss) potential, they also require more capital and carry higher risk compared to their E-mini and Micro counterparts.

E-mini

E-minis are a standard futures contract that is broken down into a fractional portion of a financial index. The “E” designates it is traded electronically. When launched in 1997, E-minis were a fraction of the size of pit-traded contracts, but they have come to dominate the futures markets.

Micro E-mini

Trade a slice of CME’s liquid futures markets and get the same capital efficiency as standard E-mini contracts with less upfront financial commitment.

Frequently Asked Questions

Why do people trade futures?

Some trade futures to hedge risk, like a farmer locking in a corn price. Others use them to speculate on price moves or to diversify their portfolios with assets beyond stocks and bonds.

How is trading futures different from trading stocks?

When you trade stocks, you’re buying or selling shares of ownership in a company. With futures, you’re trading contracts tied to the price of an asset like oil, gold, or an index, not the asset itself.

Futures are also leveraged, meaning you control a larger position with a smaller upfront investment (margin). They trade nearly 24 hours a day and are designed for short- to medium-term opportunities, while stocks are often used for long-term investing. Many traders use both to balance opportunity and risk across markets.

How much capital do you need to trade futures?

Futures are leveraged products, so you only need to post margin, a fraction of the contract’s value. That said, margin requirements vary by contract and broker.

What is margin in futures trading?

Margin is the amount of money you need to put up to open a futures position. It’s a small percentage of the contract’s full value, which allows you to control a large position with less capital. But it also means gains and losses are magnified, so it’s important to manage margin carefully.

Do I have to hold futures contracts until expiration?

No. Most traders close their futures positions before the contract expires to avoid physical delivery or final cash settlement. You can exit a position at any time during market hours, giving you flexibility to trade short-term moves.

When can you trade futures?

Most futures markets trade nearly 24 hours a day, 5 days a week, giving you flexibility to react to news and market moves as they happen.

What should I know about the risks of trading futures?

Futures can offer significant opportunities, but they also involve risk due to leverage and market volatility. Because you’re controlling large positions with relatively small margin deposits, even small price moves can lead to large gains or losses.

That’s why it’s important to understand how futures work, manage your positions carefully, and use proper risk management.

No Minimum Deposit Required

Whether you’re new to futures trading or an experienced trader, we get you on track to begin your trading journey with flexibility. No need for large initial deposits—start with an amount that suits you and grow from there.