Short selling might sound advanced, but in the futures market, it’s a core feature that’s built in. Unlike stocks or options, where shorting can be complex, costly, or restricted, futures trading makes it simple. Traders can go short just as easily as they can go long without needing to borrow anything.

In this guide, we’ll explain what a short position in futures is, how it works, and why it’s much more accessible than shorting stocks or buying puts. We’ll also cover the risks, popular markets for shorting, and how to get started.

Key Takeaways

- Shorting futures is simple and direct. You sell a contract first and buy it back later.

- Futures make short selling more accessible than in stocks and options. You do not need to borrow shares, pay borrowing fees, or worry about expiration dates.

- Traders short futures to speculate or hedge. It can be used to speculate on a market decline or protect an existing portfolio or business exposure.

- Risk management is essential when shorting. Losses can grow quickly if prices rise, so stop-losses and smart position sizing are important.

What Is a Short Position in Futures?

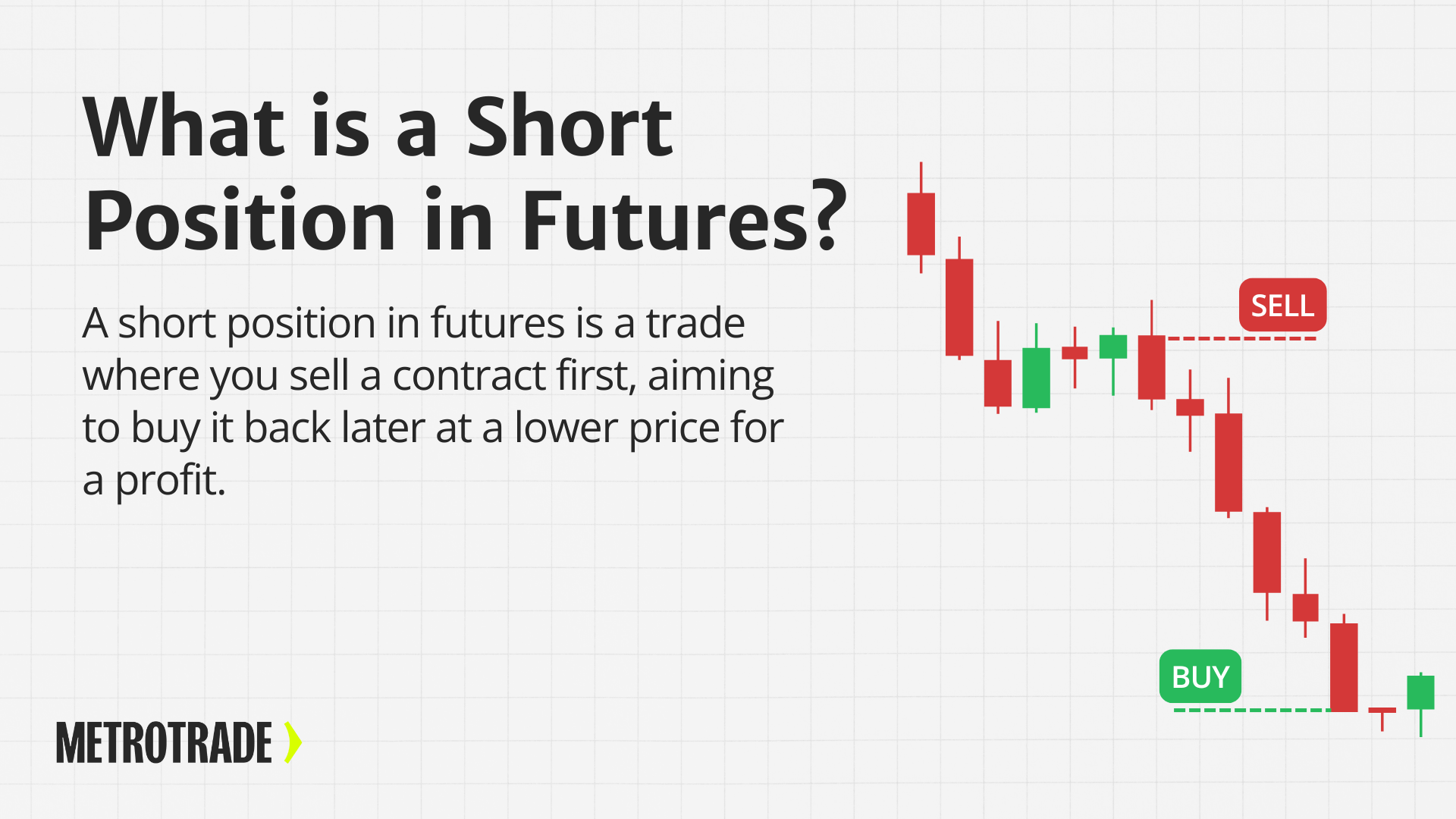

A short position in futures is when you sell a futures contract first, expecting that the price will go down. If it does, you can buy the contract back later at a lower price and pocket the difference. Of course, if the market does not go in the direction anticipated, the trade will generate a loss.

This is the exact opposite of a long position, where you buy first, hoping prices rise.

Futures are unique because you can go short without needing to borrow the asset. With stocks, shorting requires finding shares to borrow, and with options, it requires buying puts, which can be expensive and time-sensitive. Futures eliminate those barriers. The contracts are designed to support both long and short trades equally.

How Shorting Works in Futures Contracts

To short a futures contract, all you do is place a sell order. You don’t need to own the asset or borrow it from someone else. You’re simply agreeing to sell the contract now, with the plan to buy it back later.

Example:

- You sell one MCL contract at $80.

- Crude oil drops to $75.

- You buy the contract back at $75.

- The MCL contract represents 100 barrels of oil, so the price difference of $5 per barrel equals a $500 profit.

This process works in reverse if the price rises instead.

Example:

- You sell one MGC contract at $4200.

- Gold rises to $4250.

- You buy the contract back at $4250.

- The MGC contract represents 10 ounces of gold, so the $50 price increase results in a $500 loss.

Futures contracts settle daily, so your gains or losses are tracked in real time through mark-to-market adjustments.

Shorting vs Buying: The Core Difference

In any trade, you’re either going long or short:

- Long position: You buy first, then sell later at a higher price.

- Short position: You sell first, then buy later at a lower price.

With stocks, going short comes with extra hoops: borrowing shares, paying fees, dealing with rules like the uptick rule, and needing a special margin account. And if there’s a short-sale ban? You’re out of luck.

With options, shorting usually means buying a put, which costs money upfront and has an expiration date.

Futures cut out the middleman. No borrowing or special rules. Just sell to open and buy to close.

Why Traders Take Short Positions in Futures

Speculation on Falling Prices

Some traders short the market because they expect prices to drop. This could be based on chart patterns, technical indicators, or economic news. Because futures make it easy to short, traders don’t have to sit on the sidelines during downtrends.

Hedging Existing Positions

Businesses and investors use short futures to protect against falling prices. For example:

- A farmer might short corn futures before harvest to lock in a minimum price.

- A trader with long stock exposure might short equity index futures to reduce risk.

With stocks, hedging often requires options, which are more complex and expensive. Futures offer a cleaner, cheaper solution.

Cost Efficiency

Shorting stocks comes with borrowing fees. Buying puts means paying a premium. But shorting futures? No borrowing. No time decay. No options premiums. Just margin, which you can reclaim after closing the trade.

Short Positions in Futures vs Options vs Stocks

If you’re bearish on a market, you generally have three choices: short a futures contract, short a stock, or buy a put option. While all three can be used to profit from falling prices, they work very differently, especially when it comes to cost, complexity, and ease of access.

Here’s how shorting compares across the board.

Shorting with Futures

Shorting in futures is fast and simple. There’s no borrowing involved and no extra cost just because you’re bearish. You place a sell order to open your trade and buy it back later to close. Futures don’t require approval or special permissions, and the same margin rules apply whether you go long or short.

- You’re not borrowing anything, just entering into a contract.

- There are no borrowing fees or uptick rules.

- You can short any liquid contract at any time, including micros.

- Execution is instant, even in fast-moving markets.

This clean, two-sided structure is what makes futures trading so attractive for both newer traders and experienced active traders.

Buying Puts (Options)

Options offer another way to profit from falling prices, but buying a put contract comes with its own challenges. While the risk is limited to your upfront premium, you’re also fighting against time.

- Puts lose value over time due to time decay (theta).

- You need to be right on both direction and timing.

- Option premiums can be expensive, especially in volatile markets.

- Options have expiration dates and strike prices to consider.

- Not all underlying assets have liquid or affordable options.

While options can work in bearish strategies, they’re often less forgiving than futures, especially if you’re just starting.

Shorting Stocks

Shorting individual stocks is a different story. It requires borrowing shares from your broker, which isn’t always possible, especially if the stock is in high demand.

- You may have to pay daily borrowing fees based on the availability of shares.

- Some brokers require special margin accounts or approval to short.

- The uptick rule can limit your ability to short during sharp sell-offs.

- Your broker can force you to close your position if shares become hard to borrow (a buy-in).

These restrictions add friction and cost, especially for smaller retail traders. And if the stock suddenly rallies? Losses can add up fast.

Why Futures Stand Out

Futures are designed to be shorted. There’s no workaround, no extra step, and no added cost just because your trade idea is bearish. With consistent margin requirements, clear contract specs, and no need to borrow assets, futures trading removes the usual barriers to short selling.

For most traders — especially those who want direct exposure to market moves — shorting futures is simply the most efficient path.

Start Trading Futures Today

Complete your live trading application and start trading futures with as little as $100.

Common Markets Where Short Positions Are Used

Futures cover nearly every major asset class, which means traders can go short in a wide variety of markets:

- Stock index futures: Micro E-mini S&P 500 (MES), Nasdaq (MNQ), Dow (MYM)

- Commodity futures: Crude oil (CL), gold (GC), natural gas (NG)

- Crypto futures: Bitcoin (BTC), Ether (ETH)

- Agricultural futures: Corn (ZC), soybeans (ZS), wheat (ZW)

- Currency futures: Euro (6E), yen (6J), pound (6B)

- Interest rate futures: Treasury bonds, SOFR, Fed Funds

All of these allow short positions with the same ease and speed as buying.

Real-World Example: Shorting the Micro E-mini S&P 500

Let’s say you believe the S&P 500 will drop after a big rally. You decide to short the MES, which tracks the S&P 500 at 1/5th the size of the e-mini contract.

Example trade:

- You sell 1 MES contract at 6700.

- Each point is worth $5.

- Later, you buy it back at 6650.

Profit:

- 50-point drop = $250 gain

If the price increases, your short position works against you.

Let’s say you believe gold will drop after a rally. You decide to short MGC, which tracks gold at 1/10th the size of the standard contract.

Example trade:

- You sell 1 MGC contract at 4200.

- Each point is worth $10.

- Later, you buy it back at 4250.

Loss:

- 50-point increase = $500 loss

No need to borrow shares. No need to wait for an uptick. No expiration date like with a put option. Just a clean short trade, open to close.

Margin Requirements and Leverage for Shorts

All futures trades (long or short) require margin. This is a good-faith deposit to keep your trade open.

There are two types:

- Initial Margin: Required when opening the trade.

- Maintenance Margin: Minimum balance needed to keep the position open.

Because you only post a fraction of the contract’s full value, futures provide built-in leverage. That means you can control a large position with a small amount of capital.

This is another reason why shorting futures is so accessible: there’s no additional margin penalty just for being bearish.

Risk Management for Short Positions

While shorting is easy in futures, that doesn’t mean it’s risk-free.

The main danger is that prices rise instead of falling. Since there’s technically no ceiling, your losses can keep growing if the market runs against you.

To protect yourself:

- Use stop-loss orders to cap downside.

- Only trade what you’re comfortable risking.

- Consider smaller contracts like micros to reduce exposure.

And before you go live, use a demo account to practice shorting in a risk-free environment.

Short Covering Explained

When you close a short position, it’s called short covering. You’re buying back the contract to exit the trade.

In some cases, short covering can trigger a short squeeze. This happens when too many traders are short, and rising prices force them to exit quickly, pushing prices even higher.

Short squeezes are more common in stock trading, where borrow limits and float size matter. But in futures, they can still happen — especially around big news events or low-volume contracts.

Pros and Cons of Going Short in Futures

Pros:

- Simple to do: You can open a short position with a basic sell order, without needing to borrow anything or request special permissions from your broker.

- Low cost: There are no borrow fees like with stocks and no upfront premium like with options, making shorting more affordable.

- Hedge-friendly: Futures are commonly used to protect portfolios or business exposure from falling prices, giving traders and hedgers a reliable downside tool.

- Equal access: Shorting is built into the structure of the futures market, so it’s just as easy and accessible as going long.

Cons:

- Unlimited risk: If the market moves against your position and prices rise sharply, your losses can continue to grow with no cap. This is why stop-losses are so important.

- Timing matters: Getting into a short position too early can lead to painful drawdowns or forced exits before the market turns.

- Whipsaws: Markets can reverse quickly, causing sudden moves that stop out short positions even if the broader trend remains downward.

How to Open a Short Position on MetroTrader

On MetroTrader, you can short the market in just a few clicks.

- Choose your futures contract (MES, MGC, etc.)

- Enter your quantity

- Click Sell to open the short trade (yes, it’s really that easy!)

- Click Buy to close it when ready

There’s no extra setup, no short-sell approval, and no expensive borrow rates. Whether you’re trading on desktop or mobile, MetroTrader gives you direct access to fast, flexible shorting with built-in charts, indicators, and tools to help manage your risk.

Tips for New Traders Shorting Futures

- Start with micro contracts. Smaller-sized contracts like MES or MCL help limit your risk while you learn how shorting works.

- Use stop-loss orders. Setting predefined exit points helps protect your account from large, unexpected losses if the market moves against you.

- Avoid illiquid markets. Stick to contracts with strong volume so you can enter and exit trades smoothly without major slippage.

- Pay attention to market news. Events like economic reports or Fed meetings can cause sudden reversals that impact short positions.

- Practice in a demo account first. Before trading with real money, test your short setups and risk management in a risk-free environment.

Shorting can be a useful skill, not just for speculating in down markets, but for understanding how both sides of the market work.

Conclusion

Shorting stocks and buying options can be costly, complicated, and limited. But with futures, short selling is built into the system. It’s fast, affordable, and equally available to every trader.

That’s what makes futures trading so accessible. Whether you’re looking to speculate on falling prices or hedge your existing positions, shorting in futures gives you the tools to act without the red tape.

Start shorting the smarter way.

Open a live account with MetroTrade today and take advantage of market moves in any direction.

Frequently Asked Questions

What is a short position in futures trading?

A short position in futures trading is when a trader sells a futures contract first, expecting to buy it back later at a lower price to make a profit.

How do you make money from a short position in futures?

You make money by selling high and buying back the contract at a lower price. The difference between the two prices is your profit.

Can new traders short futures contracts?

Yes. New traders can short futures using small contracts like micros, and many platforms offer demo accounts to practice with no risk.

Can you short futures without owning the asset?

Yes. Futures contracts allow you to short without owning the underlying asset. You do not need to borrow anything to enter a short trade.

Do you need margin to short a futures contract?

Yes. All futures trades, including short positions, require margin. This is a good faith deposit set by the exchange and your broker.

Is shorting easier with futures than stocks or options?

Yes. Futures are designed to support shorting without borrow fees, special approvals, or expiration dates. It’s simpler than shorting stocks or buying puts.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.