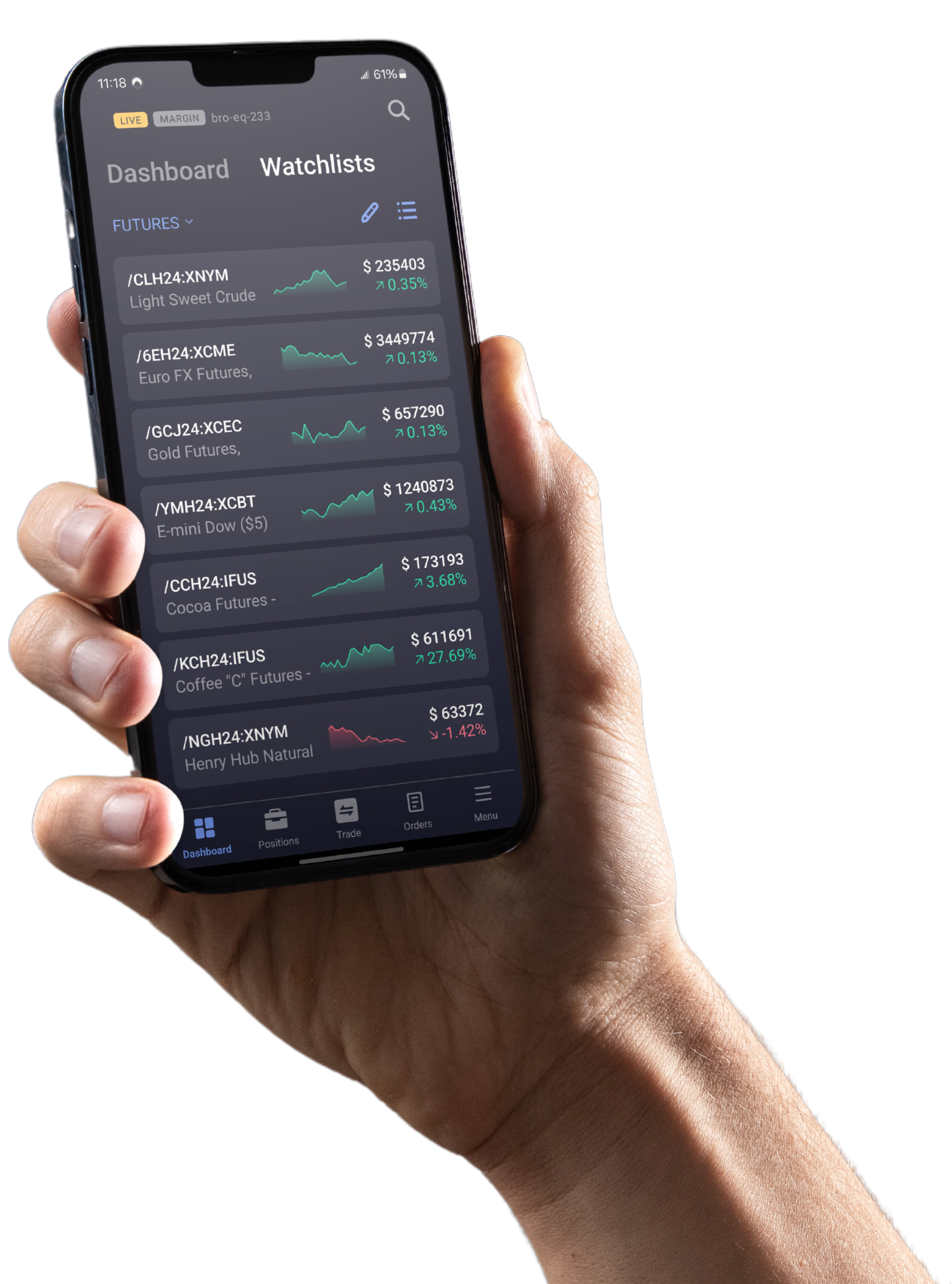

Access Global Markets

Trade Equity Index Futures

What are Equity Index Futures?

Equity index futures are contracts that let you trade the future value of major stock indexes like the S&P 500, Nasdaq 100, Russell 2000, and Nikkei 225 without owning any stocks.

Traded on the CME, these products are available in Full Size, E-mini, and Micro E-mini size contracts to suit different risk levels and accounts. They’re used by traders and investors to hedge, gain market exposure, or speculate on index movements, often with lower costs and greater flexibility than ETFs. Highly liquid and traded nearly 24/7, equity index futures are powerful tools for navigating the market’s ups and downs.

S&P 500

Tracks the performance of 500 large-cap U.S. stocks across all sectors. It’s considered the benchmark for the U.S. stock market.

Nasdaq 100

Represents 100 of the largest non-financial companies listed on the Nasdaq exchange, heavily weighted in tech.

Russell 2000

Tracks 2,000 small-cap U.S. companies, offering diversified exposure to the small-cap segment of the market.

Dow Jones

Follows 30 major U.S. blue-chip companies, often viewed as a benchmark of traditional U.S. industrial strength.

International Indices

Includes global index futures like Japan’s Nikkei 225, Germany’s DAX, and more, offering diversification outside the U.S.

Sectors

Lets you trade specific segments of the economy (e.g., tech, energy, financials) rather than the entire index.

Trade Equity Index Futures

at MetroTrade

Contracts Available

| Code | Product Name | Multiplier | Min. Tick Size | Market Hours (EST) |

|---|---|---|---|---|

| /ES | E-mini S&P 500 Index Futures | $50 x Index | 0.25 index points = $12.50 | Sun 6 PM – Fri 5 PM |

| /MES | Micro E-mini S&P 500 Index Futures | $5 x Index | 0.25 index points = $1.25 | Sun 6 PM – Fri 5 PM |

| /EMD | E-mini S&P MidCap 400 Index Futures | $100 x Index | 0.10 index points = $10.00 | Sun 6 PM – Fri 5 PM |

| /MMC | Micro E-mini S&P MidCap 400 Index Futures | $10 x Index | 0.10 index points = $1.00 | Sun 6 PM – Fri 5 PM |

| /NQ | E-mini Nasdaq-100 Index Futures | $20 x Index | 0.25 index points = $5.00 | Sun 6 PM – Fri 5 PM |

| /MNQ | Micro E-mini Nasdaq-100 Index Futures | $2 x Index | 0.25 index points = $0.50 | Sun 6 PM – Fri 5 PM |

| /RTY | E-mini Russell 2000 Index Futures | $50 x Index | 0.10 index points = $5.00 | Sun 6 PM – Fri 5 PM |

| /M2K | Micro E-mini Russell 2000 Index Futures | $5 x Index | 0.10 index points = $0.50 | Sun 6 PM – Fri 5 PM |

| /RS1 | E-mini Russell 1000 Index Futures | $50 x Index | 0.10 index points = $5.00 | Sun 6 PM – Fri 5 PM |

| /YM | E-mini Dow Jones Industrial Average Index Futures | $5 x Index | 1.00 index point = $5.00 | Sun 6 PM – Fri 5 PM |

| /MYM | Micro E-mini Dow Jones Industrial Average Index Futures | $0.50 x Index | 1.00 index point = $0.50 | Sun 6 PM – Fri 5 PM |

| /RX | Dow Jones U.S. Real Estate Index Futures | $100 x Index | 0.10 index points = $10.00 | Sun 6 PM – Fri 5 PM |

| /N1 | Nikkei 225 (JPY) Futures | ¥500 x Index | 5.00 index points = ¥2,500 | Sun 6 PM – Fri 5 PM |

| /MNI | Micro Nikkei 225 (JPY) Futures | ¥50 x Index | 5.00 index points = ¥250 | Sun 6 PM – Fri 5 PM |

| /NKD | Nikkei 225 (USD) Futures | $5 x Index | 5.00 index points = $25.00 | Sun 6 PM – Fri 5 PM |

| /TPY | TOPIX (JPY) Futures | ¥5,000 x Index | 0.50 index points = ¥2,500 | Sun 6 PM – Fri 5 PM |

| /XAU | E-mini Utilities Select Sector Futures | $100 x Index | 0.10 index points = $10.00 | Sun 6 PM – Fri 5 PM |

| /XAV | E-mini Health Care Select Sector Futures | $100 x Index | 0.10 index points = $10.00 | Sun 6 PM – Fri 5 PM |

| /XAP | E-mini Consumer Staples Select Sector Futures | $100 x Index | 0.10 index points = $10.00 | Sun 6 PM – Fri 5 PM |

Access Contracts of All Sizes

Full Size

Full-size futures contracts represent the standard, complete unit of a financial index or commodity in the futures market. These contracts offer larger position sizes and potentially greater profit (or loss) potential, they also require more capital and carry higher risk compared to their E-mini and Micro counterparts.

E-mini

E-minis are a standard futures contract that is broken down into a fractional portion of a financial index. The “E” designates it is traded electronically. When launched in 1997, E-minis were a fraction of the size of pit-traded contracts, but they have come to dominate the futures markets.

Micro E-mini

Trade a slice of CME’s liquid futures markets and get the same capital efficiency as standard E-mini contracts with less upfront financial commitment.

Frequently Asked Questions

What’s the difference between equity index futures and ETFs?

Do I need a large account to trade equity index futures?

Not necessarily. CME Group offers Micro E-mini contracts, which are designed for smaller accounts and allow you to participate with lower margin requirements.

When can I trade equity index futures?

These contracts trade nearly 24 hours a day, five days a week, allowing for flexibility across global time zones and the ability to react to after-hours news.

What are the most popular equity index futures?

The most commonly traded include the S&P 500 (ES), Nasdaq 100 (NQ), Russell 2000 (RTY), and Dow Jones (YM) futures.

Why are equity index futures considered liquid?

They have high daily trading volumes and tight bid-ask spreads, meaning you can enter and exit positions quickly with minimal slippage.

Can I use equity index futures to hedge my portfolio?

Yes. Many investors use index futures to offset potential losses in their stock or ETF holdings, especially during volatile markets.

No Minimum Deposit Required

Whether you’re new to futures trading or an experienced trader, we get you on track to begin your trading journey with flexibility. No need for large initial deposits—start with an amount that suits you and grow from there.