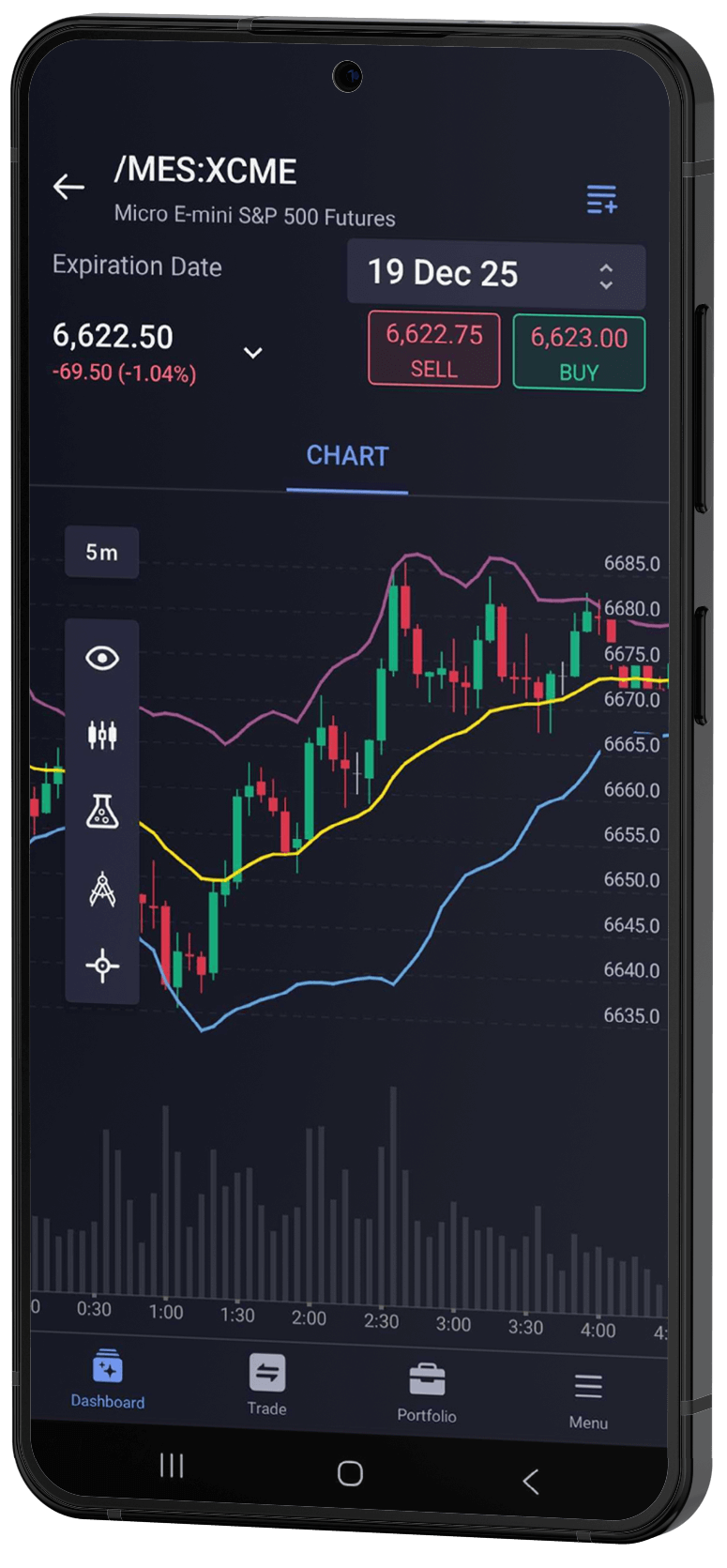

Trade Micro Futures with Lower Costs

Micro e-mini futures give you a smaller way to trade the same major markets with reduced contract sizes, lower margins, and more flexibility in how you manage positions.

What are Micro Futures?

Micro e-mini futures are smaller versions of e-mini futures that use the same contract specs but with a lower multiplier. The reduced size gives traders a way to access the same markets with less capital per contract.

-

Micro contracts follow the same markets and price movement as e-mini futures.

-

The smaller contract size cuts the capital needed to enter a trade.

-

Position sizing becomes easier, which helps traders manage risk with more control.

Available Micro Futures Contracts

MetroTrade offers a wide list of micro futures products built for smaller account sizes.

Micro Equity Index Futures

Contracts like MES & MNQ let traders follow major stock index movement with a smaller contract size.

Micro Gold Futures

Micro gold futures (MGC) give traders a simple way to trade gold price changes with less capital.

Micro Crude Oil Futures

Micro crude oil futures (MCL) provide access to crude oil price swings through a reduced-size contract.

Micro Bitcoin Futures

Micro bitcoin futures (MBT) track Bitcoin price movement in a small, cash-settled format.

Micro Currency Futures

Micro currency futures such as Euro FX (M6E) offer exposure to major currency pairs without large capital needs.

Start Trading Micro Futures

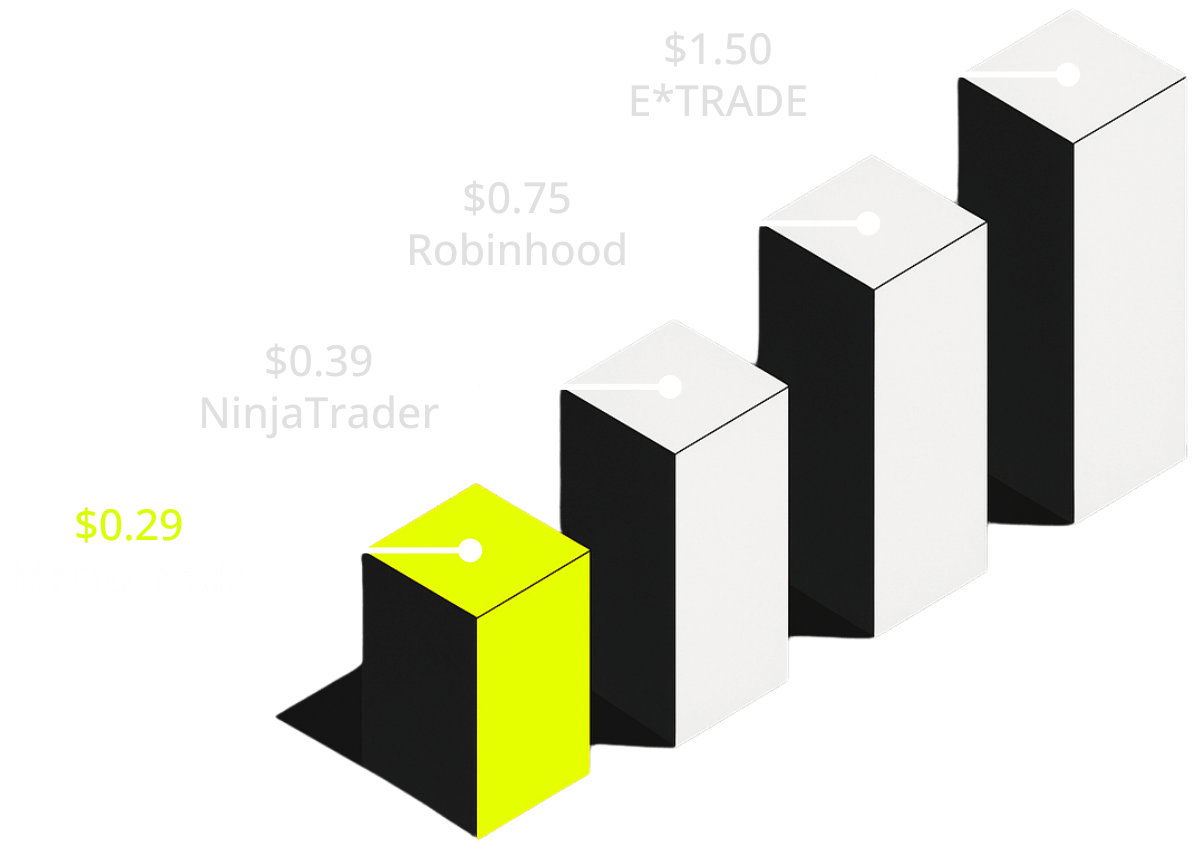

Enjoy Low Commissions

MetroTrade keeps micro futures pricing simple with competitive rates that let you focus on setups without worrying about hidden fees.

*Commission rates shown reflect broker fees only and do not include NFA or exchange fees. Pricing is based on publicly available information and is current as of November 2025.

Why Trade Micro Futures?

Micro contracts give traders a simple way to trade active markets with less capital while keeping risk under control.

- Lower capital requirements: The small multiplier cuts the amount of money needed to enter a trade.

- Flexible Position Sizing: You can size positions with more precision and scale your trades.

Key Features of Micro Futures

Contract Size

Micro contracts use a lower multiplier, which reduces the notional value and lowers the impact of each price move.

Tick Size & Value

Tick size stays the same as the larger contract, but the tick value is smaller. This helps traders manage risk while the market moves.

Lower Margins

Micro contracts use reduced intraday and overnight margins, which makes it easier for traders with smaller accounts to participate.

Capital Efficiency

The smaller size helps traders test strategies, build confidence, and adjust positions without tying up large amounts of capital.

Start Trading Micro E-Mini Futures

MetroTrade offers some of the lowest commissions on micro futures contracts, starting at just $0.29 per side.

Frequently Asked Questions

What are micro futures and how do they work?

Micro futures are smaller versions of e-mini futures that follow the same market prices but use a lower multiplier. This reduces the capital needed to trade them.

How much money do I need to trade micro futures?

Micro futures use lower margins than full-size contracts, so the capital required is smaller. Exact margin levels depend on the exchange and market conditions.

Which micro futures contracts are the most popular?

Micro E mini index futures like MES, MNQ, MYM, and M2K are widely traded, along with micro gold, micro crude oil, micro bitcoin, and several micro currency products.

Are micro futures good for beginners?

Many new traders start with micro contracts because the smaller tick value helps manage risk and offers a simple way to learn how futures move.