Understanding the language of futures trading starts with one essential concept: symbology. Futures symbology refers to the standardized codes used to identify each futures contract. These short letter-number combinations may look confusing at first, but they carry all the key details about what you’re trading.

If you’re a beginner trying to trade futures on a platform like MetroTrader or looking at contracts listed on the CME Group, you’ll need to know how to read these symbols. This guide breaks down how futures symbology works, what each part of a contract code means, and how to confidently identify contracts on any trading platform.

By the end of this article, you’ll understand how to decode futures symbols and avoid trading the wrong contract by mistake. If you’re just getting started, you can even test your knowledge in a free simulated trading account on MetroTrader with no risk.

Key Takeaways

- Futures symbology is a standardized code system used to identify each futures contract by asset, expiration month, and year.

- Each symbol includes three parts: a root symbol (like ES or CL), a month code (like Z for December), and a single- or double-digit year (like 5 for 2025).

- Knowing how to read futures symbols helps traders avoid costly mistakes, like entering the wrong contract or trading the wrong month.

- You can find official contract symbols on the CME Group website and broker platforms, and practice identifying them risk-free in a simulated trading account on MetroTrader.

What Is Futures Symbology?

Futures symbology is the naming system used to identify futures contracts. Each contract has a unique code that tells you three important things: the underlying asset, the delivery month, and the delivery year.

For example, the symbol ESZ5 is a shorthand way of saying you’re looking at the E-mini S&P 500 futures contract expiring in December 2025. Traders, brokers, and exchanges all use these symbols to make trading fast, consistent, and standardized.

Unlike stock tickers, which usually contain only a few letters representing a company, futures symbols include letters and numbers that pack in more information. This system is used globally and follows rules set by exchanges like the CME Group.

Knowing how to read and interpret these symbols is an important skill for any trader. Whether you’re trading crude oil, gold, or equity index futures, you’ll need to understand what each contract symbol means before placing a trade.

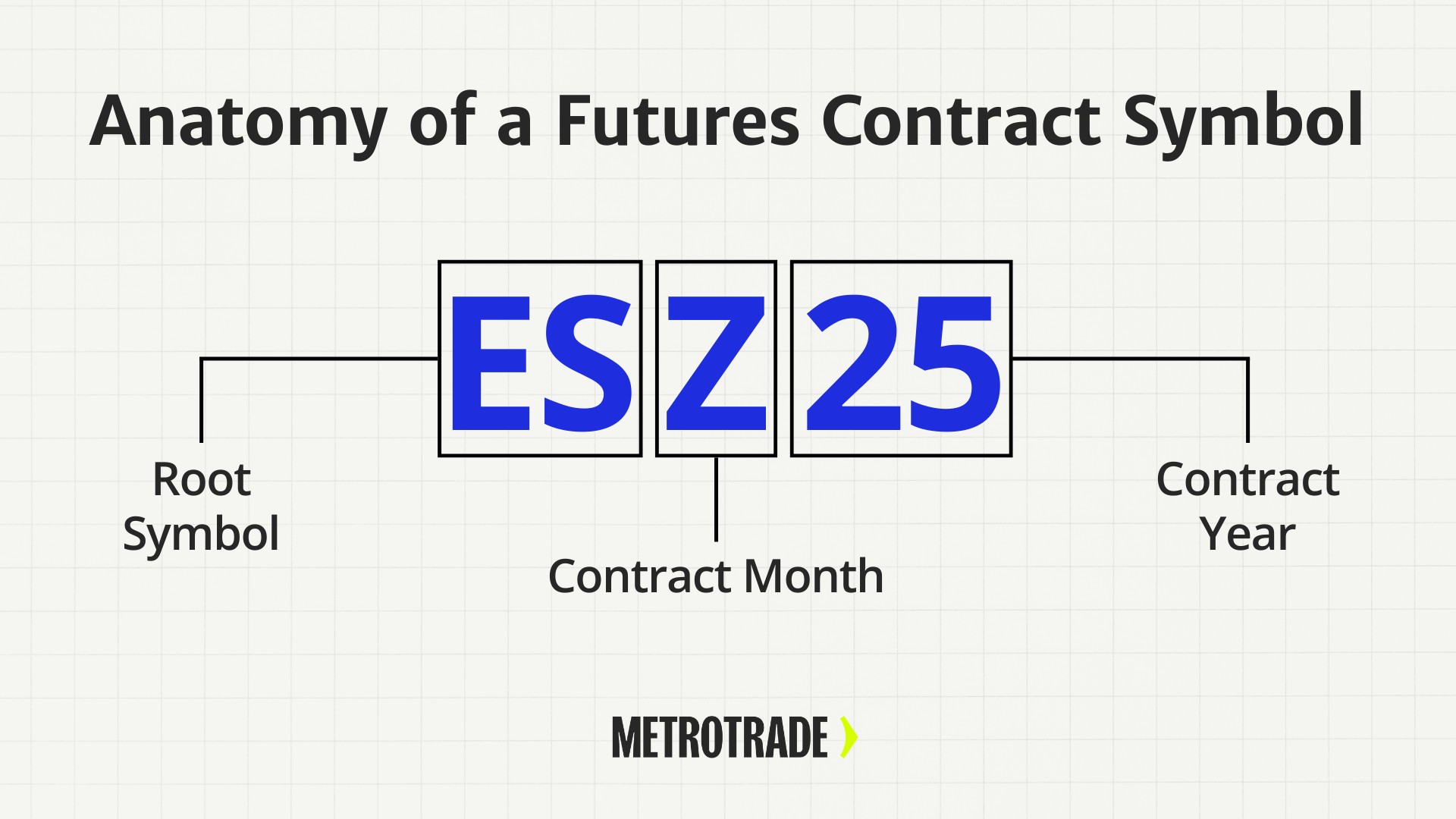

Anatomy of a Futures Contract Symbol

Most futures symbols follow a simple structure: a root symbol, a letter for the contract month, and a number for the contract year. Here’s a breakdown using the symbol ESZ5 as an example.

1. Root Symbol

This is a short abbreviation that identifies the underlying asset. Some common examples include:

- ES: E-mini S&P 500

- CL: Crude Oil

- GC: Gold

- NQ: E-mini Nasdaq-100

2. Contract Month Code

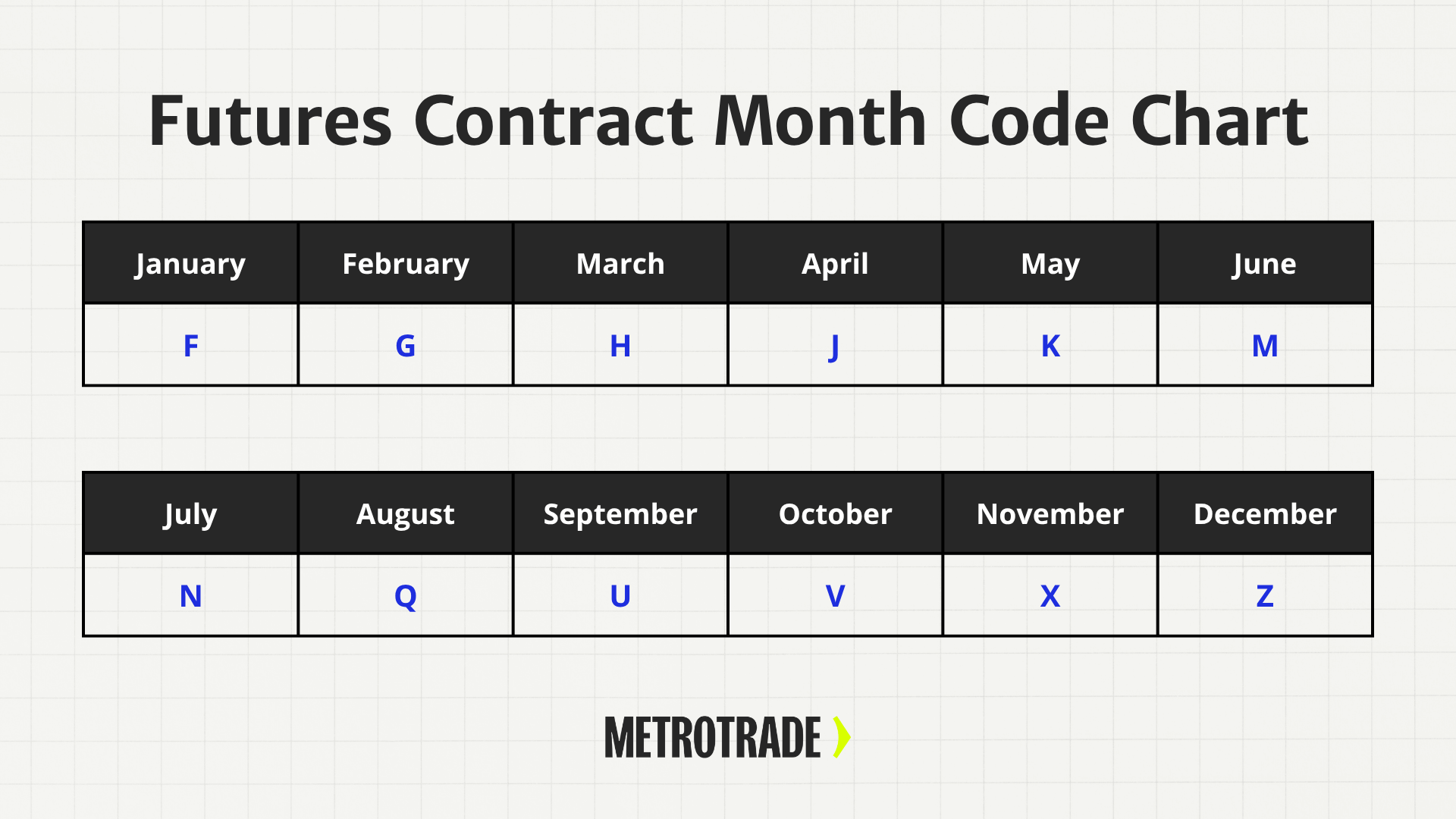

The second part is a single letter that tells you which month the contract expires. This is standardized across all CME-listed futures.

| Month | Code |

| January | F |

| February | G |

| March | H |

| April | J |

| May | K |

| June | M |

| July | N |

| August | Q |

| September | U |

| October | V |

| November | X |

| December | Z |

In our example, Z stands for December.

3. Contract Year

The final part is a number that represents the expiration year. In the symbol ESZ5, the number 5 refers to the year 2025. Sometimes you’ll see four-digit years on other platforms, like “ESZ2025”, but both formats mean the same thing.

Putting It All Together

- ES = E-mini S&P 500

- Z = December

- 5 = 2025

So ESZ5 means the E-mini S&P 500 December 2025 futures contract.

Futures Month Code Reference Chart

Month codes are used in nearly every futures contract symbol. They follow a fixed system across all CME Group products.

Here’s a quick reference you can return to whenever you need to decode a contract:

Every futures trader should memorize or bookmark this table. Using the wrong month code when entering a trade can result in a position on a different contract than intended.

How to Read Full Futures Symbols on Trading Platforms

Different trading platforms and brokers may display contract symbols in slightly different formats, even when they refer to the same product.

Here are a few examples:

- CME Group format: ESZ5 or ESZ2025

- TradingView format: /ESZ2025 or CME:ESZ2025

- MetroTrader format: /ES:XCME DEC 25 (as listed in the watchlist or chart widgets)

Some platforms include a slash (/) or exchange prefix to indicate which market the product is listed on. Others use the full four-digit year to avoid confusion. Regardless of the formatting, the core structure remains the same: root + month code + year.

When using charting tools or placing orders, make sure you select the correct symbol for the correct expiration month. Many platforms also include the expiration date and other specs next to the symbol for clarity.

Start Trading Futures Today

Start your live trading application and begin with margins as low as $80 per contract.

Examples of Popular CME Futures Symbols

To help you get familiar with common contracts, here’s a list of frequently traded CME futures along with sample symbols and brief descriptions.

|

Symbol |

Description |

Sample Full Symbol |

|

ES |

E-mini S&P 500 |

ESZ5 |

|

MES |

Micro E-mini S&P 500 |

MESZ5 |

|

NQ |

E-mini Nasdaq-100 |

NQZ5 |

|

MNQ |

Micro E-mini Nasdaq-100 |

MNQZ5 |

|

CL |

Crude Oil |

CLZ5 |

|

MCL |

Micro Crude Oil |

MCLZ5 |

|

GC |

Gold |

GCZ5 |

|

MGC |

Micro Gold |

MGCZ5 |

|

ZB |

30-Year Treasury Bond |

ZBZ5 |

|

ZN |

10-Year Treasury Note |

ZNZ5 |

|

6E |

Euro FX |

6EZ5 |

|

BTC |

Micro Bitcoin |

BTCZ5 |

|

ZW |

Wheat |

ZWZ5 |

|

ZC |

Corn |

ZCZ5 |

|

ZS |

Soybeans |

ZSZ5 |

These symbols represent a wide range of asset classes, including stock indexes, commodities, energy products, metals, interest rates, and currencies. Learning to identify them by root symbol will help you navigate any futures platform more confidently.

Symbology Differences: Micros vs E-minis vs Full-Size

Many popular futures contracts are offered in different sizes. While the root symbols are similar, they often include an extra letter to indicate size.

- ES = E-mini S&P 500

- MES = Micro E-mini S&P 500

- CL = Crude Oil

- MCL = Micro Crude Oil

These products track the same underlying asset but differ in contract size, tick value, and margin required. However, the symbology does not always reflect the contract multiplier. That’s why it’s important to check the contract specs, not just the symbol.

For example:

- MESZ5 is one-tenth the size of ESZ5

- MCLZ5 is one-tenth the size of CLZ5

The margin requirements, profit and loss per tick, and trading strategy can all change based on the contract size, so be sure you’re trading the version that fits your account size and risk profile.

Where to Find Futures Symbology Info

If you’re unsure about a futures symbol, you can find official information from a few trusted sources:

- CME Group’s Contract Directory

The CME website lists every active and historical futures contract, along with its root symbol, specifications, and expiration dates. - Broker Platforms

Most platforms like MetroTrader display contract symbols in dropdowns or search bars. These platforms often include detailed contract specs, tick sizes, and margins alongside each symbol.

Always verify the contract you’re trading, especially during rollover periods when multiple months are actively traded.

Why Futures Symbology Matters for Trading

Futures symbology is essential to making accurate trading decisions. Here’s why it matters:

- Prevents Trading Mistakes

If you misread the symbol, you might enter a position on a different asset or expiration month. This can lead to unexpected outcomes, especially when expiration dates approach. - Tracks Expiration Dates

Each symbol tells you when the contract expires. Understanding symbology helps you plan your rollovers and avoid trading illiquid or soon-to-expire contracts. - Supports Risk Management

Two contracts may look similar but have very different tick values and margin requirements. For example, ESZ5 (E-mini) vs MESZ5 (Micro) represent different levels of exposure. - Improves Trade Execution

When you’re entering orders, especially quickly, knowing the correct symbol format ensures accuracy. This is particularly important for day traders and scalpers.

Mastering futures symbology also makes it easier to follow news, use screeners, and share trade ideas with other traders.

Conclusion

Futures symbology might seem confusing at first, but once you understand the structure, it becomes second nature. These codes pack important information into just a few characters, helping traders identify the right contract at a glance.

Learning to read futures symbols is one of the most basic but important skills for any beginner trader. It helps prevent costly mistakes, supports smarter decisions, and gives you the confidence to navigate futures markets effectively.

Ready to put your knowledge into practice? Start trading live futures contracts in MetroTrader today – all you have to do is create a MetroTrade account and complete a quick application.

FAQs About Futures Symbology

What is futures symbology?

Futures symbology is the standardized naming system used to identify futures contracts. It includes a root symbol for the asset, a letter code for the expiration month, and a number for the expiration year.

How do you read a futures contract symbol?

To read a futures contract symbol, break it into three parts: the root symbol (asset), the month code (expiration month), and the year code (expiration year). For example, ESZ5 refers to the E-mini S&P 500 contract expiring in December 2025.

What is the difference between ES and MES futures?

The ES futures contract is the E-mini S&P 500, while the MES contract is the Micro E-mini S&P 500. MES is one-tenth the size of ES, making it better suited for small accounts or beginners.

Do all futures contracts use the same symbol format?

Most futures contracts follow a standard format: root symbol, month code, and year. While the structure is consistent across exchanges like CME, the way symbols appear may vary by platform or charting tool.

Where can I find official futures contract symbols?

You can find official futures contract symbols on the CME Group’s contract directory or your broker’s trading platform (like MetroTrader).

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.