Pullback trading is one of the most popular strategies in the futures market. Instead of chasing price moves, traders look for brief pauses or dips in an existing trend and time their entries at more favorable prices. It’s a method used by both beginners and pros, thanks to its clear rules and built-in risk control.

In this guide, we’ll break down how pullback trading works, how to spot strong pullbacks, and how to use them to improve your trade entries and exits. Whether you’re trading micro contracts or full-size futures, understanding this simple method can make your strategy more effective.

Key Takeaways

- Pullback trading helps traders enter trends at better prices by waiting for a short dip or pause before entering the trade.

- This strategy works well in futures because of high liquidity and volatility, giving traders more chances to find strong setups.

- Pullbacks often occur near key technical levels, such as moving averages, Fibonacci retracements, or prior support and resistance.

- Managing risk is easier with pullback trading, since you can place tighter stop-loss orders near recent highs or lows.

What Is Pullback Trading?

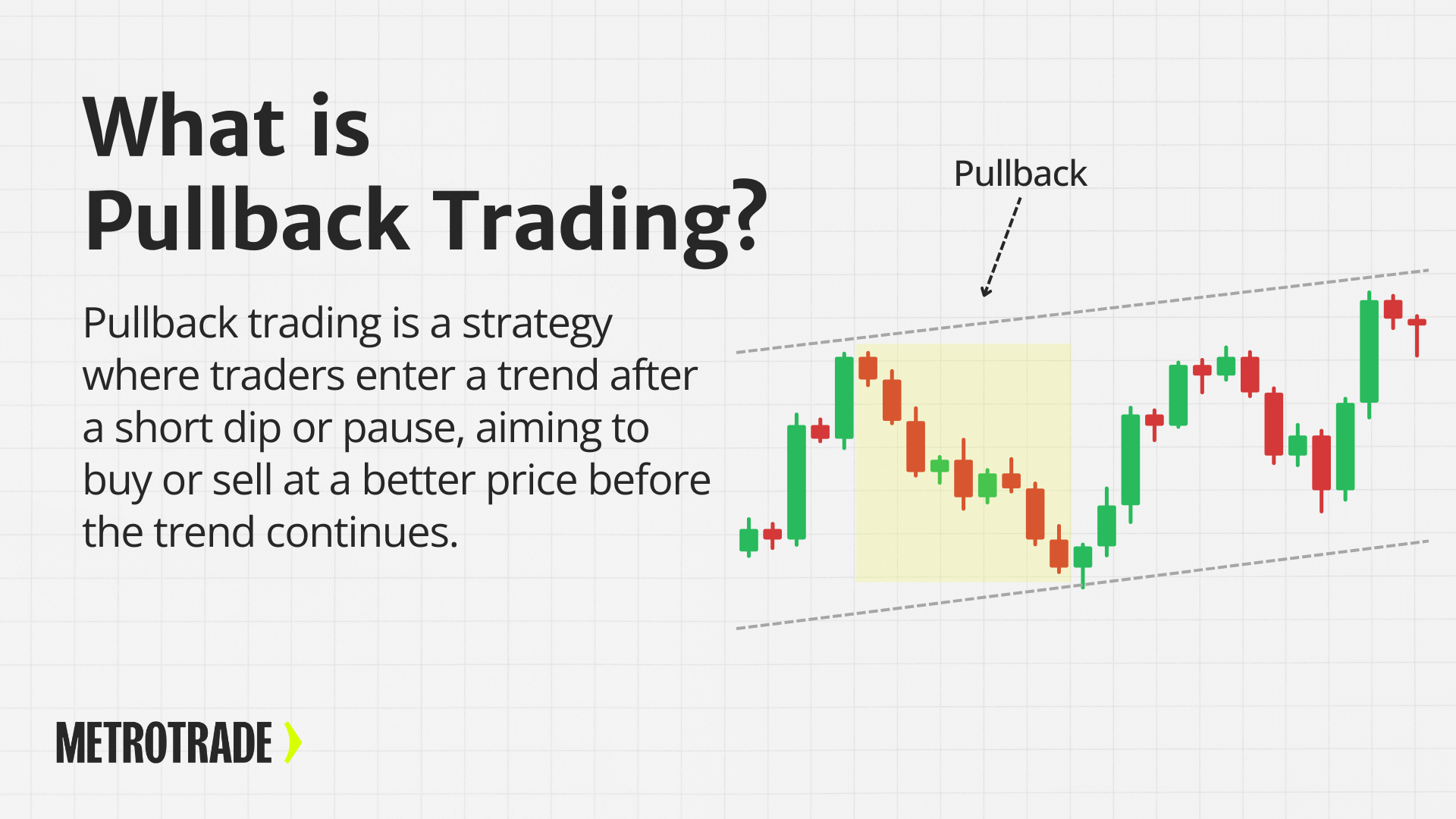

Pullback trading involves entering a trade after a brief pause or minor reversal in the direction of the current trend. For example, in an uptrend, a pullback might be a short dip before the price continues higher. In a downtrend, it might be a small rally before the price drops again.

The key idea is to avoid chasing trades after big moves. Instead, pullback traders wait for a “second chance” entry when the price temporarily moves against the trend. This allows them to enter with better pricing, lower risk, and potentially stronger reward-to-risk ratios.

Pullbacks are not full trend reversals. They’re simply short-term corrections or pauses. Spotting the difference between a pullback and a reversal is critical, and we’ll cover how to do that below.

Why Pullback Trading Works in Futures Markets

Futures markets are ideal for pullback strategies because they often trend strongly and have deep liquidity. This creates natural price movements where pullbacks form often, offering consistent opportunities.

Here’s why pullback trading fits well in the futures space:

- Futures are trend-friendly: Instruments like equity index futures (MES, MNQ), oil (MCL), and gold (MGC) often follow clear technical trends.

- High leverage rewards timing: With leverage, even small dips or rallies in price can be used for quick gains if entries are well-timed.

- Liquidity helps execution: Futures markets have tight spreads and deep books, making it easier to enter or exit during a pullback without much slippage.

- Pullbacks are created by real market forces: Profit-taking, rebalancing, and short-term noise often cause temporary dips, even in strong trends. These moves can offer cleaner entries than breakouts.

Types of Pullbacks

Not all pullbacks are the same. Here are some of the most common types you’ll see in futures charts:

- Shallow Pullbacks: Small retracements, often less than 25% of the prior move. They tend to happen in strong trends and may last only a few bars or minutes.

- Deep Pullbacks: Larger corrections that may retrace 50% or more of the previous trend move. These often touch key technical levels like moving averages or Fibonacci lines.

- Channel Pullbacks: Price moves in a sideways or slightly diagonal range before breaking out again. These can trap impatient traders, but provide opportunities for disciplined ones.

Understanding which type you’re dealing with helps you adjust your risk, entry timing, and stop placement.

How to Identify a Pullback in Futures

To trade pullbacks well, you need to recognize them early. Here’s what to look for:

- Trend structure remains intact: In an uptrend, the pullback should not break below the last swing low. In a downtrend, it shouldn’t break above the last swing high.

- Volume drops: Many pullbacks come with declining volume, showing that the counter-trend move lacks strong support.

- Indicators signal pause: RSI might cool off from overbought/oversold levels. MACD might show slowing momentum without crossing over.

- Fib retracements hold: Price often stalls or bounces between 38.2% and 61.8% retracement levels of the last move.

- Touch of key moving averages: Pullbacks frequently return to the 20 or 50 EMA/SMA before resuming trend direction.

Look for confluence when multiple signs point to a potential pullback rather than relying on one signal alone.

Best Entry Techniques for Pullback Trading

There are several ways to enter a pullback, depending on how aggressive or cautious you want to be.

Limit Orders at Key Levels

Set a buy or sell limit order at a technical level you expect the price to bounce from. This could be a previous support/resistance zone, a trendline, or a Fib level.

Wait for a Confirmation Candle

Instead of guessing the bottom of a pullback, wait for a strong reversal candle. Examples include bullish engulfing, hammer, or a break above a small inside bar.

Use Moving Averages

Enter when price returns to and bounces off a key moving average like the 20 EMA in an uptrend. This can offer both structure and simplicity.

Aggressive vs Conservative

- Aggressive entries aim to catch the bounce early but risk getting stopped out if the pullback continues.

- Conservative entries wait for confirmation but may miss some of the move. Choose based on your risk tolerance and experience.

Common Indicators Used in Pullback Trading

Indicators are not required, but many traders use them to support pullback entries. Here are some favorites:

- 20 EMA or 50 SMA: Tracks the trend and acts as dynamic support or resistance during pullbacks.

- Fibonacci Retracement Tool: Measures the % retracement of a move. Watch the 38.2%, 50%, and 61.8% levels.

- RSI (Relative Strength Index): A drop from overbought may hint at a pullback. A bounce from 40–50 in an uptrend can signal continuation.

- MACD: Helps spot weakening momentum during a pullback. Avoid entries when MACD crosses in the direction of the pullback.

- Bollinger Bands: A price touch or close outside the band, followed by a re-entry, can hint at the end of a pullback.

No single indicator is perfect. Use them as tools to support a clean price action setup.

Start Trading Futures Today

Complete your live trading application and start trading futures with as little as $100.

Pullback Trading in Different Market Conditions

Pullback trading works best when the market is trending, but the quality of setups can change based on conditions.

Trending Markets

- Best environment for pullback trades

- Trends offer clean highs and lows

- Fewer fakeouts when the structure is clear

Sideways Markets

- Pullbacks can look like trends, but the price often chops

- Avoid trading during consolidation unless the range is wide

- Use larger timeframes to find the true trend

Volatile Markets

- Pullbacks can be sharp and fast

- Widen stops and reduce position sizes

- Use caution with news-related spikes

Knowing the broader market context can help you decide when to trade and when to stay out.

Risk Management for Pullback Trading

Good timing means nothing without smart risk control. Here’s how to protect yourself when trading pullbacks:

- Set stop-losses just beyond the pullback: In an uptrend, place it just below the recent low. In a downtrend, place it just above the recent high.

- Size your positions based on account size and volatility: Avoid maxing out on leverage just to hit big wins.

- Stick to a 2:1 reward-to-risk ratio: If you risk 10 points, aim for 20 points of potential profit.

- Use ATR to guide stop distance: The Average True Range can help you avoid placing stops too close in volatile markets.

Futures trading carries high risk, so never skip this step.

Examples of Pullback Trades in Futures Markets

Micro E-mini S&P 500 (MES)

- Trend: Uptrend on 15-minute chart

- Pullback: Price drops to 20 EMA

- Entry: Bullish engulfing candle at support

- Stop: Below the recent swing low

- Target: Retest of previous high

Crude Oil Futures (MCL)

- Trend: Strong downtrend on hourly chart

- Pullback: Retraces to 50% Fib level

- Entry: Bearish pin bar at resistance

- Stop: Above Fib zone

- Target: Extension to new low

Gold Futures (MGC)

- Trend: Uptrend on daily chart

- Pullback: Price dips into Bollinger Band midline

- Entry: Hammer candle forms

- Stop: Under candle low

- Target: Upper band or prior high

These setups show how pullbacks can be used across different asset classes and timeframes.

Common Mistakes to Avoid in Pullback Trading

- Chasing the Move: Entering too early without confirmation can lead to quick losses.

- Ignoring the Trend: Trying to trade pullbacks in sideways or choppy markets often fails.

- Placing Stops Too Tight: A little wiggle room can prevent being stopped out by normal volatility.

- Overusing Indicators: Relying on too many tools can lead to analysis paralysis.

Keep it simple. Focus on structure, support/resistance, and timing.

Pullback Trading vs Breakout Trading

Pullback trading and breakout trading are both trend-based strategies, but they use very different entry tactics and risk profiles. Understanding when and how to use each can help you become a more well-rounded trader.

What’s the Difference?

- Pullback Trading waits for the price to temporarily move against the trend before entering. Traders look for retracements to support or resistance, moving averages, or Fibonacci levels to time their entries.

- Breakout Trading enters when the price moves beyond a defined level, like a prior high or low. It’s all about catching the momentum early when the price breaks out of consolidation or a range.

Which Is Better?

That depends on your trading style and personality:

- Pullback trading is ideal for traders who prefer clear structure, well-defined risk, and more conservative entries. It often suits swing traders and those who trade with limit orders or confirmations.

- Breakout trading fits traders who thrive on speed and momentum. It’s common among scalpers and intraday traders who want to catch explosive moves as they happen.

Can You Use Both?

Absolutely. Many traders build systems that use both approaches. For example, they may trade breakouts during earnings season or high-volatility news events, and pullbacks during slow, trending conditions.

Just make sure you don’t mix the two in the same trade. Have a clear plan for whether you’re entering on strength (breakout) or weakness (pullback), and stick to your rules.

Learn More About Breakout Trading

If you want to explore breakout strategies in more detail, check out our full guide: Breakout Trading Strategy Explained for Futures Traders

Tips for Beginners Starting with Pullback Trading

- Stick to liquid contracts: MES, MNQ, MCL, and MGC are good starting points.

- Use 1–2 setups only: Master a simple pattern like 20 EMA bounce or Fib retracement.

- Track every trade: Journal entries, exits, and notes. This helps you improve.

Small consistent wins are better than chasing big trades.

How to Practice Pullback Trading on MetroTrader

MetroTrader makes it easy to use a pullback strategy in live markets:

- Built-in Indicators: Use moving averages, Bollinger Bands, and Fib tools right on your chart.

- Drawing Tools: Mark up support/resistance zones and trendlines to find pullback zones.

- Multi-Timeframe Views: See the trend on multiple levels to confirm your setup.

Conclusion

Pullback trading is a powerful way to trade trends with less risk and more structure. Instead of chasing price, you wait for the market to give you a better entry point. Futures markets, with their speed, leverage, and deep liquidity, make pullback trading especially appealing.

Just remember, no setup is perfect. Combine solid technicals with risk management, and you’ll be better prepared to trade futures with confidence.

When you’re ready, open an account with MetroTrade and start applying your strategy in real markets.

Frequently Asked Questions

What is a pullback in trading?

A pullback is a temporary dip or pause in price movement that happens during a trend. It’s not a full reversal, just a short-term correction.

Is pullback trading good for beginners?

Yes, pullback trading is doable for beginners because it provides clear entry points and helps manage risk more easily than breakout strategies.

How do you know when a pullback is over?

A pullback may be over when the price bounces off a support level or moving average, and a strong reversal candle appears. Indicators like RSI or MACD can also confirm the change.

What timeframe is best for pullback trading?

Popular timeframes include 5-minute for scalpers, 15-minute or 1-hour for day traders, and 4-hour or daily charts for swing traders.

How do you trade a pullback safely in futures?

Use small position sizes, set clear stop-loss orders just outside the pullback zone, and wait for confirmation before entering the trade.

What’s the difference between a pullback and a reversal?

A pullback is a short-term countertrend move that resumes the original trend. A reversal is a full change in trend direction.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.