Chart patterns play a key role in helping traders make decisions based on price behavior. One of the most recognizable and widely used continuation setups in technical analysis is the bull flag pattern. Traders often look for this formation during strong uptrends, viewing it as a sign that prices may continue rising after a short pause.

In this guide, you’ll learn what the bull flag pattern is, how to spot it on a chart, and how it can be used within a futures trading strategy. We’ll also explore key indicators that can enhance your analysis, along with common mistakes to avoid when trading this popular setup.

Whether you’re scalping intraday moves or holding a swing trade, recognizing the bull flag can help you take advantage of momentum-driven markets.

Key Takeaways

- The bull flag pattern is a bullish continuation setup that forms after a sharp price rally, followed by a brief downward or sideways consolidation. It signals that the uptrend is likely to continue once the pattern completes.

- The pattern reflects strong buying pressure and temporary profit-taking, indicating that the market remains bullish despite a short pause in price movement.

- Bull flags are common in fast-moving markets like futures, where volatility and leverage reward traders who can identify and trade trend continuations.

- Trading bull flags requires confirmation and proper risk control, including volume analysis, stop-loss placement, and alignment with supporting indicators to avoid false breakouts.

What Is a Bull Flag Pattern?

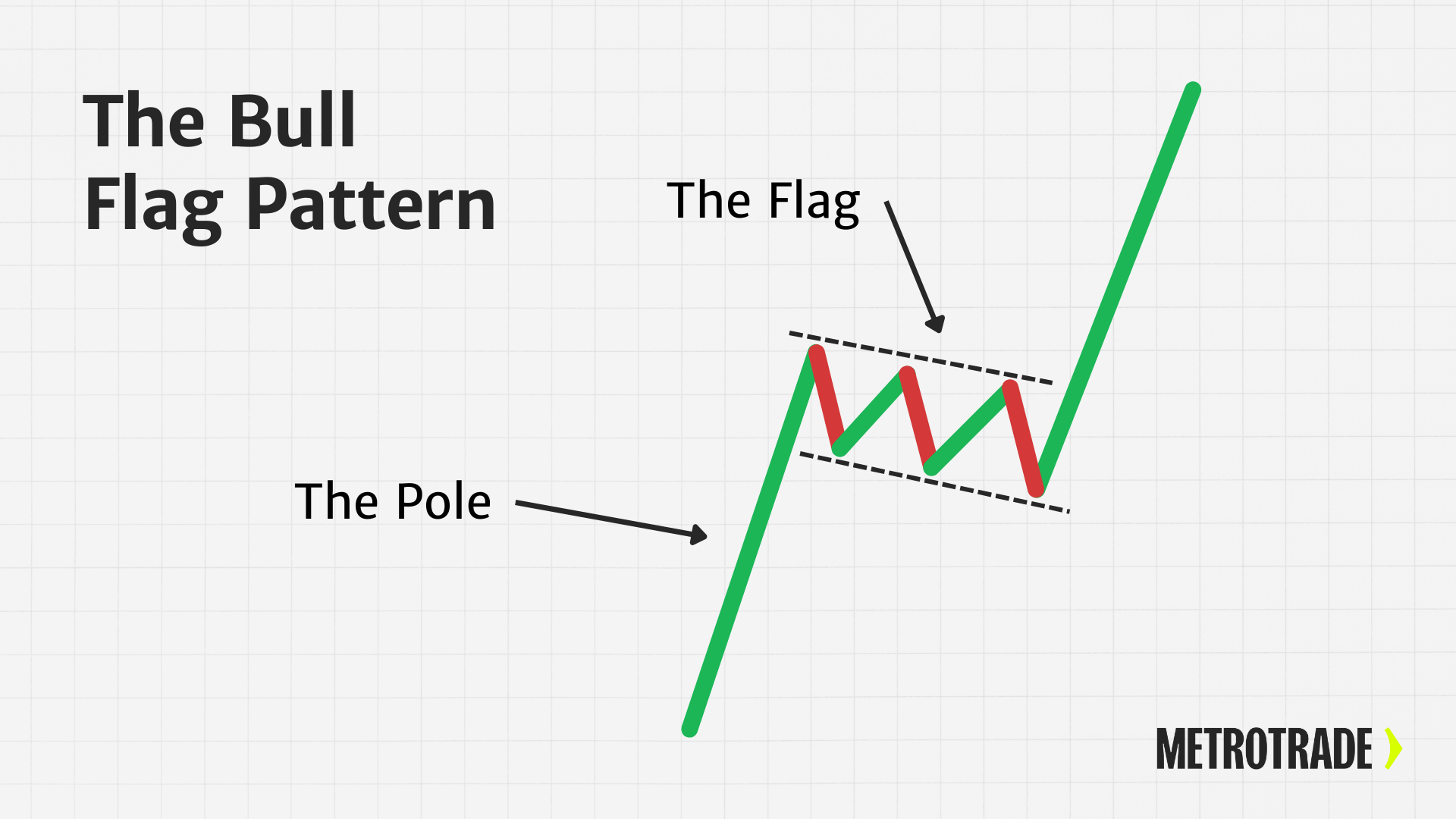

A bull flag pattern is a bullish continuation formation that appears during an uptrend. It begins with a strong upward price surge (called the “flagpole”), followed by a brief period of consolidation or slight retracement (the “flag”). Once the consolidation phase ends, prices typically break out to the upside and resume the prior uptrend.

The pattern is named for its resemblance to a flag on a pole: a sharp vertical move followed by a downward-sloping or sideways rectangle.

Bull flags are commonly used in futures, stocks, and crypto markets. Technical traders use them to enter or add to long positions with a defined risk and reward structure during strong trending conditions.

Key Features of a Bull Flag

While every chart is different, most bull flags share a set of common traits:

- Flagpole: A rapid price rally, usually on high volume, driven by strong buying activity or positive news.

- Flag: A tight, downward-sloping or horizontal consolidation that forms a parallel channel.

- Volume: Volume is high on the rally and often declines during the consolidation phase.

- Breakout: A breakout above the flag’s upper trendline signals the continuation of the uptrend.

The pattern is most reliable when it forms after a clear and decisive move upward. The flag should show orderly price action, with minimal signs of selling pressure.

What the Bull Flag Suggests About Market Sentiment

The bull flag pattern reflects a healthy, bullish market with strong demand and temporary profit-taking. After a fast upward move, early buyers may take profits, causing the price to dip or consolidate. However, selling pressure remains limited, and volume usually falls during the flag phase.

This pattern shows that bulls are still in control, and the market is simply pausing before its next move higher.

Here’s what it tells us about trader behavior:

- Buyers are in control: The initial flagpole indicates strong demand and momentum.

- Sellers are cautious or short-term: The pullback is mild and orderly, with no panic or aggressive selling.

- The market is resting, not reversing: The flag is a pause in the uptrend, not a sign of a top.

- Breakouts often spark renewed buying: When the flag breaks to the upside, sidelined traders often jump in, pushing the price even higher.

Understanding this sentiment helps traders stay aligned with market momentum instead of exiting too early or betting against the trend.

Bull Flag vs Bear Flag: Core Differences

Bull and bear flags are structurally similar but occur in opposite market conditions. Here’s how they differ:

- Trend direction: Bull flags form in uptrends and signal continued upside. Bear flags form in downtrends and signal further downside.

- Flagpole movement: Bull flags start with a sharp upward move; bear flags start with a steep drop.

- Flag shape: Bull flags form a downward or sideways consolidation. Bear flags form an upward or sideways one.

- Breakout direction: Bull flags break out above resistance. Bear flags break down below support.

- Trader sentiment: Bull flags show controlled profit-taking before more buying. Bear flags show weak buying during a pause in a broader selloff.

Knowing which pattern you’re seeing helps ensure you’re trading in the direction of the trend, not against it.

How to Identify a Bull Flag on a Chart

To recognize a bull flag in real time, follow these steps:

- Spot the flagpole: Look for a strong upward price move, ideally on increasing volume.

- Identify the flag: Watch for a short pullback or sideways channel forming right after the rally. Draw parallel lines across the highs and lows to define the flag.

- Wait for the breakout: The pattern completes when the price breaks above the upper trendline of the flag, signaling bullish continuation.

Bull flags appear on many timeframes. Intraday traders may see them on 1- or 5-minute charts, while swing traders might spot them on hourly or daily charts. On MetroTrader, bull flags are often seen in contracts like MES, NQ, CL, or GC during news-driven rallies or momentum surges.

Chart Example: Bull Flag in Action

Let’s walk through a real-world example using the Micro E-mini Nasdaq-100 (MNQ):

- Flagpole: MNQ rallies from 15,200 to 15,500 in under 90 minutes on strong volume.

- Flag: The contract retraces gradually to 15,430, forming a neat downward channel.

- Breakout: Price breaks above the flag resistance and surges past 15,550, confirming the pattern and attracting new buyers.

This type of setup is common during market openings, after earnings reports, or following strong economic data. The pattern allows traders to enter with structure, rather than chasing the initial rally.

Entry and Exit Strategy for Bull Flag Setups

Bull flags work best when traded with a clear plan. Here’s how traders often approach it:

- Entry: Wait for the flag to complete and look for signs of buyer strength, such as volume picking up or resistance being tested.

- Stop-Loss: Place your stop just below the lower boundary of the flag. This helps manage risk in case the breakout fails.

- Trade Entry Point: Enter the trade when the price breaks above the flag’s upper trendline. Some traders prefer a candle close above resistance or a retest of the breakout level.

- Take Profit: Use the height of the flagpole to project a target from the breakout point. This gives you a logical upside objective based on the strength of the prior move.

Sticking to this structure keeps your risk controlled and gives the setup room to play out, especially in volatile futures markets.

Why Bull Flags Work Well in Futures Trading

Futures markets are fast-moving, leveraged, and often trend-driven — all ideal conditions for bull flag setups.

Why traders rely on bull flags in futures:

- Volatility: Price can surge quickly, creating flagpoles with follow-through.

- Leverage: Traders can magnify gains (and losses) with small capital commitments.

- Liquidity: Top contracts like MES, NQ, CL, and ZB provide smooth execution and clean setups.

Bull flags are particularly useful for momentum traders, breakout traders, and trend-followers looking for high-probability entries in trending conditions.

Enhancing Bull Flags with Technical Indicators

While price action is key, several technical indicators can help confirm a bull flag setup:

- Volume: Volume should decline during the flag and increase on the breakout.

- RSI (Relative Strength Index): A bull flag often forms when RSI cools off from overbought, then resumes upward.

- MACD: A bullish MACD crossover near the breakout strengthens the setup.

- Moving Averages: A rising 20-period or 50-period MA below the flag supports bullish continuation.

These tools help filter out weak patterns and improve confidence before entering a trade.

Common Mistakes When Trading Bull Flags

Avoid these common errors when trading bull flag patterns:

- Entering too early: Jumping in before a confirmed breakout increases the chance of being faked out.

- Mistaking any pullback for a flag: Not all retracements are bull flags. Look for orderly consolidation, not choppy reversals.

- Ignoring volume: Weak breakout volume often signals that buyers lack conviction.

- Risking too much: Futures are leveraged. Always size your position properly and use stop-losses.

Discipline and patience are critical. Wait for clear signals and manage risk carefully.

Bull Flag Pattern vs Other Bullish Setups

Bull flags are just one type of bullish continuation pattern. Here’s how they compare to similar formations:

- Ascending Triangle: Features rising support and flat resistance. Breakouts often occur near the apex.

- Cup and Handle: A longer-term pattern where price forms a rounded bottom followed by a small pullback.

- Bull Pennant: Similar to a bull flag, but the consolidation takes the shape of a small symmetrical triangle.

Understanding the subtle differences between patterns can improve your ability to trade them correctly and avoid lookalikes.

Analyzing Bull Flags on MetroTrader

You can analyze bull flag setups directly on MetroTrader Web and Mobile using intuitive tools built for real-time decision-making.

MetroTrader allows you to:

- View multiple chart timeframes for scalping or swing trading.

- Draw parallel channels to define the flag’s structure.

- Apply volume studies to track accumulation during the setup.

- Add RSI, MACD, and moving averages to support your breakout thesis.

Whether you’re tracking micro contracts or larger indices, MetroTrader offers the tools you need to act with speed and confidence.

Using Bull Flags in Your Trading Strategy

Bull flags are most powerful when they’re part of a bigger trading system. To improve your consistency:

- Backtest the pattern: Review how bull flags performed on your preferred contracts in various market conditions.

- Keep a trade journal: Save screenshots and notes of successful and failed trades to identify patterns in your decision-making.

- Practice with a demo account: Test your setups and timing on MetroTrader’s free demo account before going live.

With repetition and discipline, the bull flag can become a reliable entry tool in your trading playbook.

Conclusion

The bull flag pattern is a popular and powerful continuation setup used by traders across markets. It offers a structured way to enter long positions during a trending market, with defined risk and a clear upside target.

In leveraged futures markets, this pattern can help traders capture trend momentum while minimizing emotional decisions. But like any setup, bull flags work best when confirmed by price, volume, and supporting indicators.

Ready to start trading the bull flag for real?

Open a live MetroTrader account today and take advantage of low margins, fast execution, and the most active futures contracts.

FAQs

What is a bull flag pattern in trading?

A bull flag pattern is a chart setup that signals the continuation of an uptrend. It forms after a strong rally, followed by a brief consolidation, and often leads to another leg higher.

Is the bull flag pattern bullish or bearish?

The bull flag pattern is bullish. It indicates that buyers are in control and the market is likely to continue rising after a temporary pause.

What timeframe is best for spotting bull flags?

Bull flags can appear on any timeframe, including 1-minute, 5-minute, hourly, and daily charts. The best timeframe depends on your trading goals and strategy.

How do you confirm a bull flag pattern?

A bull flag is confirmed when the price breaks above the flag’s upper trendline on rising volume. Many traders also use indicators like RSI or MACD for added confirmation.

Is the bull flag pattern reliable?

The bull flag is considered one of the more reliable continuation patterns, especially in trending markets. Its success depends on confirmation and proper trade management.

Can you use bull flags in futures and crypto trading?

Yes, bull flags are frequently used in both futures and crypto markets. These fast-moving environments often produce clean bull flag setups that reward trend-following strategies.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.