Options on Futures Give You More Ways to Trade

Trade options on popular CME futures markets with MetroTrade. Use them to manage risk or take advantage of market opportunities all within the MetroTrader platform.

What Are Options on Futures?

An option on a futures contract gives a trader the right, but not the obligation, to buy or sell a specific futures contract at a set price before it expires.

- The underlying asset is the futures contract itself, which represents commodities, indexes, or financial instruments traded on the CME Group.

- Options on futures combine leverage, flexibility, and risk control, making them useful for both hedging and short-term trading strategies.

Why Trade Options on Futures?

Options on futures give traders key advantages that traditional stock or equity options cannot match.

No PDT Rule

Trade freely without a $25,000 minimum or pattern day trading limits.

Leverage

Control larger positions with less capital while managing risk precisely.

Tax Treatment

Enjoy blended long-term and short-term gains under Section 1256 rules.

23-Hour Trading

Access CME markets nearly around the clock to react to global moves.

Start Trading Options on Futures

How Options on Futures Work

Each options contract includes a strike price, an expiration date, and a premium that determines its cost and potential risk.

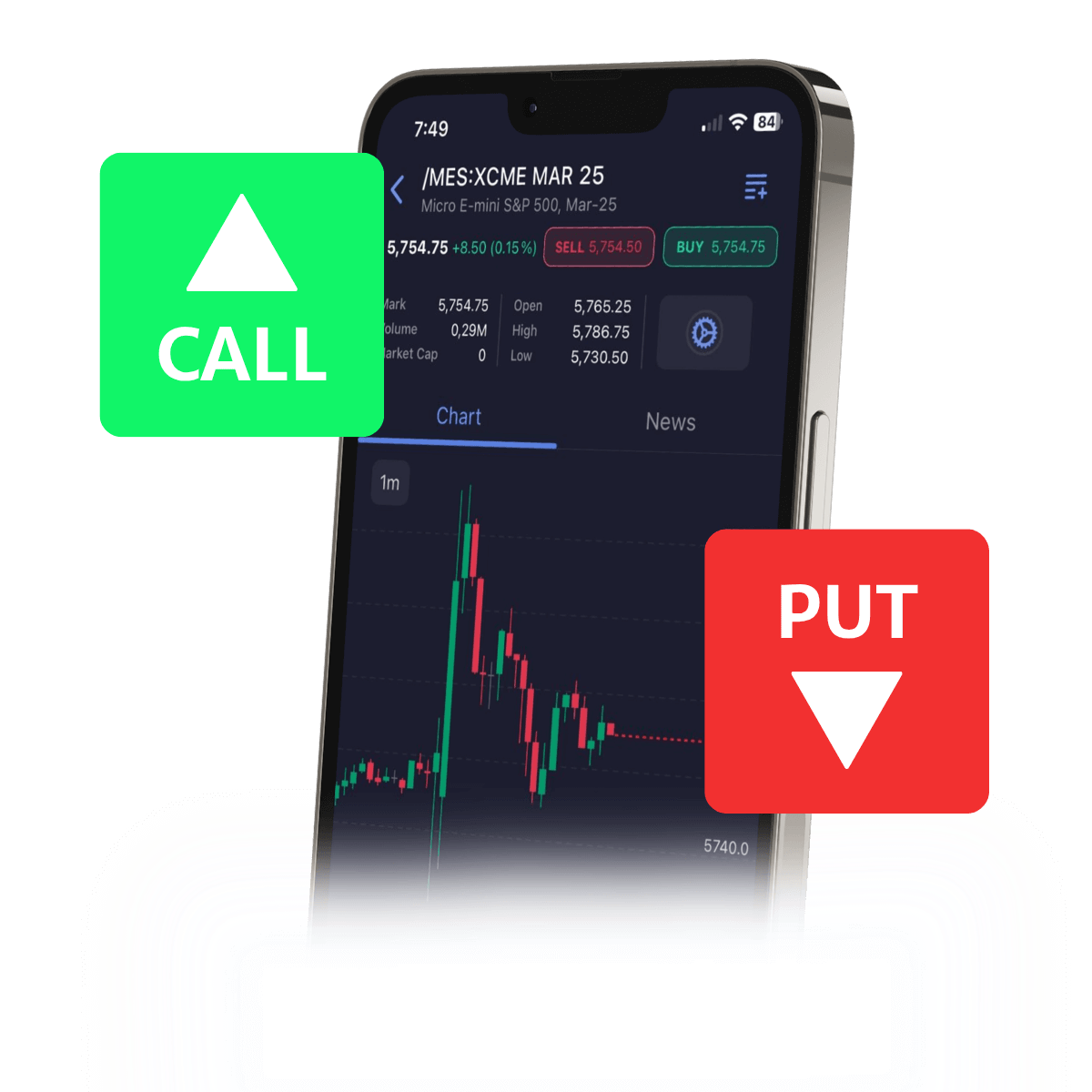

- A call option gives the right to buy a futures contract, while a put option gives the right to sell one.

- Buyers pay the premium and have limited risk equal to that amount, while sellers collect the premium but take on potential obligation if the market moves against them.

Futures Options Pricing

| Options Product | Opening Commission | Closing Commission |

| Micro Futures | $0.58 | $0.00 |

| E-Mini Futures | $2.18 | $0.00 |

Additional exchange fees may apply.

Learn How to Trade Futures Options

Get a quick primer on how to trade futures options.

Frequently Asked Questions

What are options on futures?

Options on futures are contracts that give traders the right, but not the obligation, to buy or sell a futures contract at a specific price before it expires. They allow traders to manage risk, hedge positions, or take advantage of market opportunities using less capital.

How do options on futures work?

Each option is linked to a specific futures contract and includes a strike price, expiration date, and premium. A call option gives the right to buy a futures contract, while a put option gives the right to sell one. The buyer pays the premium, which defines their maximum risk.

Do options on futures follow the Pattern Day Trader rule?

No. The Pattern Day Trader rule applies only to stock trading. Futures and futures options accounts are exempt, allowing traders to open and close positions as often as they like without a $25,000 balance requirement.

When can I trade options on futures?

Most CME Group futures options trade nearly 24 hours a day, five days a week. This schedule lets traders react to market news and global events as they happen, rather than waiting for the traditional stock market to open.