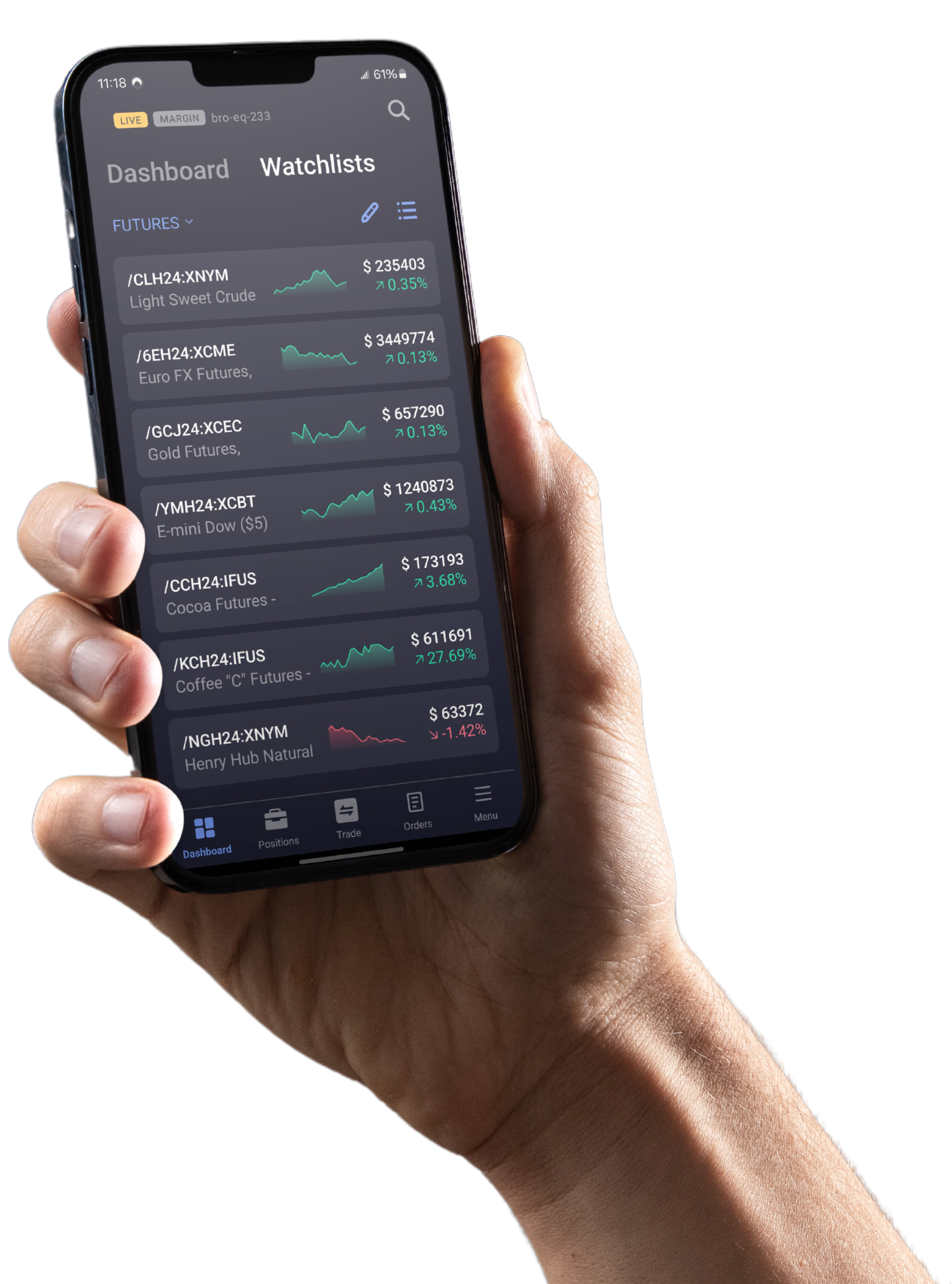

Access Global Markets

Trade Energy Futures

What are Energy Futures?

Energy futures are standardized contracts for physical energy commodities like crude oil, natural gas, gasoline, and heating oil, delivered at a specified future date and predetermined price.

These contracts provide exposure to energy price movements without requiring physical commodity handling or storage. Major energy futures like crude oil and natural gas rank among the world’s most actively traded contracts. With extended trading hours and high liquidity, energy futures offer efficient access to global energy markets. Traders use these contracts to express views on energy price direction or manage exposure to commodity price volatility.

Energy futures represent a direct way to participate in one of the global economy’s most essential and dynamic sectors.

Crude Oil

Trade the world’s most important energy benchmark. Crude oil futures offer exposure to global supply, demand, and geopolitical movements.

Refined Products & Biofuels

Futures on gasoline, diesel, and ethanol help manage risk in fuel markets tied to transportation, refining, and energy trends.

Natural Gas

Highly responsive to weather and seasonal demand, natural gas futures provide key exposure to one of the most volatile energy commodities.

Carbon Emissions

Offset futures tied to carbon credits allow traders and companies to manage climate-related compliance and sustainability targets.

Weather

Weather futures let you hedge against temperature-driven risks using heating and cooling degree day indexes tied to specific regions.

Trade Energy Futures

at MetroTrade

Contracts Available

| Code | Product Name | Multiplier | Min. Tick Size | Trading Hours (EST) |

|---|---|---|---|---|

| /CL | WTI Crude Oil Futures | 1,000 barrels | $0.01 = $10.00 | Sun 6 PM – Fri 5 PM |

| /QM | E-mini WTI Crude Oil Futures | 500 barrels | $0.025 = $12.50 | Sun 6 PM – Fri 5 PM |

| /MCL | Micro WTI Crude Oil Futures | 100 barrels | $0.01 = $1.00 | Sun 6 PM – Fri 5 PM |

| /NG | Henry Hub Natural Gas Futures | 10,000 MMBtu | $0.001 = $10.00 | Sun 6 PM – Fri 5 PM |

| /QG | E-mini Henry Hub Natural Gas Futures | 2,500 MMBtu | $0.005 = $12.50 | Sun 6 PM – Fri 5 PM |

| /MNG | Micro Henry Hub Natural Gas Futures | 1,000 MMBtu | $0.005 = $5.00 | Sun 6 PM – Fri 5 PM |

| /NN | Henry Hub Last Day Financial Futures | 10,000 MMBtu | $0.001 = $10.00 | Sun 6 PM – Fri 5 PM |

| /RB | RBOB Gasoline Futures | 42,000 gallons | $0.0001 = $4.20 | Sun 6 PM – Fri 5 PM |

| /QU | E-mini RBOB Gasoline Futures | 21,000 gallons | $0.0001 = $2.10 | Sun 6 PM – Fri 5 PM |

| /HO | NY Harbor ULSD Futures | 42,000 gallons | $0.0001 = $4.20 | Sun 6 PM – Fri 5 PM |

| /QH | E-mini NY Harbor ULSD Futures | 21,000 gallons | $0.0001 = $2.10 | Sun 6 PM – Fri 5 PM |

| /MHO | Micro NY Harbor ULSD Futures | 10,500 gallons | $0.0001 = $1.05 | Sun 6 PM – Fri 5 PM |

| /CU | Chicago Ethanol Platts Futures | 29,000 gallons | $0.001 = $29.00 | Sun 6 PM – Fri 5 PM |

| /H4 | New York HDD Monthly Futures | $20 x HDD Index | 1 index point = $20 | Sun 6 PM – Fri 5 PM |

| /H2 | Chicago HDD Monthly Futures | $20 x HDD Index | 1 index point = $20 | Sun 6 PM – Fri 5 PM |

| /K4 | New York CDD Monthly Futures | $20 x CDD Index | 1 index point = $20 | Sun 6 PM – Fri 5 PM |

| /K2 | Chicago CDD Monthly Futures | $20 x CDD Index | 1 index point = $20 | Sun 6 PM – Fri 5 PM |

Access Contracts of All Sizes

Full Size

Full-size futures contracts represent the standard, complete unit of a financial index or commodity in the futures market. These contracts offer larger position sizes and potentially greater profit (or loss) potential, they also require more capital and carry higher risk compared to their E-mini and Micro counterparts.

E-mini

E-minis are a standard futures contract that is broken down into a fractional portion of a financial index. The “E” designates it is traded electronically. When launched in 1997, E-minis were a fraction of the size of pit-traded contracts, but they have come to dominate the futures markets.

Micro E-mini

Trade a slice of CME’s liquid futures markets and get the same capital efficiency as standard E-mini contracts with less upfront financial commitment.

Frequently Asked Questions

How can I use energy futures in my trading strategy?

Energy futures can be used to speculate on price movements, hedge fuel-related costs, or gain exposure to global economic trends. Traders often use them to capitalize on volatility in crude oil, natural gas, and refined product markets.

Why are energy futures so popular?

They’re some of the most actively traded contracts globally due to high volatility, deep liquidity, and their connection to global economic activity and geopolitics.

What are the main energy contracts?

Key contracts include WTI Crude Oil (CL), Brent Crude, RBOB Gasoline (RB), Heating Oil (HO), and Natural Gas (NG), as well as micro-sized versions for smaller accounts.

Who trades energy futures?

Traders, energy companies, refiners, airlines, and hedge funds use them to speculate, hedge fuel costs, or manage exposure to global energy prices.

Are energy futures physically settled?

Some contracts are physically settled (e.g., WTI), while others are financially settled. Most traders close positions before expiration to avoid delivery.

What impacts energy futures prices?

Prices are driven by supply and demand, weather, geopolitical tensions, inventory levels, and OPEC policy decisions.

No Minimum Deposit Required

Whether you’re new to futures trading or an experienced trader, we get you on track to begin your trading journey with flexibility. No need for large initial deposits—start with an amount that suits you and grow from there.