If you’re trading futures or just getting started, you’ve probably seen the terms volume and open interest on a chart or in your platform’s data feed. These numbers can seem similar at first, but they represent two very different things.

Volume shows how many trades are happening. Open interest shows how many contracts are still active. Together, they give you powerful insight into market activity, trend strength, and trader positioning.

In this guide, we’ll break down the difference between open interest and volume, explain how to read them, and show how they can help you trade smarter.

Key Takeaways

- Volume shows the number of contracts traded during a specific time period.

- Open interest shows the total number of outstanding contracts that haven’t been closed or settled.

- These tools work best when used together to analyze market strength and participation.

- Traders use volume and open interest to confirm trends, spot reversals, and gauge market sentiment.

What Is Volume in Futures Trading?

Volume in futures trading is the total number of contracts traded during a specific time frame. It resets at the beginning of each trading day.

If 1,000 Micro E-mini S&P 500 (MES) contracts trade hands before lunch, the volume for that day is already 1,000, even if some traders are buying and others are selling.

How Volume Is Calculated

Every time a futures contract is bought and sold, that counts as one unit of volume. Both the buyer and seller are included in a single count, not as two separate units.

Example: If Trader A buys 1 MES contract from Trader B, volume increases by 1.

Real-Time vs End-of-Day Volume

Most trading platforms show volume in real-time. This helps you monitor market activity as it unfolds.

At the end of the trading day, you’ll see the daily volume total on the exchange or in your trading platform. High-volume days typically mean strong interest or volatility.

Why Volume Matters

- High volume can confirm a price move.

- Low volume can suggest a lack of conviction.

- Volume spikes can signal breakouts, reversals, or news reactions.

What Rising or Falling Volume Tells You

- Rising volume during a price rally suggests buyers are active and committed.

- Falling volume during a move higher may hint at a weak or unsustainable rally.

- Low volume in sideways markets can indicate indecision.

- Sudden volume spikes often occur around key economic reports or market opens.

Volume by itself doesn’t tell you who’s in control, but it shows how many participants are actively trading.

What Is Open Interest in Futures Trading?

Open interest is the total number of open futures contracts that are still active and have not been closed or settled. It helps traders understand how much capital is staying in the market.

Unlike volume, open interest does not reset daily. It carries over and updates based on contract creation or closure.

How Open Interest Is Calculated

- Open interest increases when a new buyer and seller enter a contract.

- Open interest decreases when both sides close out existing positions.

Example: If Trader A opens a new long MES contract and Trader B opens a new short MES contract, open interest increases by 1.

But if they both close their existing contracts, open interest decreases by 1.

When Does Open Interest Update?

Most platforms update open interest once per day, usually after the close. That means it’s not real-time like volume, but still useful for analyzing trends and participation.

What Changes in Open Interest Indicate

Understanding how open interest changes from one day to the next can reveal what traders are doing behind the scenes. While volume shows the activity level, open interest shows whether positions are being added or closed.

Here are the main types of open interest changes and what they could mean:

Rising Open Interest

An increase in open interest means that new contracts are being created. This happens when a buyer and a seller enter into a brand-new agreement, rather than closing existing ones.

What it suggests:

- New money is entering the market

- Traders are confident in the trend or expect movement

- The current price direction (up or down) may continue

Example: If crude oil futures are rising and open interest increases for three straight days, it likely means new longs are being added, fueling the rally.

Falling Open Interest

A drop in open interest means that traders are closing out existing positions. This happens when both the long and short side exit their trades, either through taking profits, hitting stop losses, or losing interest in the market.

What it suggests:

- Traders are taking money off the table

- The trend could be weakening or nearing exhaustion

- The market may be entering a consolidation phase

Example: If gold futures are falling but open interest is also falling, it may signal that the selling pressure is running out of steam.

Flat or Unchanged Open Interest

When open interest remains relatively stable, it often means that buyers and sellers are equally matched. Positions are being transferred, but not created or closed in meaningful numbers.

What it suggests:

- Traders are uncertain about the next move

- Could indicate a pause before a breakout

- Often seen during sideways or range-bound markets

Example: The S&P 500 might trade in a narrow 20-point range for several days with little change in open interest, suggesting traders are waiting on a key economic report.

Why this matters:

Tracking open interest can help you see who’s staying in the fight. If traders are opening new positions, it shows commitment. If they’re exiting, it shows hesitation. Combine this with price and volume, and you can get ahead of shifts in market sentiment.

Open Interest vs Volume: Core Differences

While both open interest and volume relate to futures trading activity, they measure very different things. Knowing how they differ helps you avoid confusion and interpret market data more effectively.

Here’s a breakdown of the core differences:

1. Volume Measures Activity, Open Interest Measures Participation

- Volume counts the number of trades made during a specific time frame.

- Open interest counts how many contracts are still active at the end of the trading day.

Think of volume as a speedometer—it tells you how fast the market is moving. Open interest is more like an odometer—it tells you how many traders are still on the road.

2. Volume Resets Daily, Open Interest Rolls Over

- Every trading day, volume starts at zero.

- Open interest continues from the previous day and changes only when traders open or close contracts.

If 1,000 contracts trade on Monday and another 2,000 on Tuesday, volume is 2,000 for Tuesday. But if none of those trades close out existing positions, open interest stays constant or increases.

3. Volume Responds to News; Open Interest Shows Commitment

- Volume often spikes during news events, earnings, or data releases. It captures short-term excitement.

- Open interest rises when traders build positions and falls when they exit. It reflects longer-term views.

4. Volume is Real-Time; Open Interest is Delayed

Most platforms display volume in real time as trades occur. But open interest updates once per day, usually after the market closes. This time lag makes OI better for tracking position buildup over multiple sessions—not intraday trading.

5. Strategy Use Cases

Both volume and open interest play different roles depending on your trading strategy.

- Confirming breakouts: Volume is often the first place traders look to confirm a breakout. If price pushes above resistance but volume is weak, the move may not last. Open interest can add confirmation on the following day. If it rises alongside volume, it suggests new positions are supporting the breakout.

- Gauging trend strength: A strong trend usually has both rising volume and rising open interest. If volume remains high but open interest levels off or drops, it may signal that traders are exiting and the trend is weakening.

- Spotting reversals: Sharp reversals often begin with unusual volume and a change in open interest. For example, if price falls sharply but open interest decreases, it could indicate profit-taking rather than strong selling pressure, hinting at a possible bounce.

- Measuring conviction: Open interest is better than volume for assessing how committed traders are to their positions. High and rising open interest reflects strong conviction and participation, while falling OI can show that traders are backing away.

- Timing intraday entries: Volume is more useful than open interest for intraday trading because it updates in real time. Many day traders watch volume spikes around support/resistance levels or key news events to time entries or exits. Open interest, with its daily delay, is less helpful on lower timeframes.

By understanding how each data point fits into your strategy, you can better decide when to enter, hold, or exit a trade.

Price, Volume, and Open Interest: The Three-Part Signal

When you combine price, volume, and open interest, you gain a more complete understanding of what’s happening beneath the surface. Let’s look at how these three indicators interact and how traders interpret common patterns.

1. Price ↑ + Volume ↑ + Open Interest ↑

This is often seen as bullish confirmation. Price is moving up, more trades are taking place, and traders are adding new long positions.

What it means:

- Buyers are confident

- Fresh capital is entering

- Trend may have room to run

Used in trend continuation setups or breakout entries.

2. Price ↑ + Volume ↑ + Open Interest ↓

This pattern usually signals a short-covering rally. Traders who were short are closing their positions, which pushes the price higher. But no new longs are entering.

What it means:

- Rally may lack staying power

- Could reverse once short covering ends

- Not a trend to chase aggressively

Use caution here. Wait for confirmation or retest before going long.

3. Price ↓ + Volume ↑ + Open Interest ↑

This often points to bearish conviction. Price is falling, volume is rising, and more traders are opening short positions.

What it means:

- Strong selling pressure

- Downtrend likely to continue

- Bearish sentiment gaining strength

Can signal short entries or trend continuation setups.

4. Price ↓ + Volume ↓ + Open Interest ↓

This is usually a weak downtrend or early bottoming pattern. Low participation and no new capital entering the trade.

What it means:

- Sellers may be taking profits

- No conviction on either side

- Possible reversal or sideways action ahead

Look for support zones or bullish divergence in other indicators.

5. Price Flat + Volume Low + Open Interest Rising

This pattern may indicate quiet accumulation or positioning. Price may not be moving yet, but traders are quietly entering positions in anticipation of a breakout.

What it means:

- The market may be coiling for a large move

- Often seen before major news or contract rollovers

- Smart money may be entering early

Useful for breakout traders. Watch for volume to spike and price to confirm.

How to Use the Three-Part Signal in Practice

When these three metrics line up, they can provide high-confidence trade setups. But when they diverge, like rising prices with falling open interest, it’s often a warning sign. Here are a few tips:

- Don’t look at volume or open interest in isolation. They work best together, with price action as the third leg.

- Check multiple timeframes. A bullish setup on the daily chart might conflict with short-term noise on a 5-minute chart.

- Use it as confirmation, not prediction. These signals are more reliable when used to confirm an idea, not to guess market direction on their own.

How to Read Volume and Open Interest Together

Volume and open interest complement each other. Here’s how to use them side by side:

- Volume confirms price: A breakout with low volume may be a trap. High volume adds credibility.

- Open interest tracks participation: Rising OI shows commitment. Falling OI shows traders backing away.

Together, these tools can help you:

- Confirm trend strength

- Avoid weak breakouts

- Spot potential reversals

- Gauge trader sentiment

Real Example: Volume and Open Interest in MES Futures

Let’s say the MES (Micro E-mini S&P 500) is trading at 4,800. Over the last two sessions, the price has steadily risen.

- Volume jumped from 200,000 to 300,000 contracts.

- Open interest rose from 1.1 million to 1.3 million.

What does this mean?

- Price ↑ + Volume ↑ + OI ↑

This suggests strong buying pressure, with new traders entering the market. The trend could continue.

But if instead:

- Volume is 300,000, and OI drops to 1.0 million; that’s a red flag.

Price ↑ + Volume ↑ + OI ↓

This could indicate short covering or profit-taking, not new bullish bets.

These insights help traders adjust position size or risk management based on the conviction behind the move.

How to View Volume on MetroTrader

Real-time volume is easy to access on the MetroTrader platform. The Watchlist widget displays live volume updates for all selected contracts. As soon as a contract is added to your watchlist, you’ll see current volume figures without needing to open a chart.

Where to find Open Interest Data

While MetroTrader offers real-time volume, open interest data is not updated live and is not currently displayed on the platform.

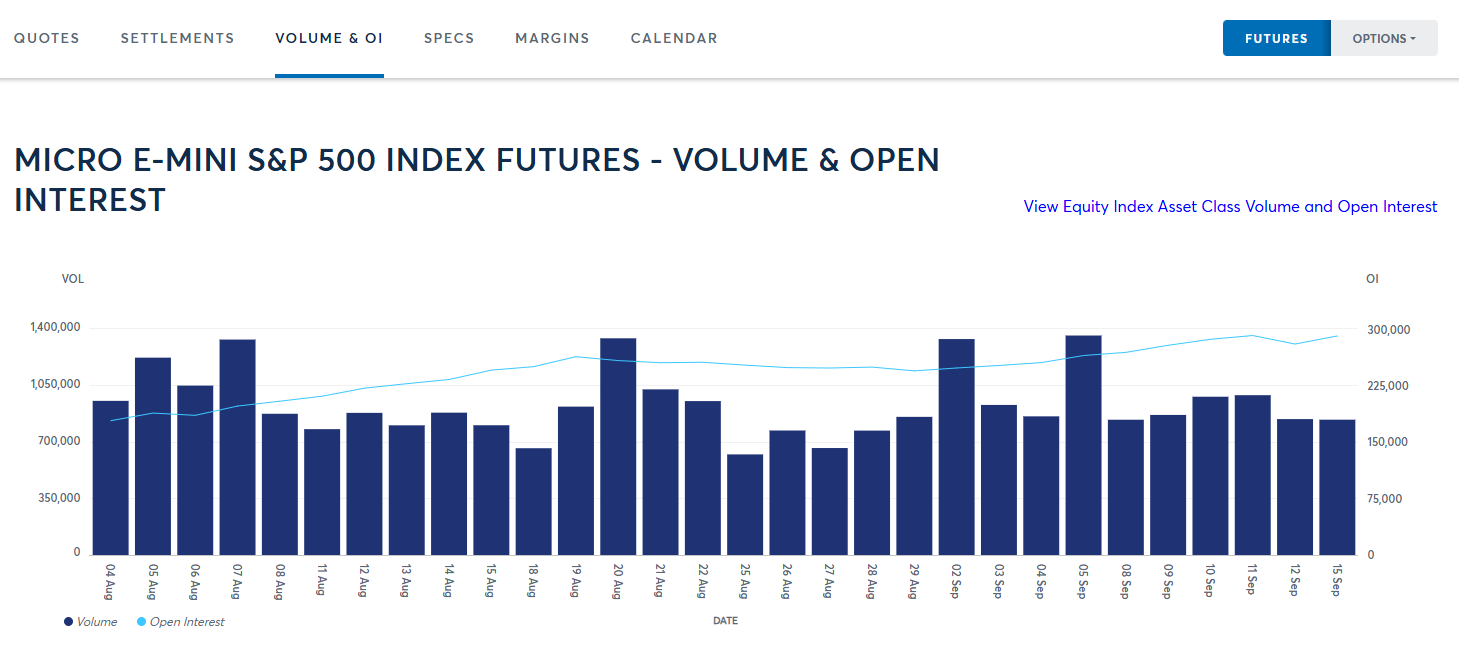

To access official and up-to-date open interest figures, visit the CME Group website.

Go to CME Group’s Daily Volume and Open Interest page or search for a specific contract and go to the Volume & OI tab (MES example).

These reports are updated at the end of each trading day and are the most reliable source for futures open interest across all CME-listed contracts.

Tips for Using Open Interest and Volume in Your Strategy

- Always analyze both volume and open interest in the context of price movement.

- Use these tools with others like VWAP, moving averages, or RSI.

- Don’t act on one-day spikes. Look for consistent trends.

- Practice reading these metrics in a demo account before risking real capital.

- Pay attention to rollover dates, as volume and OI can drop when traders shift to a new contract month.

Common Misconceptions

- High volume doesn’t mean bullish: It just means many trades happened. It could be aggressive selling.

- Open interest isn’t directional: It shows contracts are open, but not who is long or short.

- You can’t see who’s winning: Volume and OI don’t show P&L or trader positioning.

- Open interest can fall during rallies: Often due to profit-taking or short covering.

Understanding these myths helps avoid costly assumptions.

Conclusion

Volume and open interest are two of the most important tools in futures trading. Volume shows market activity. Open interest shows market participation. When used together, they provide a more complete view of what’s happening under the surface.

Next time you spot a breakout, don’t just look at price. Check the volume and open interest too. These signals can help you avoid traps and spot real opportunities.

Ready to put this into action? Create a MetroTrade account today and start analyzing volume and open interest in a free 30-day demo account.

FAQs

What is the difference between open interest and volume in futures trading?

Open interest is the number of active futures contracts that are still open and not yet closed. Volume is the number of contracts traded during a specific time period, such as a day. Open interest shows ongoing participation; volume shows daily trading activity.

Is high open interest bullish or bearish?

High open interest is neither bullish nor bearish by itself. It simply means many contracts are still active. To understand market sentiment, traders compare open interest with price and volume changes.

What does increasing volume mean in futures trading?

Increasing volume means more contracts are being traded. This often signals strong interest in the current price move and can confirm the direction of a breakout or trend.

Can open interest decrease while volume increases?

Yes. Open interest can decrease if traders are closing positions, even as volume rises. This usually means contracts are being liquidated rather than created, which can weaken a trend.

How often is open interest updated?

Open interest is typically updated once per day, after the trading session closes. Unlike volume, it is not updated in real time on most platforms.

How do traders use volume and open interest together?

Traders use volume to confirm short-term price moves and open interest to assess market participation. When both rise with price, it suggests a strong trend. If price rises but open interest falls, it may be a short-covering rally.

What does it mean when price rises but open interest falls?

When price rises and open interest falls, it usually means traders are closing out short positions. This is known as short covering and can signal a temporary rally rather than a strong new uptrend.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.