Candlestick patterns help traders make sense of price movement on charts. Among the many formations, the hammer candlestick pattern stands out as a simple yet powerful tool for spotting potential reversals in the market.

If you’re new to technical analysis, this guide will walk you through what a hammer candlestick is, how it forms, what it means, and how to use it in real-world trading, especially in futures markets.

Key Takeaways

- The hammer candlestick pattern signals a potential bullish reversal when it appears after a downtrend, showing buyers may be regaining control.

- Its structure includes a small real body near the top and a long lower wick, which reflects intraday selling pressure followed by a strong recovery.

- Confirmation from the next candle and supporting volume increases reliability, helping traders avoid false signals and time entries more effectively.

- Hammer patterns are widely used across futures markets and work best when combined with support levels, trend context, and other technical indicators.

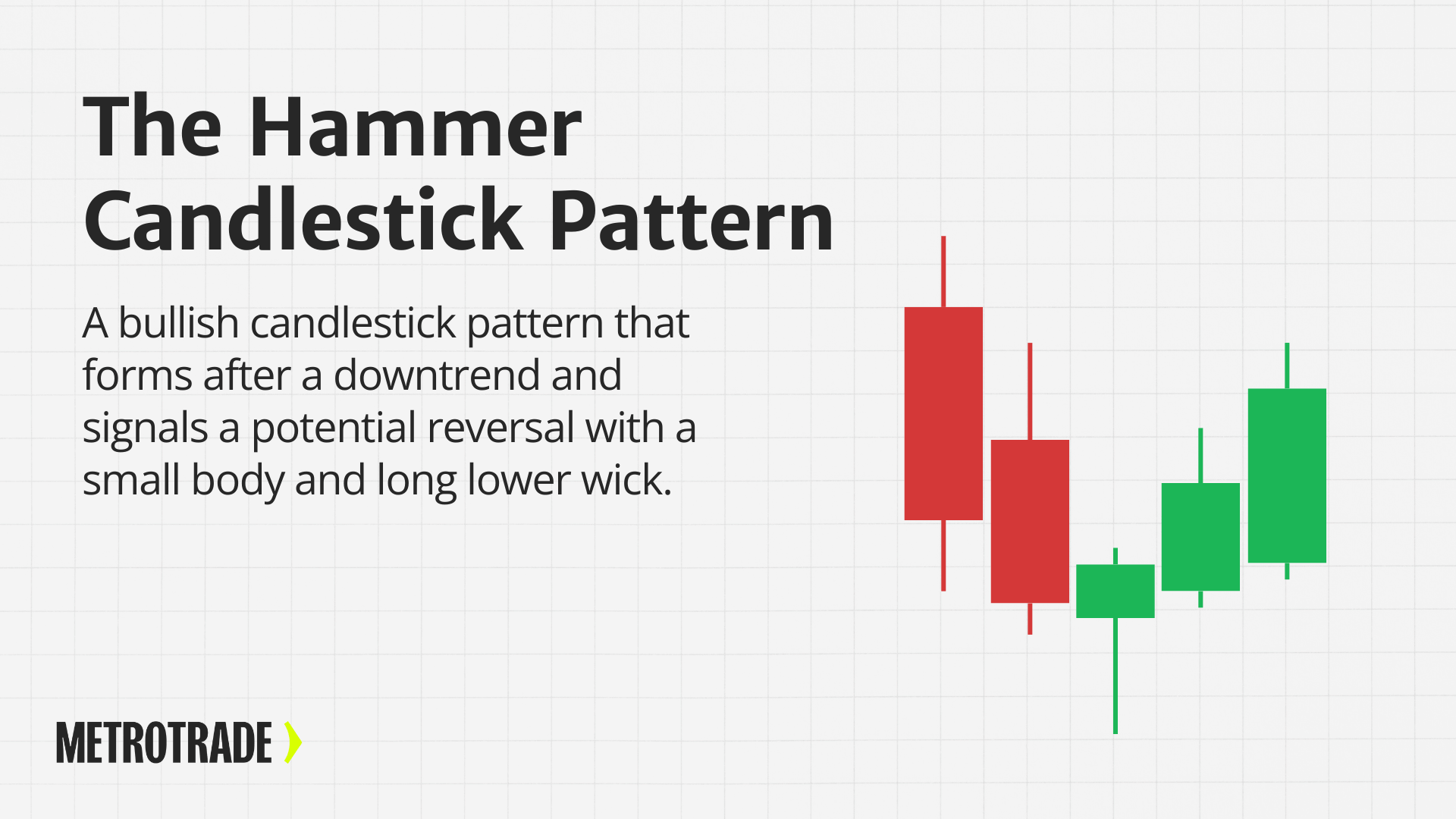

What Is the Hammer Candlestick Pattern?

The hammer candlestick is a single-bar bullish reversal pattern that forms after a downtrend. It signals that selling pressure may be weakening and that buyers are starting to regain control. The name comes from its shape, which resembles a hammer: a small body near the top of the range and a long lower wick that shows the price was driven down but sharply rejected.

Traders look for hammer candles because they often mark the beginning of a shift in momentum. While the pattern itself is simple, its meaning comes from context. A hammer tells the story of a market that attempted to push lower but failed, closing the session with signs of buyer strength.

When paired with confirmation from the next candle or other technical tools, the hammer pattern can offer a useful early signal of a potential price reversal.

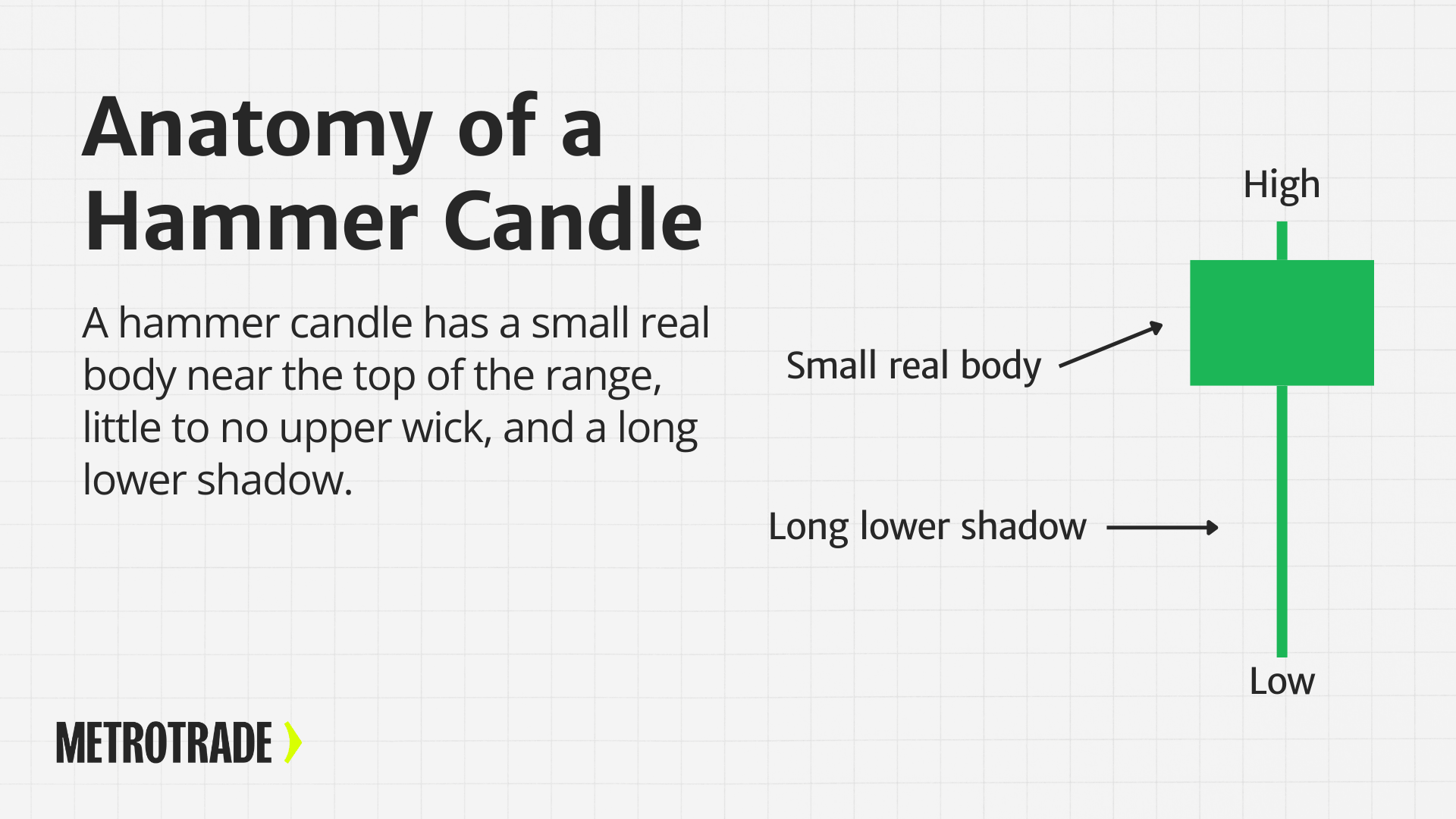

Anatomy of a Hammer Candle

A proper hammer has three defining features:

- Small Real Body: Located near the top of the candle’s range. The color can be green (bullish) or red (bearish), but green is often more reliable.

- Long Lower Shadow: The lower wick should be at least twice the height of the real body. This shows how far sellers were able to push price down before buyers took control.

- Little to No Upper Shadow: A small upper wick or none at all means buyers held the gains into the close.

This structure is key. Without the long lower wick, it’s not a hammer; it’s just a regular candlestick.

Where the Hammer Appears: Context Matters

The hammer candlestick pattern is only effective when it forms in the right context. Many beginners make the mistake of spotting a candle with a long lower wick and calling it a hammer without looking at where it occurs on the chart. But the location of the pattern is what gives it meaning.

A hammer only matters after a downtrend.

For the hammer to suggest a potential reversal, it needs to follow a clear price decline. The pattern reflects a shift in momentum, so if there’s no prior selling pressure, there’s no real shift to signal.

For example:

- If price has been falling steadily for several days or weeks and a hammer forms near a key support level, it may indicate that selling is slowing and buyers are starting to step in.

- If price is moving sideways or consolidating in a range, a hammer-shaped candle might appear, but it lacks significance because there’s no established trend to reverse.

Avoid trading hammers in isolation.

Even if the candle has the perfect shape, it’s meaningless without proper context. Traders should always consider:

- Trend direction: Has the market clearly been in a downtrend?

- Price levels: Is the hammer forming near a support zone, prior low, or key technical level?

- Volume behavior: Was there increased volume on the hammer candle, showing buyer interest?

Hammers at the top of a trend are not bullish.

If a hammer forms at the top of an uptrend, it may look visually identical but carries the opposite meaning. This is called a hanging man pattern, and it can suggest that buyers are losing control. Mistaking a hanging man for a hammer is a common beginner error.

In short, not all hammers are created equal. A hammer at the right place and time can be a valuable signal, but without trend context and confirmation, it’s just another candle.

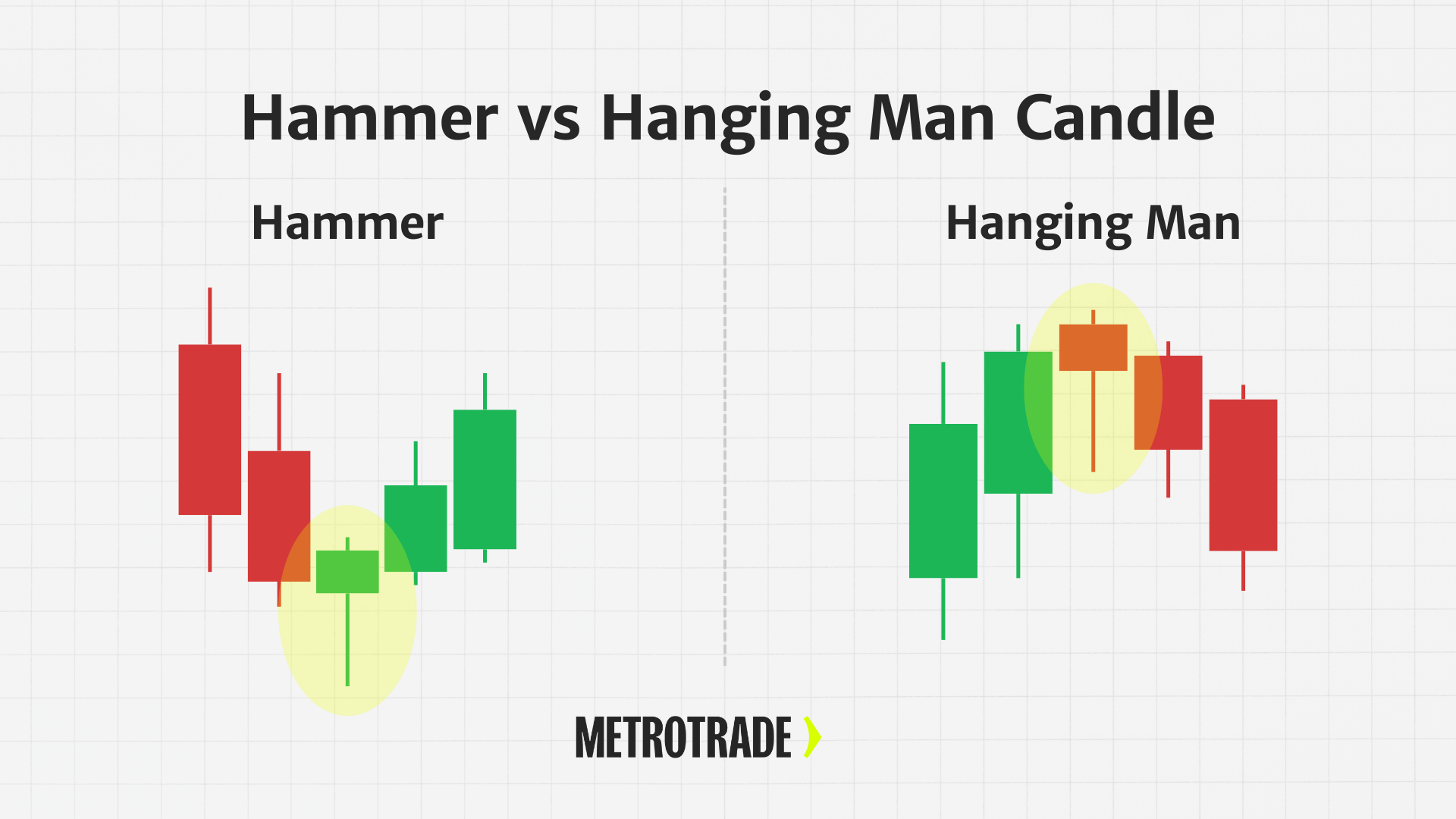

Hammer vs Hanging Man Candlestick Pattern

The hammer and the hanging man look almost identical on a chart, but they signal completely opposite things. This is why understanding placement within the trend is essential for interpreting candlestick patterns correctly.

Both candles have:

- A small real body near the top of the range

- A long lower shadow at least twice the height of the body

- Little to no upper shadow

So what’s the difference? It’s all about where the pattern appears.

- Hammer: Forms after a downtrend. Signals a potential bullish reversal.

- Hanging Man: Forms after an uptrend. Signals a potential bearish reversal.

In both cases, the long lower wick shows that sellers were able to drive prices down during the session. The small real body shows that buyers recovered some or most of that loss by the close.

But here’s the key psychological difference:

- With a hammer, the rejection of lower prices after a sustained decline suggests that selling pressure is weakening and buyers are stepping in. This shift may lead to a reversal higher.

- With a hanging man, the recovery from intraday lows may appear bullish at first glance, but the fact that sellers were able to push the price down significantly during an uptrend raises a red flag. It may signal exhaustion from the bulls and early signs of a reversal to the downside.

How to tell them apart:

Ask yourself:

- What was the trend leading into the candle?

- Are you seeing this at the bottom of a decline (hammer) or the top of a rally (hanging man)?

- Are there other technical signals supporting a possible reversal?

Don’t assume a candle’s message based on its shape alone. A hammer and hanging man are functionally the same candle, but they tell two very different stories depending on trend direction.

When in doubt, zoom out. Check the broader price action before and after the candle. Context is what turns a single candlestick into a trading signal.

Psychology Behind the Hammer Candle

Understanding the psychology of the hammer candlestick can improve your confidence in using it.

Here’s what’s happening inside the candle:

- Sellers push the price down early in the session.

- At some point, buyers step in aggressively.

- By the close, the price is near the opening level, suggesting buyer dominance.

This shift shows that bearish momentum may be ending and bullish momentum could be starting. It doesn’t guarantee a reversal, but it’s a strong hint that the tide may be turning.

In highly liquid markets like futures, this kind of price behavior often reflects major order flow changes from institutions or large speculators. A hammer can signal that buyers have absorbed available supply and are ready to take control.

Variations of the Hammer Pattern

There are a few candlestick patterns closely related to the hammer:

Inverted Hammer

- Looks like an upside-down hammer.

- Small real body at the bottom with a long upper wick.

- Still considered a bullish reversal, but needs strong confirmation.

Dragonfly Doji

- Similar to a hammer, but with no real body, open and close are nearly the same.

- Shows extreme intraday selling pressure followed by a full recovery.

- Signals indecision with potential for reversal.

While not true hammers, these variations tell a similar story: a possible shift in momentum from bearish to bullish.

How to Trade the Hammer Candlestick Pattern

Trading the hammer pattern requires more than just spotting the candle—you need a clear strategy for entry, risk, and profit targets. Here’s how to approach it:

- Entry point: Wait for confirmation. Don’t enter a trade as soon as a hammer forms. Instead, wait for the next candle to close above the hammer’s high. This follow-through shows that buyers are continuing to gain control and confirms the reversal setup.

- Volume confirmation: Look for strong participation. If the hammer candle forms with higher-than-average volume, that adds credibility to the pattern. Increased volume suggests that more market participants are supporting the reversal.

- Stop-loss placement: Protect your trade below the low. A common method is to place your stop-loss just below the low of the hammer candle. If price breaks that level, the pattern has failed, and exiting the trade limits your loss.

- Profit targets: Use resistance levels or risk-reward ratios. You can target the next logical resistance zone above the entry or use a 2:1 reward-to-risk ratio. Some traders scale out of positions as the trade moves in their favor, locking in partial profits along the way.

- Confluence: Combine with other indicators. Hammer patterns are more effective when confirmed by additional technical signals, such as RSI divergence, a bounce off a support line, or a trendline break. The more confluence, the stronger the setup.

- Avoid trading in isolation: Always consider the broader chart. Hammers in the middle of a range or with no volume support often lead to false signals. The best setups occur in clean downtrends, near clear support zones, and with visible signs of momentum shift.

By sticking to these rules and waiting for confirmation, traders can increase their success rate and avoid chasing setups that don’t follow through.

Advanced Tip: Multi-Timeframe Analysis

To improve your win rate, consider identifying hammer patterns on a lower timeframe that align with bullish signals on a higher timeframe.

For example:

- Spot a hammer on a 15-minute chart.

- Confirm that the 1-hour or 4-hour chart is showing signs of trend reversal or momentum shift.

- This adds context and reduces false signals.

Hammer Pattern in Futures Trading

The hammer candlestick pattern can be applied to a wide range of futures contracts, including:

- E-mini S&P 500 (ES)

- Micro E-mini (MES)

- Crude Oil (CL)

- Gold Futures (GC)

- Euro FX (6E)

In futures markets, the hammer is especially useful during volatile sessions or after news events. Because futures trade nearly 24 hours, hammer patterns can appear in overnight sessions or around economic releases.

Using tools like volume overlays, VWAP, and order flow analysis alongside hammer patterns can strengthen your entries and exits.

Example Chart Setup Using Hammer Candles

Let’s look at this hypothetical setup:

MES (Micro E-mini S&P 500):

- Price drops for three straight sessions and approaches a support zone.

- A hammer forms on the 15-minute chart with high volume.

- The next candle closes above the high of the hammer.

- A trader enters long, places a stop just below the hammer’s low, and targets the next resistance zone 2 points higher.

These examples show how hammer candles are used with support levels, confirmation candles, and volume to develop high-probability trades.

Common Mistakes to Avoid

When learning to trade hammer candlesticks, it’s easy to fall into a few traps. Avoid these mistakes:

- Ignoring trend context: A hammer after an uptrend is not bullish; it could be a hanging man.

- Trading without confirmation: Acting too early can lead to false entries. Always wait for follow-through.

- Over-relying on the pattern: Candlestick patterns work best when paired with other signals.

- Forgetting volume: Low-volume hammers are less reliable than high-volume ones.

- Neglecting key levels: Hammers near support zones are stronger than those floating in “no man’s land.”

Discipline and patience go a long way when using this pattern.

Platforms and Tools to Spot Hammer Patterns

If you’re trading with MetroTrade, you can use MetroTrader, our web and mobile platform, to spot and test hammer setups.

Using MetroTrader for Pattern Recognition

- Apply candlestick chart view in your dashboard.

- Zoom into recent price action and scan for hammer formations near key levels.

- Apply technical overlays like VWAP or moving averages for confirmation.

- Use RSI or stochastic indicators to gauge oversold conditions.

Practice with Simulated Trading

- MetroTrader’s demo mode uses real-time market data.

- Test hammer setups across MES, crude oil, gold, and other contracts without risk.

- Refine your entry/exit strategies and build muscle memory before going live.

Pros and Cons of Trading the Hammer Candlestick

Pros:

- Easy to identify: Simple structure makes it beginner-friendly.

- Versatile: Works on all markets and timeframes.

- Strong signal: Offers early signs of bullish momentum.

- Low barrier to entry: Can be traded using simple confirmation rules.

Cons:

- Not foolproof: Requires confirmation to reduce false signals.

- Context-sensitive: Only works well after a clear downtrend.

- Low-volume setups are weak: Volume is key to reliability.

- Can be overused: Traders may see hammers where they don’t exist.

Conclusion

The hammer candlestick pattern is one of the most effective single-bar setups in technical analysis. It tells a story of buyer strength returning after a selloff, giving traders a potential entry point into a market reversal.

By learning to recognize it, confirm it, and manage trades properly, you can turn this simple pattern into a powerful part of your trading toolkit.

Ready to put your skills to the test?

Start identifying hammer candlestick patterns with a free MetroTrader demo account and sharpen your edge before going live.

FAQs

What does a hammer candlestick pattern indicate?

A hammer candlestick pattern indicates a potential bullish reversal after a downtrend. It shows that sellers pushed the price down, but buyers regained control by the close.

Is the hammer candlestick pattern bullish or bearish?

The hammer pattern is bullish. It signals that downward momentum may be ending and a price reversal to the upside could follow.

How do you confirm a hammer candlestick pattern?

A hammer candlestick is confirmed when the next candle closes above the high of the hammer, especially if accompanied by increased volume.

Can a red hammer candlestick still be bullish?

Yes. A red hammer can still be bullish if it forms after a downtrend and meets the structural criteria. However, green hammers are typically considered stronger signals.

What is the difference between a hammer and a hanging man?

The hammer appears after a downtrend and signals a potential move up. The hanging man looks the same but forms after an uptrend and may signal a reversal to the downside.

What timeframe is best for trading hammer candlestick patterns?

Hammer candlestick patterns can appear on any timeframe, but they are more reliable on higher timeframes like the 1-hour, 4-hour, or daily chart.

Does the hammer candlestick pattern work in futures trading?

Yes. Futures traders use the hammer pattern to spot potential reversals in contracts like the S&P 500, crude oil, gold, and more—especially near key support zones.

How accurate is the hammer candlestick pattern?

The hammer candlestick pattern can be accurate when used with confirmation and trend context, but it is not foolproof. Success improves when combined with volume, support levels, and other indicators.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.