The first move of the day can set the tone for the entire trading session. Many futures traders look to capitalize on this early momentum using a technique known as the ORB trading strategy.

Short for “Open Range Breakout,” the ORB strategy is a time-tested, rules-based method for entering trades based on a breakout above or below the initial trading range. While it’s popular across many markets, it’s especially effective in futures due to the high volume, volatility, and structured trading hours of contracts like the E-mini S&P 500 or crude oil futures.

In this guide, we’ll break down how the ORB trading strategy works, why it’s popular among day traders, and how to start applying it to your futures trading routine.

Key Takeaways

- The ORB strategy is a breakout method based on the day’s opening range. Traders mark the high and low of the first 5–60 minutes of the session and look for the price to break above or below that range.

- ORB setups help futures traders capture early momentum. Many contracts experience strong directional moves shortly after the open, and the ORB strategy provides a structured way to trade them.

- Clear entry, exit, and risk rules make the strategy beginner-friendly. Traders wait for confirmation, set defined stop-losses, and aim for risk-to-reward ratios like 1:2 to manage trades consistently.

- Success depends on discipline, not prediction. The ORB strategy works best when traders wait for clean breakouts, avoid forcing trades, and follow a repeatable process.

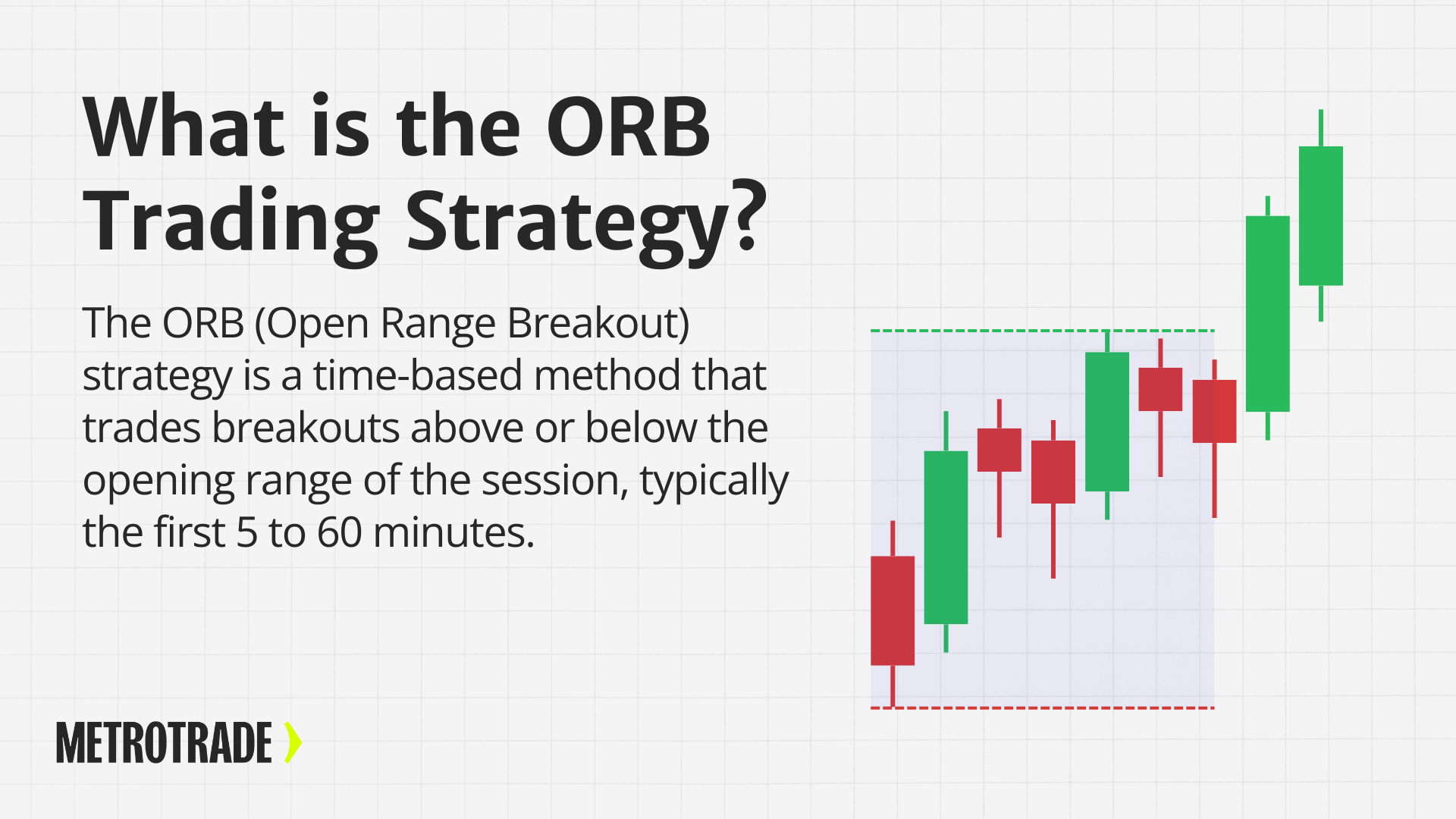

What Is the ORB Trading Strategy?

The ORB (Open Range Breakout) strategy is a trading approach that looks for strong price moves after a specific time-based range is formed at the beginning of the session.

Traders define the “opening range” by marking the high and low during the first segment of trading—often 5, 15, or 30 minutes after the market opens. They then look for the price to break out of this range and take a trade in the direction of the breakout.

The idea is simple: many markets tend to establish a clear direction early in the day. If price breaks above the morning range, buyers may be in control. If it breaks below, sellers may have the upper hand.

This strategy is popular among day traders and intraday futures traders who want to capture early momentum and avoid overcomplicating their analysis.

How the ORB Strategy Works in Futures Trading

Here’s a step-by-step breakdown of how the ORB strategy could be executed on a futures chart:

- Wait for the Opening Period to Finish

Most traders use the first 15 minutes of the trading session, but 5-, 30-, or 60-minute ranges are also common. - Mark the High and Low of the Range

Draw horizontal lines at the high and low of the selected opening time window. This defines your “range.” - Watch for a Breakout

Monitor price action closely. A breakout occurs when a full candle closes above the high or below the low of the range. - Enter the Trade

Enter a long position if the price closes above the range, or enter a short position if it closes below. - Set Your Stop-Loss

Place your stop just outside the opposite side of the range. For a long trade, the stop goes below the range low. - Set a Target

Use a fixed risk-to-reward ratio (such as 1:2) or trail your stop as the price moves in your favor.

This structure gives traders clear rules for entry, exit, and risk control—all of which are vital in fast-moving futures markets.

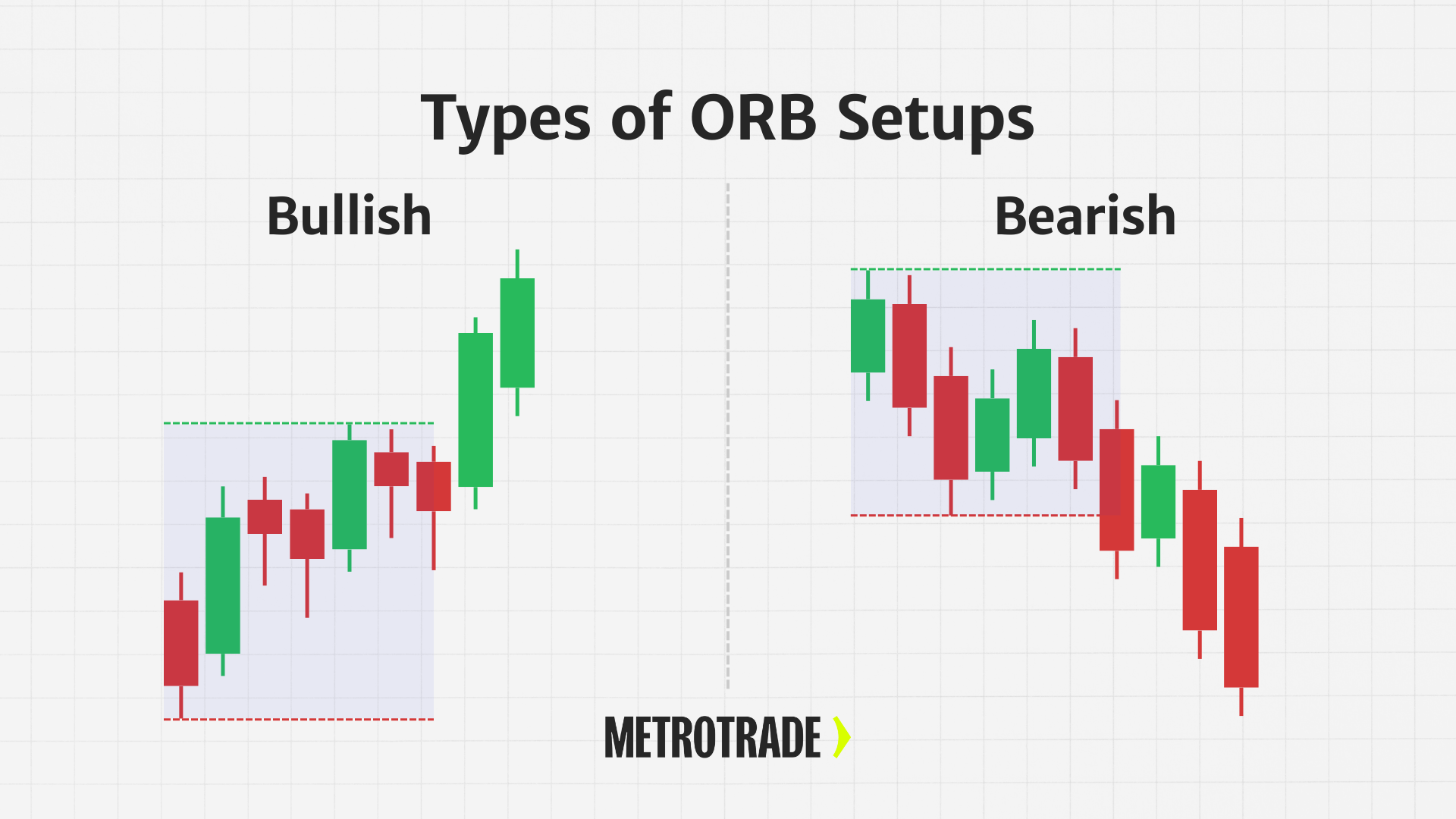

Bullish vs Bearish ORB Setups

The ORB strategy gives traders a structured way to follow price momentum whether the market is pushing upward or breaking down. The direction of the breakout determines your trade bias, entry point, and risk placement.

Let’s break down how to approach both bullish and bearish setups.

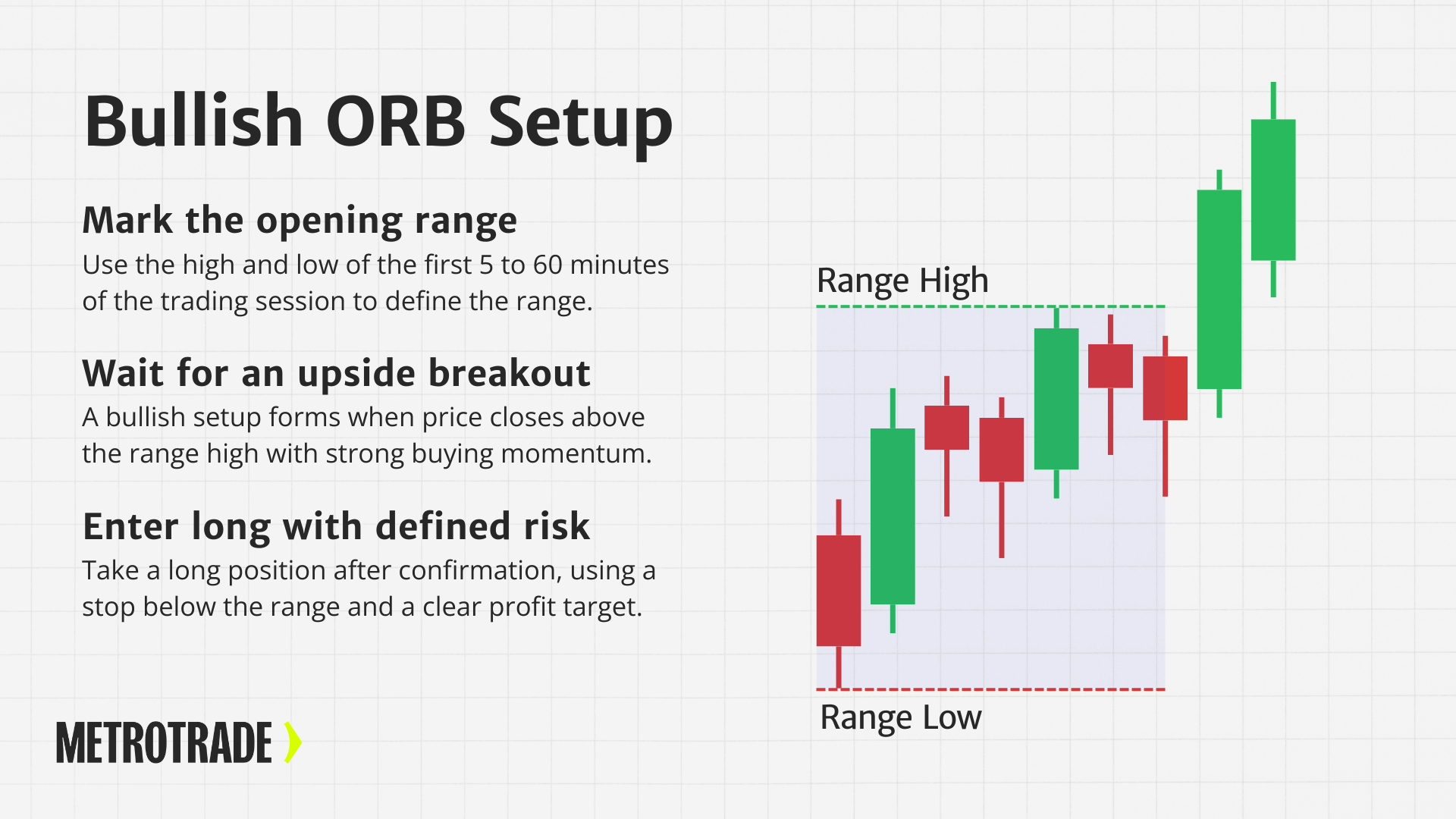

Bullish ORB Setup

A bullish ORB setup happens when the price breaks above the high of the opening range. This signals that buyers are in control and that the market may continue rising through the early part of the session.

This setup is typically used when the broader market shows strength at the open and momentum is aligned to the upside.

Key characteristics of a bullish ORB:

- Breakout direction: Price closes above the opening range high.

- Trade bias: Long (buy) entry.

- Stop-loss location: Just below the range low.

- Profit target: Typically 1.5x to 2x the stop distance or managed using a trailing stop.

Example trade setup:

- Let the market open and form a 15-minute range.

- Draw the high and low of that range.

- Wait for a strong candle to close above the high.

- Enter a long position on the breakout close.

- Set a stop-loss just below the range low.

- Place a target that reflects your desired risk-to-reward ratio.

When to use it:

Bullish ORB setups work best when the market opens strongly, momentum is supported by positive news or economic data, and volume is rising on the breakout.

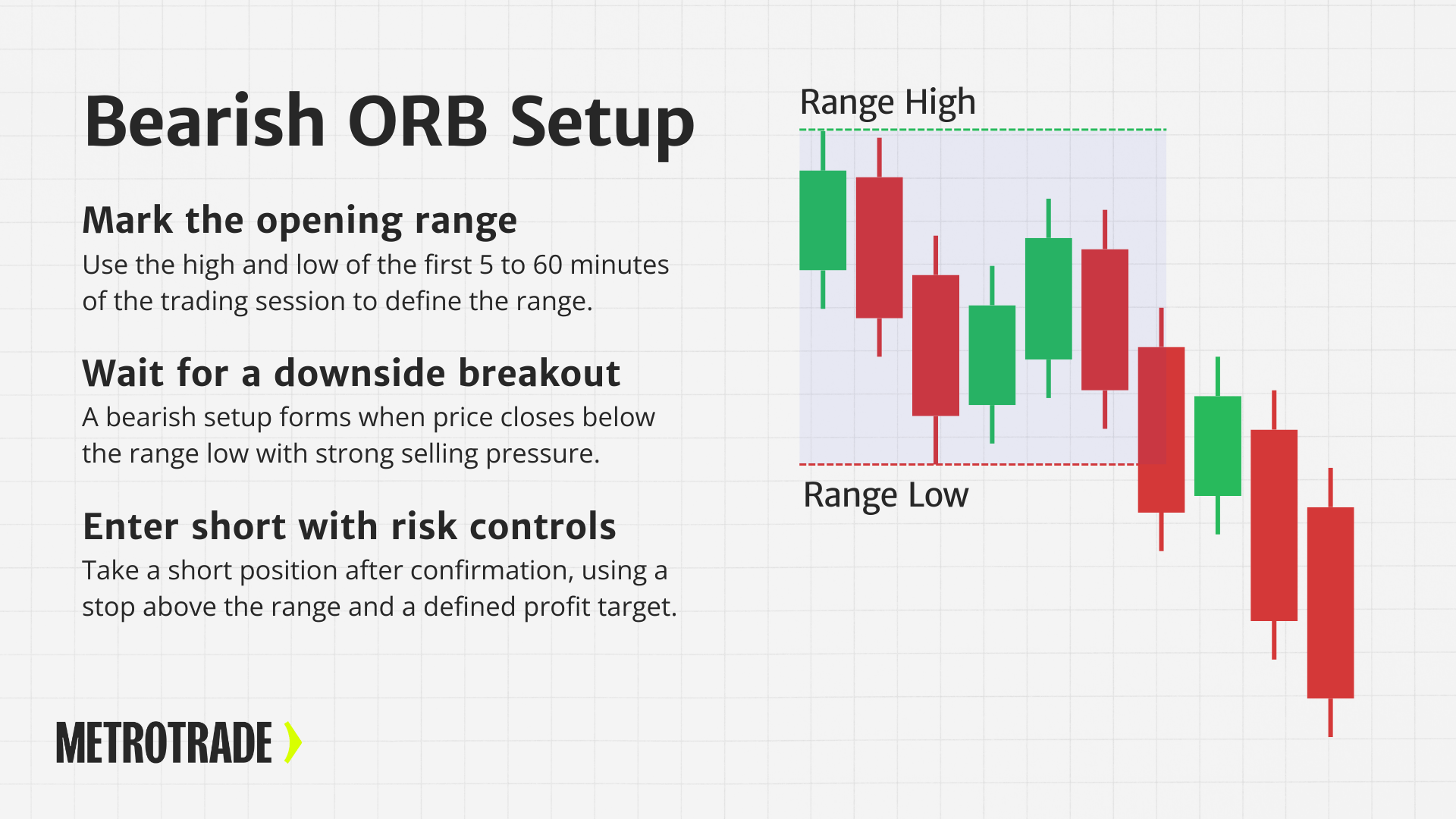

Bearish ORB Setup

A bearish ORB setup occurs when the price breaks below the low of the opening range. This suggests that sellers are dominating early price action and that downward momentum may follow.

This setup can be effective when market sentiment is weak and there’s a clear lack of buying support.

Key characteristics of a bearish ORB:

- Breakout direction: Price closes below the opening range low.

- Trade bias: Short (sell) entry.

- Stop-loss location: Just above the range high.

- Profit target: Typically 1.5x to 2x the risk distance, or managed with a trailing exit.

Example trade setup:

- Let the first 15 minutes of the session form the range.

- Draw lines at the range high and low.

- Watch for a clean candle close below the low.

- Enter short on the breakout close.

- Place a stop-loss just above the range high.

- Target a reward that aligns with your trade plan or market volatility.

When to use it:

Bearish ORB setups are most effective when the market opens weak, downside momentum is fueled by negative news or risk-off sentiment, and selling pressure continues to accelerate on the breakout.

Best Timeframes for ORB in Futures Trading

The timeframe you choose to define your opening range can impact how early you get a trade signal and how reliable that signal is. Shorter timeframes may give faster entries but can increase the chance of false breakouts. Longer timeframes may filter out noise but delay your setup.

Below are the most common timeframes used in ORB strategies and how they function in futures trading.

5-Minute Opening Range

A 5-minute range captures the high and low of the first five minutes of the session. This approach gives the earliest possible entry signals, which can be helpful for traders who want to act quickly on strong momentum. However, these signals are more prone to false breakouts, especially in choppy or low-volume environments. This timeframe is best used with additional confirmation tools like volume spikes or trend filters.

15-Minute Opening Range

The 15-minute range is the most popular choice for futures traders using the ORB strategy. It offers a balanced view of early market activity, capturing more data than a 5-minute window but still providing timely breakout opportunities. This timeframe tends to filter out early noise while maintaining enough responsiveness to catch the day’s first real move. It works well across a wide range of contracts, including equity index futures and crude oil.

30-Minute Opening Range

A 30-minute range provides a broader view of the market’s initial behavior and is often used by more patient traders. While it can delay entry, it helps confirm that any breakout is more meaningful and supported by consistent price action. This timeframe works best in markets where the initial 15 minutes are often volatile or erratic, such as during economic news releases or earnings seasons.

1-Hour Opening Range

The 1-hour range is the most conservative option and is typically used by swing traders or institutional participants who want to see a strong directional bias before entering a trade. It significantly reduces noise and false signals but may miss some of the fastest-moving opportunities. This timeframe is best suited for high-timeframe traders who focus on large contract sizes or multi-hour trade setups.

How to choose your timeframe:

- Highly volatile markets (like crude oil) may benefit from shorter ranges.

- Index futures often respond well to 15-minute or 30-minute opening ranges.

- Avoid adjusting the timeframe too often. Consistency helps build reliable performance data.

Markets and Contracts Where ORB Strategy Works Well

The ORB strategy works best in highly liquid futures markets with strong morning participation.

Top contracts to consider:

- E-mini S&P 500 (ES): High liquidity, clean price action, and consistent volatility.

- E-mini Nasdaq 100 (NQ): More volatility, suitable for experienced traders.

- Crude Oil (CL): High volume and sharp early moves.

- Gold (GC): Clear reaction to economic data releases.

Tip:

Focus on contracts with tight spreads and regular volume during U.S. trading hours. Avoid thinly traded or erratic markets.

Test the ORB Strategy Live

Start your live trading application and begin with margins as low as $80 per contract.

Pros and Cons of ORB Trading Strategy

Pros

- Simple to learn and apply: The ORB strategy relies on time-based rules and clear breakout levels, making it easy to follow without needing advanced indicators or complex analysis.

- Ideal for capturing momentum: It’s designed to catch strong moves early in the session, especially during trending market conditions.

- Well-suited to liquid futures markets: High-volume contracts like the E-mini S&P 500 or crude oil futures tend to respect opening range levels, making this strategy more effective.

- Compatible with structured risk management: Defined entry and stop-loss levels allow for consistent position sizing and favorable risk-to-reward ratios.

Cons

- Vulnerable to false breakouts: In choppy or low-volume markets, price may breach the opening range only to reverse, leading to whipsaw trades.

- Less effective in sideways markets: When there’s no strong directional bias, breakouts often fail, reducing the strategy’s reliability.

- Requires discipline and patience: Traders must wait for confirmation before entering, which can be difficult for those prone to overtrading.

- Doesn’t adapt to all market conditions: During news events, premarket gaps, or low volatility sessions, the opening range may not provide a useful signal.

Types of ORB Setups: Classic, Modified, and Advanced

While the core idea behind the ORB strategy remains the same, traders often adjust how they apply it based on their experience level, risk tolerance, and market conditions. Here are three common variations:

Classic ORB

This is the most straightforward version of the strategy. Traders enter a position as soon as a full candle closes above or below the opening range.

- Classic ORB setups involve no additional filters or indicators and rely solely on price action.

- This approach is popular for its simplicity and speed, allowing traders to act immediately on breakout signals.

- It works best in markets that show strong, clean trends early in the session.

- Because of its simplicity, it is often the first version new traders experiment with when learning the ORB strategy.

Modified ORB

The modified version adds filters to help reduce false signals and improve trade quality.

- Traders may require additional confirmation, such as a volume spike or a retest of the breakout level before entering.

- Some use moving averages or VWAP to confirm trend direction before placing a trade.

- This version often produces fewer trades but may improve win rates by avoiding low-quality setups.

- It’s well-suited for traders who want more structure and prefer to filter out some of the noise from early market volatility.

Advanced ORB

This variation is typically used by more experienced traders who incorporate multiple layers of analysis.

- Advanced setups might include order flow, volume profile, or multi-timeframe confluence to confirm the breakout.

- Traders may align the ORB signal with macroeconomic trends or overnight market structure.

- This version allows for more customization and strategic nuance, often tailored to the trader’s individual edge.

- It tends to require more screen time and technical knowledge but can lead to higher-probability trades.

Risk Management in ORB Trading

Risk control is crucial when trading breakouts. The best setups can still fail, and losses must be limited.

Key techniques:

- Stop-loss placement: Your stop-loss should be placed just outside the opposite side of the opening range to limit exposure if the breakout fails.

- Position sizing: Use fixed dollar risk per trade—such as $50 or $100—based on your account size and comfort level to ensure consistent risk.

- Risk-to-reward ratio: Aim for a minimum of 1:2 risk-to-reward on each trade so that your winners outweigh your losers over time.

- Daily loss limits: Set a maximum number of losing trades or a fixed dollar loss per day to prevent emotional decision-making or revenge trading.

- Trade selectivity: Avoid taking every breakout and focus on setups that show strong volume, clean structure, or alignment with market context.

By keeping risk controlled and consistent, traders give themselves the best chance to stay in the game and grow their accounts over time.

Entry and Exit Techniques for ORB Traders

How you enter and exit can affect win rate and risk-reward balance.

Entry methods:

- Enter a full candle close above or below the range.

- Use limit orders at the retest of the breakout level.

- Wait for a volume surge or momentum bar.

Exit methods:

- Use a fixed target (e.g., 2x your risk).

- Trail your stop behind the price structure.

- Exit manually if the market stalls or reverses.

Match your exit strategy to the market context. Trending days may justify holding longer.

Indicators and Tools That Support ORB Strategies

While the ORB strategy can be traded using price action alone, many traders use indicators to filter breakout setups, confirm momentum, or manage exits. These tools can enhance the quality of your entries and reduce false signals, especially during uncertain market conditions.

All of the following indicators are accessible in MetroTrader under the Studies (ƒ) menu:

- VWAP (Volume-Weighted Average Price): VWAP helps confirm institutional buying or selling and can act as a dynamic support or resistance level that reinforces breakout direction.

- ATR (Average True Range): ATR gives you a clear view of recent volatility so you can size your stops and profit targets appropriately based on the contract’s price behavior.

- Moving averages: Simple and exponential moving averages help define trend direction and can be used to confirm whether the breakout aligns with broader market momentum.

These tools aren’t required to trade ORB, but they can improve your timing, reduce uncertainty, and help you stay consistent when conditions get choppy.

Validating the ORB Strategy

Before trading live, test your ORB strategy to confirm that it works in your chosen market.

Ways to test:

- Use a demo account to practice execution.

- Track stats: win rate, average R/R, drawdowns.

- Log results in a trade journal.

Tip: MetroTrade offers a free 30-day demo with access to delayed futures data, ideal for testing setups like ORB.

Common Mistakes ORB Traders Should Avoid

- Entering early before confirmation.

- Ignoring market context like macro news or premarket trends.

- Overtrading: trying to force multiple ORB setups in one session.

- Widening stops after entering a bad trade.

- Failing to track results and review performance.

Even a solid strategy can fail if executed poorly.

Tips to Improve ORB Trading Performance

- Stick to one or two high-quality contracts (like ES or CL).

- Trade only during high-volume sessions.

- Use alerts and pre-marked levels to reduce screen time.

- Limit the number of trades per day to reduce burnout.

- Record your trades and review them weekly.

Consistent execution matters more than chasing perfect trades.

Can Beginners Use the ORB Strategy?

Yes, the ORB strategy is a strong choice for beginners because it uses simple, time-based rules to define entries, exits, and stop-loss levels. It removes much of the guesswork by focusing on breakouts from the opening range, which are easy to identify on a chart. With proper risk management and demo practice, new traders can use this strategy to build confidence and discipline.

Conclusion: Is the ORB Strategy Right for You?

If you’re looking for a clean, rule-based strategy to trade futures, the ORB method is worth exploring. It gives traders a structured way to capture momentum and manage risk without relying on dozens of indicators.

Success with the ORB strategy depends on execution. Avoid guessing. Wait for confirmation. Respect your stops. And track your results.

Ready to try it yourself?

Create your MetroTrade account today and start trading live futures markets.

FAQs

What is the ORB trading strategy in futures?

The ORB (Open Range Breakout) strategy is a time-based breakout method that uses the high and low of the opening range—typically the first 5 to 60 minutes of the session—to identify potential trade entries in the direction of a breakout.

How do you determine the opening range in trading?

To find the opening range, monitor the market from the open and mark the highest and lowest price during a fixed period, such as the first 15 minutes. These levels form the range that traders use to watch for breakouts.

What timeframe works best for ORB setups?

The 15-minute opening range is the most commonly used timeframe, offering a balance between early signal generation and filtering out market noise. Some traders also use 5-, 30-, or 60-minute ranges depending on the market.

Is the ORB strategy good for beginner traders?

Yes, the ORB strategy is beginner-friendly because it uses clear, rules-based entries and exits, with predefined risk and reward levels. It helps new traders stay disciplined and avoid emotional decision-making.

How do you manage risk with the ORB trading strategy?

Risk is managed by placing a stop-loss just outside the opposite side of the opening range and using a consistent risk-to-reward ratio—typically aiming for 1:2 or better—on each trade.

Which futures contracts are best for ORB trading?

Highly liquid contracts like the E-mini S&P 500 (ES), Nasdaq-100 (NQ), crude oil (CL), and gold (GC) are ideal for ORB trading because they offer consistent volume and strong price action during the opening session.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.