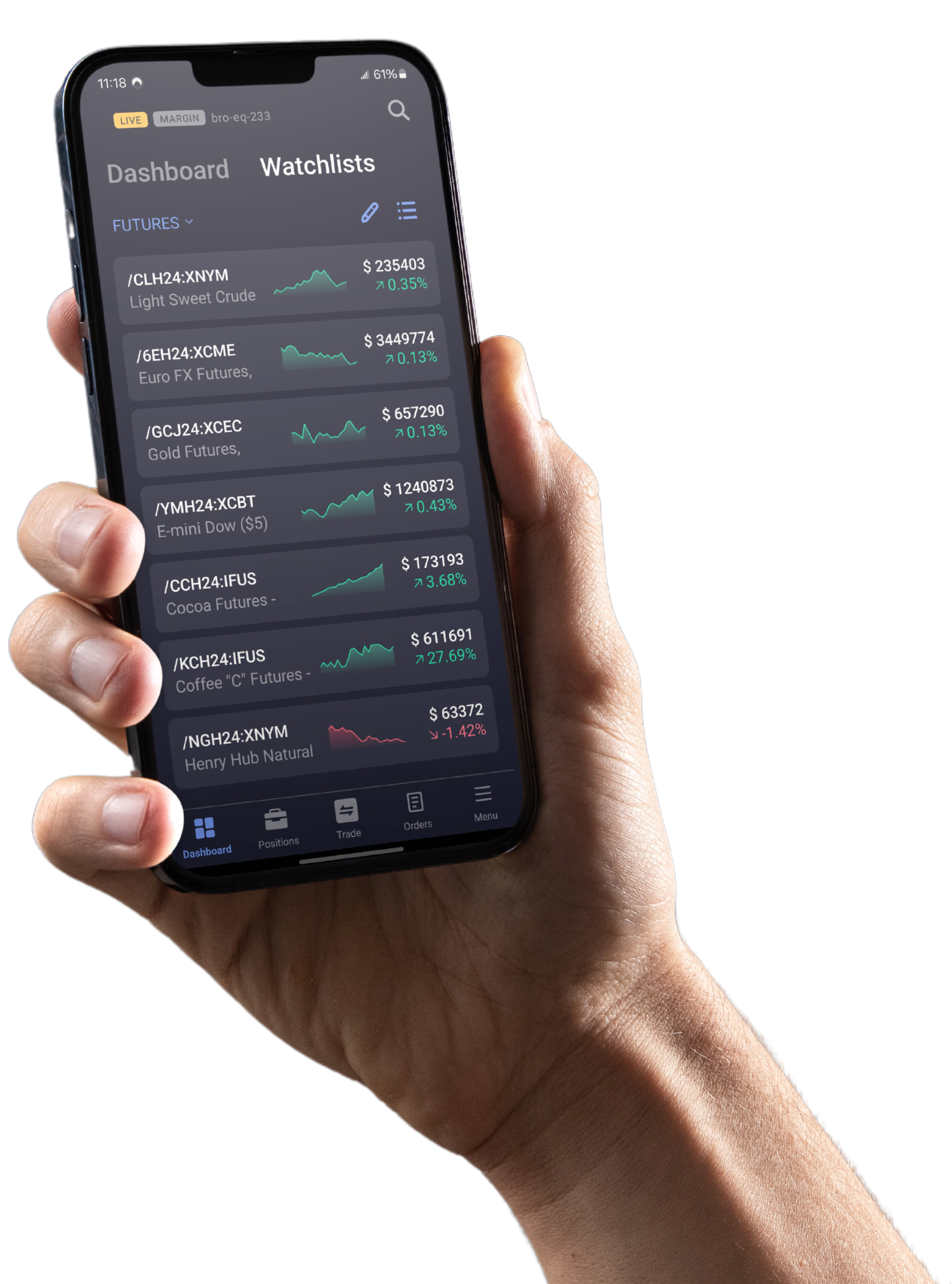

Access Global Markets

Trade Currency Futures

What are Currency Futures?

Currency futures, also known as FX or Forex futures, are standardized contracts that allow traders to buy or sell a specific foreign currency at a predetermined price on a set date in the future.

Unlike over-the-counter trading, currency futures are traded on regulated exchanges like the CME, where all contracts are cleared through a central counterparty. These futures are quoted in U.S. dollars and follow fixed sizes and expiration dates, making them popular for both hedging currency exposure and speculating on exchange rate movements. Currency futures offer transparency, reduced counterparty risk, and a more structured alternative to traditional spot forex trading.

EUR/USD

The euro versus the U.S. dollar, often used to trade interest rate expectations and economic trends.

JPY/USD

Tracks the yen against the U.S. dollar, popular for carry trades and reacting to shifts in risk sentiment.

AUD/USD

Measures the Australian dollar versus the U.S. dollar, driven by commodities and APAC demand.

GBP/USD

The British pound against the U.S. dollar, shaped by UK economic data, central bank moves, and politics.

CAD/USD

Tracks the Canadian dollar versus the U.S. dollar, often influenced by oil prices and trade with the U.S.

Trade Currency Futures

at MetroTrade

Contracts Available

| Code | Product Name | Contract Size | Min. Tick Size | Trading Hours (EST) |

|---|---|---|---|---|

| /6E | Euro FX Futures | 125,000 EUR | 0.00005 = $6.25 | Sun 5 PM – Fri 4 PM |

| /E7 | E-mini Euro FX Futures | 62,500 EUR | 0.00005 = $3.125 | Sun 5 PM – Fri 4 PM |

| /M6E | Micro Euro FX Futures | 12,500 EUR | 0.0001 = $1.25 | Sun 5 PM – Fri 4 PM |

| /6J | Japanese Yen Futures | 12,500,000 JPY | 0.0000005 = $6.25 | Sun 5 PM – Fri 4 PM |

| /J7 | E-mini Japanese Yen Futures | 6,250,000 JPY | 0.000001 = $6.25 | Sun 5 PM – Fri 4 PM |

| /MJY | Micro Japanese Yen Futures | 1,250,000 JPY | 0.000001 = $1.25 | Sun 5 PM – Fri 4 PM |

| /6A | Australian Dollar Futures | 100,000 AUD | 0.0001 = $10.00 | Sun 5 PM – Fri 4 PM |

| /M6A | Micro Australian Dollar Futures | 10,000 AUD | 0.0001 = $1.00 | Sun 5 PM – Fri 4 PM |

| /6B | British Pound Futures | 62,500 GBP | 0.0001 = $6.25 | Sun 5 PM – Fri 4 PM |

| /M6B | Micro British Pound Futures | 6,250 GBP | 0.0001 = $0.625 | Sun 5 PM – Fri 4 PM |

| /6C | Canadian Dollar Futures | 100,000 CAD | 0.0001 = $10.00 | Sun 5 PM – Fri 4 PM |

| /MCD | Micro Canadian Dollar Futures | 10,000 CAD | 0.0001 = $1.00 | Sun 5 PM – Fri 4 PM |

Access Contracts of All Sizes

Full Size

Full-size futures contracts represent the standard, complete unit of a financial index or commodity in the futures market. These contracts offer larger position sizes and potentially greater profit (or loss) potential, they also require more capital and carry higher risk compared to their E-mini and Micro counterparts.

E-mini

E-minis are a standard futures contract that is broken down into a fractional portion of a financial index. The “E” designates it is traded electronically. When launched in 1997, E-minis were a fraction of the size of pit-traded contracts, but they have come to dominate the futures markets.

Micro E-mini

Trade a slice of CME’s liquid futures markets and get the same capital efficiency as standard E-mini contracts with less upfront financial commitment.

Frequently Asked Questions

Why trade currencies using futures instead of the spot forex market?

Futures offer greater transparency, centralized pricing, and exchange-traded security, making them ideal for traders who want regulated access to currency markets without relying on retail forex brokers.

How are currency futures different from forex trading?

While forex (FX) trades over-the-counter with variable pricing and broker spreads, currency futures are standardized, regulated, and cleared through a central exchange like the CME, reducing counterparty risk.

What currencies can I trade as futures?

Major contracts include EUR/USD, JPY/USD, GBP/USD, AUD/USD, and CAD/USD. Most are available in standard and micro sizes, though availability varies by contract.

Who uses currency futures?

FX futures are used by multinational businesses, fund managers, and individual traders to hedge foreign exchange exposure or speculate on price movements in global currency markets.

When do currency futures trade?

Most FX futures trade nearly 24 hours a day, from Sunday 5 PM to Friday 4 PM ET, with a one-hour break each weekday between sessions.

Are currency futures physically delivered?

Most CME currency futures are cash-settled in U.S. dollars, but settlement terms can vary by contract. Always check the specifications for the product you’re trading on the CME Group website.

No Minimum Deposit Required

Whether you’re new to futures trading or an experienced trader, we get you on track to begin your trading journey with flexibility. No need for large initial deposits—start with an amount that suits you and grow from there.