Trade Spot-Quoted Futures at Exact Market Prices

New Spot-Quoted Futures (SQFs) let you trade index and crypto markets at exact prices, with lower capital requirements and no expiration worries.

Why Trade Spot-Quoted Futures?

Spot-Quoted Futures are designed to give traders a more direct and transparent way to access markets. Unlike traditional futures, which can trade at a premium or discount, SQFs are quoted exactly at the spot index level.

Trade at Spot Prices

You can enter and exit positions directly at the real index level.

Trade with Less

SQFs are designed for accessibility, allowing traders to get started with as little as $100.

Long Expirations

Spot-Quoted Futures come with longer expirations, so you don’t need to worry about rollovers.

Day Trading Friendly

SQFs combine smaller contract sizes with direct pricing to suit active traders.

How to Trade SQFs

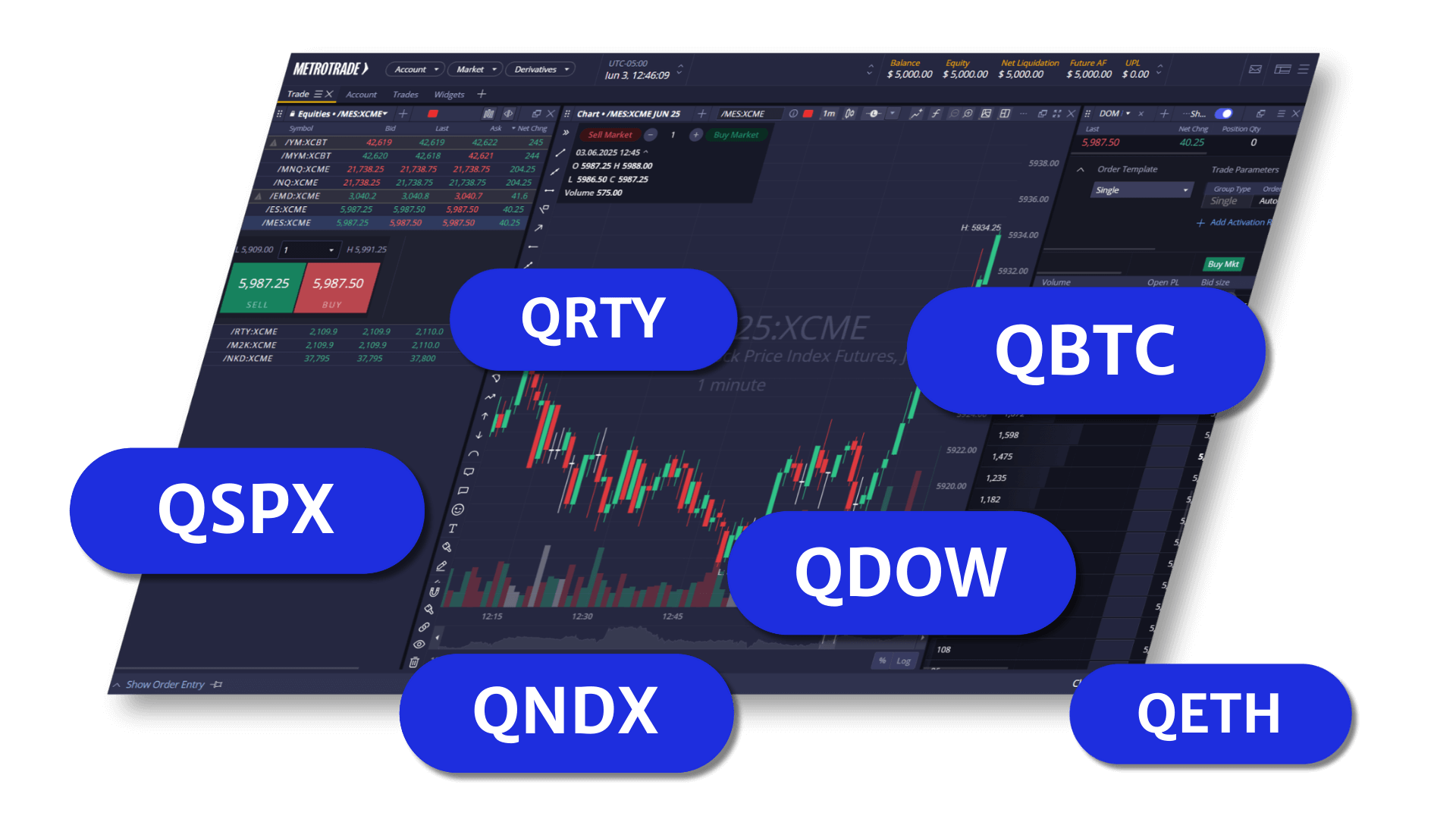

Pick Your Market

Choose from popular equity indexes and cryptocurrencies, including S&P 500, Nasdaq-100, Dow Jones, Russell 2000, Bitcoin, and Ethereum.

Trade at the Exact Price

Each order is quoted at the live index level, making it easy to track your positions.

Simple Results

With smaller contract sizes and direct pricing, your profit and loss are easy to calculate and track.

How Do Spot-Quoted Futures Work?

Available Markets & Specs

| Product Code | Market | Contract Size | Tick Value |

| QSPX | S&P 500 | $1 × Index | $1 per tick (1 index point) |

| QNDX | Nasdaq-100 | $0.10 × Index | $0.10 per tick |

| QDOW | Dow Jones | $0.10 × Index | $0.10 per tick |

| QRTY | Russell 2000 | $1 × Index | $1 per tick (1 index point) |

| QBTC | Bitcoin | 0.01 BTC | $10 per BTC (≈ $0.10 per tick) |

| QETH | Ether | 0.20 ETH | $0.50 per ETH (≈ $0.10 per tick) |

Source: CME Group

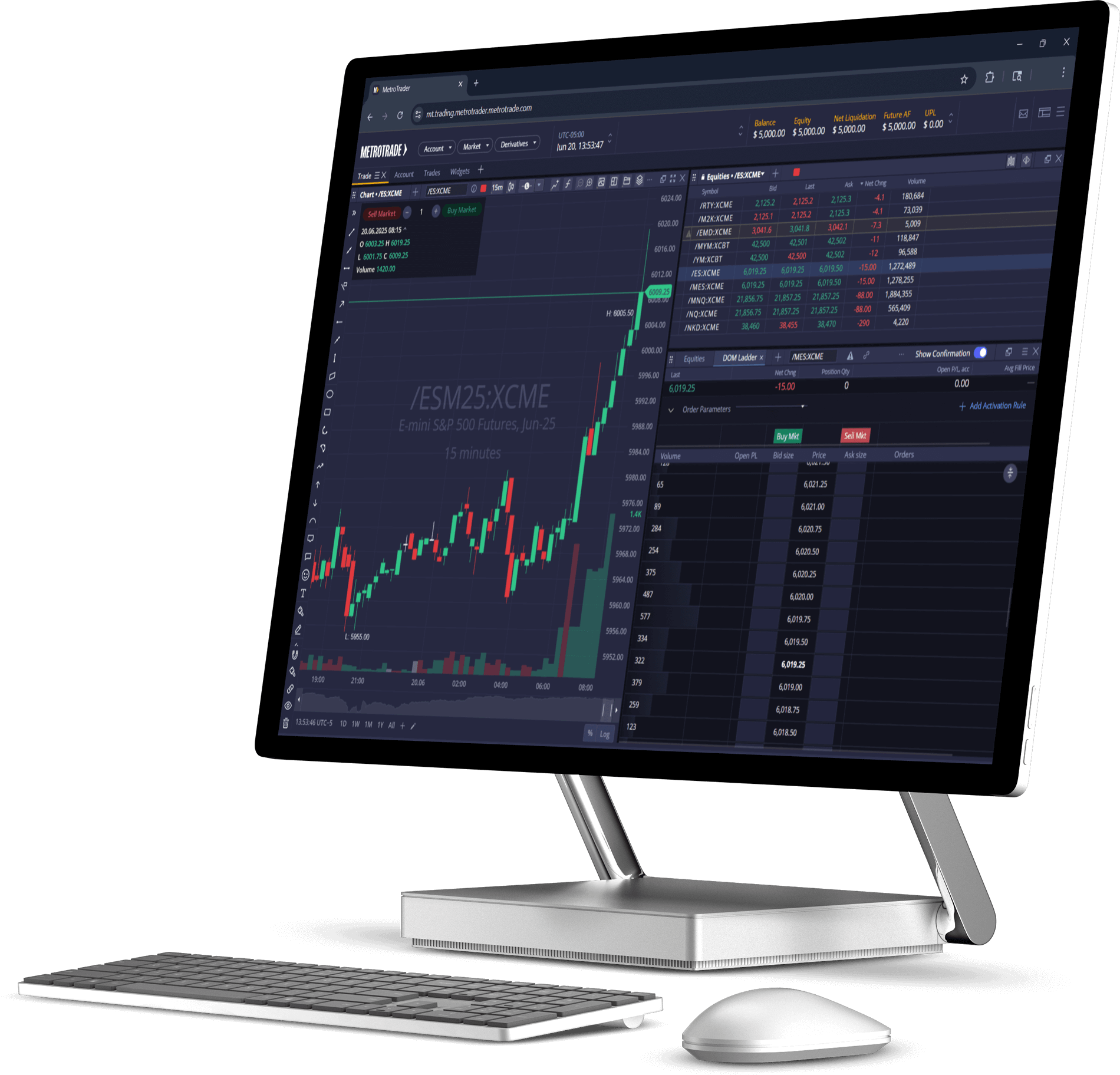

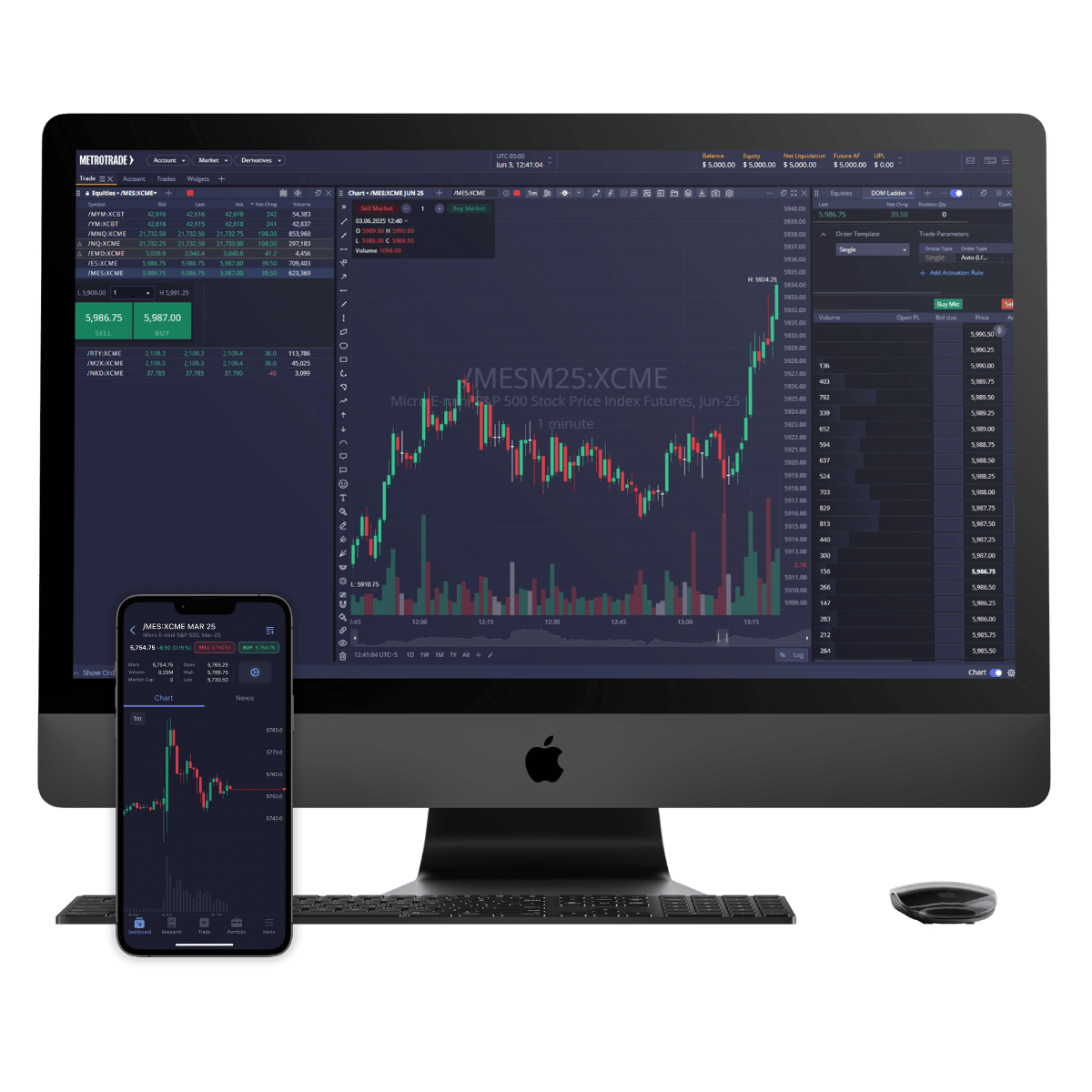

Trade Spot-Quoted Futures Today

Spot-Quoted Futures are available to trade on MetroTrade! Be among the first to trade CME’s newest contracts with exact market pricing, simplified results, and lower capital requirements.

Frequently Asked Questions

What are Spot-Quoted Futures (SQFs)?

Spot-Quoted Futures are CME-listed contracts that trade directly at the spot index level, eliminating premiums or discounts found in traditional futures.

How do Spot-Quoted Futures differ from traditional futures?

Traditional futures often trade above or below the index price. Spot-Quoted Futures always match the index, making them simpler and easier to understand.

What markets can I trade with Spot-Quoted Futures?

You can trade Spot-Quoted Futures on major equity indexes like the S&P 500, Nasdaq-100, Dow Jones, Russell 2000, as well as Bitcoin and Ether.

What is the minimum capital required to trade SQFs?

Spot-Quoted Futures are smaller contracts, and most can be traded with as little as $100 in margin.

Are Spot-Quoted Futures good for day traders?

Yes. SQFs are designed for active traders, offering smaller contract sizes, direct index pricing, and no expiration worries.