If you’ve ever looked at a candlestick chart and seen price seem to “skip” a level, you might’ve spotted what traders call a fair value gap. These gaps represent areas where price moved so quickly that it didn’t trade efficiently at every level. Understanding them can give traders an edge, especially those who use technical analysis or follow smart money concepts like the ICT (Inner Circle Trader) strategy.

In this guide, we’ll break down what a fair value gap is, why it matters, and how traders use it to spot possible trading opportunities. Whether you’re new to chart analysis or looking to deepen your trading toolkit, learning about fair value gaps can help you make more informed decisions.

Key Takeaways

- A fair value gap is a price imbalance that forms when the market moves too quickly to trade efficiently at every level.

- These gaps appear as three-candle patterns where price skips over a zone without overlapping the first candle’s wick.

- Traders use fair value gaps to plan entries and exits, often expecting the price to retrace and “fill” the gap before continuing its trend.

- Fair value gaps work best with confirmation and confluence, especially when combined with market structure, trend analysis, and risk management tools.

What Is a Fair Value Gap?

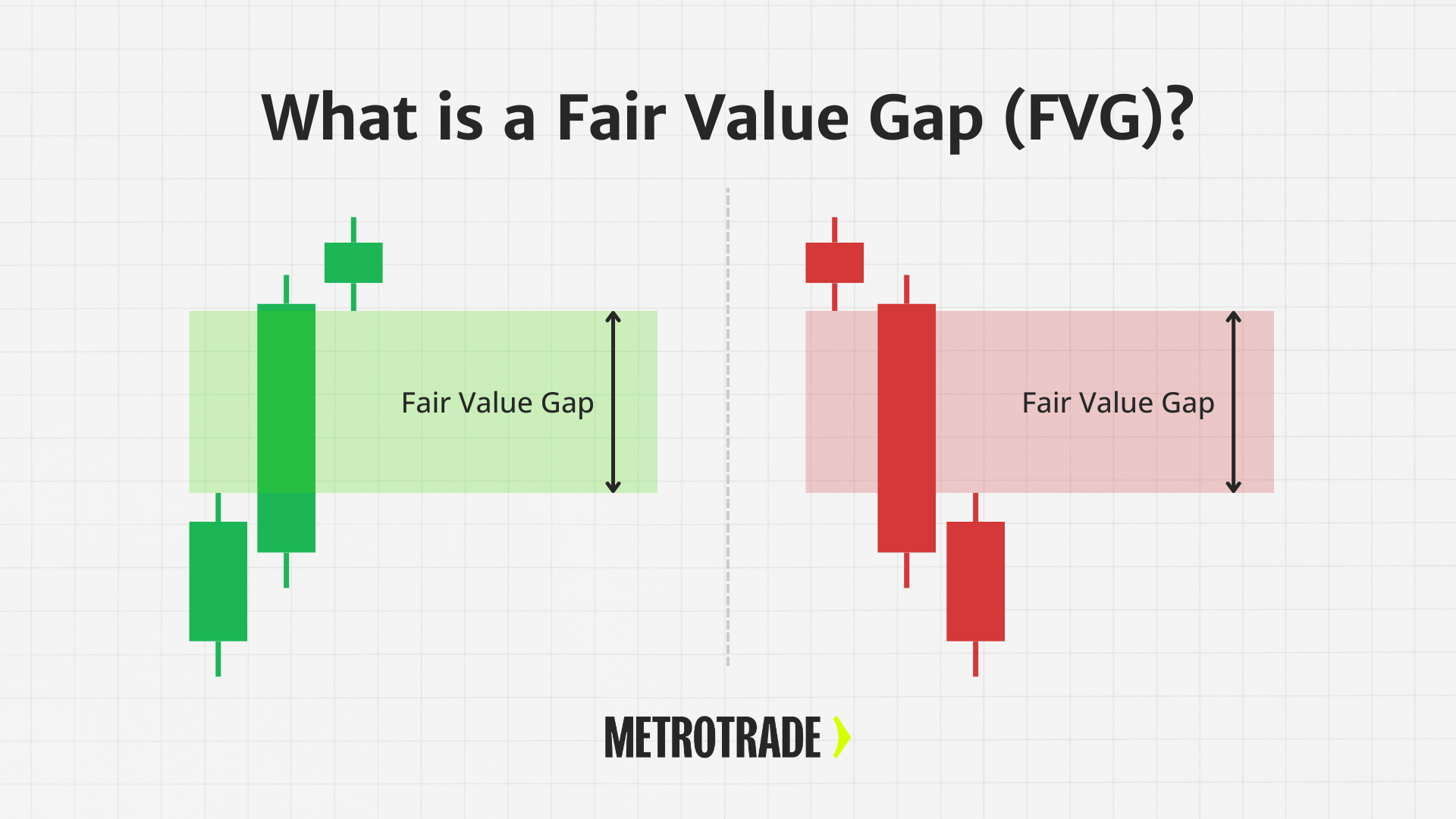

A fair value gap is a type of price imbalance on a candlestick chart. It forms when the market moves so quickly that it doesn’t leave behind a fair or balanced exchange between buyers and sellers. This creates a visible “gap” where price failed to trade efficiently.

Unlike traditional gaps that happen between trading sessions (like in stock markets), fair value gaps often form within active sessions. They’re typically spotted on charts with strong momentum, where price explodes up or down, skipping over levels without much resistance.

In simple terms: a fair value gap is the space between a candle’s wick and a later candle’s wick, where price didn’t overlap. It suggests the market may come back to “fill” or test that level before continuing its move.

How Fair Value Gaps Form on Price Charts

Fair value gaps usually form over a three-candle sequence:

- Candle A: A strong move in one direction (up or down)

- Candle B: Continuation of that move, showing strong momentum

- Candle C: Opens and closes beyond the range of Candle A, leaving a gap between their wicks

This gap between Candle A’s high and Candle C’s low (or vice versa) is the fair value gap.

It’s easiest to see on lower timeframes like the 5-minute or 15-minute chart, but fair value gaps also appear on the 1-hour, 4-hour, or daily chart. The timeframe matters because gaps on higher timeframes are often seen as more significant by institutional traders.

Why does this happen? The market is made up of orders. When large buy or sell orders hit the market quickly, the price may jump past certain levels without matching previous buyers or sellers. That creates a gap (an area of low liquidity) which the price may revisit later to “rebalance” before resuming its trend.

Types of Fair Value Gaps

Fair value gaps can form in both rising and falling markets. Understanding the difference between bullish and bearish fair value gaps is key to spotting trade setups and managing risk.

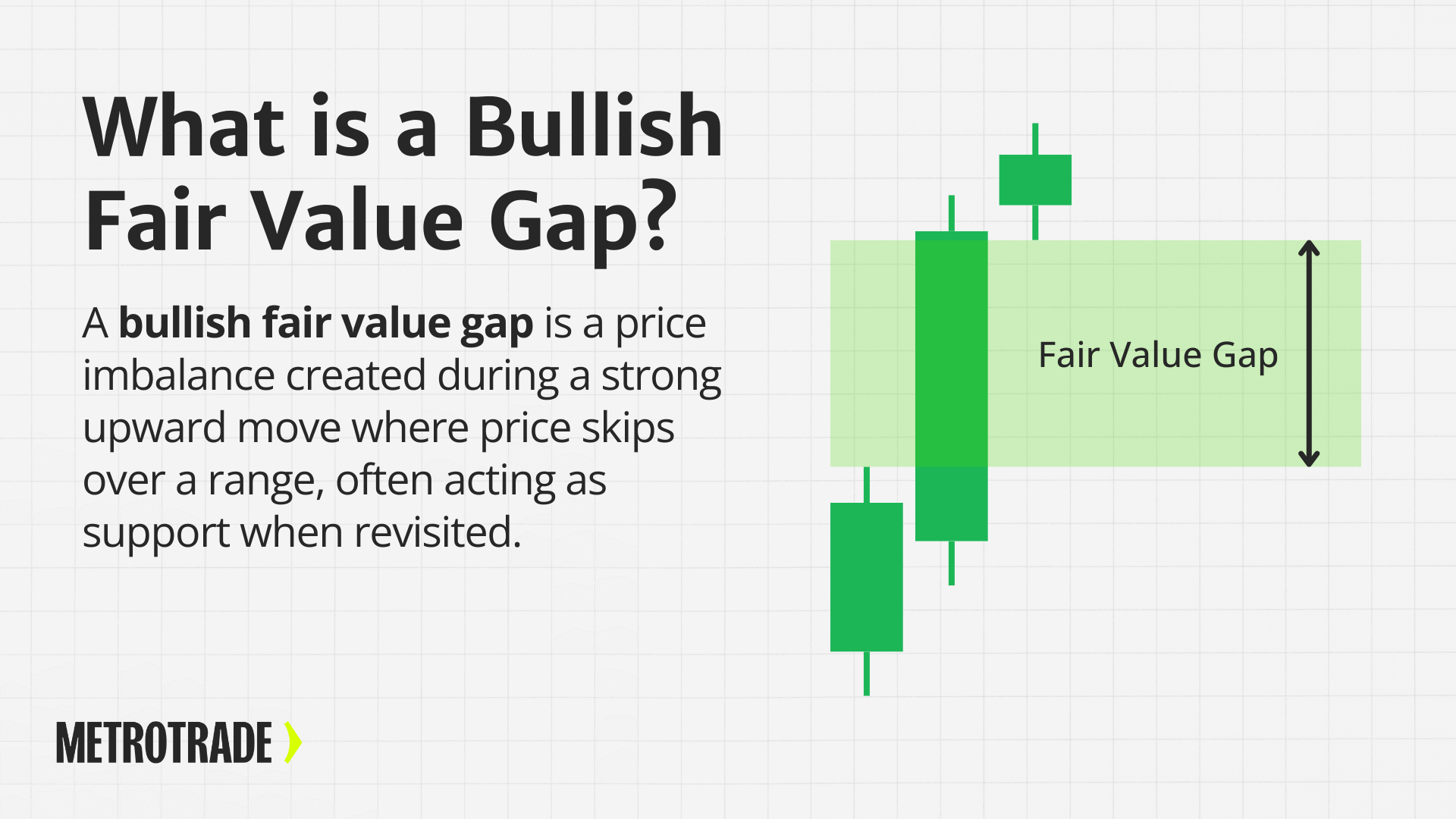

Bullish Fair Value Gap

A bullish fair value gap forms during a strong upward move when buyers aggressively push price higher, skipping over certain price levels. This creates an imbalance—an area on the chart where sellers didn’t have a fair chance to transact.

The gap typically appears between the high of Candle A and the low of Candle C in a three-candle pattern. Since price skipped this zone, many traders believe the market may return to “fill” it before continuing higher.

Why it matters:

Bullish fair value gaps are often used as support zones. If price revisits the gap and shows signs of holding (e.g. bullish wicks, bounce off key levels, or confirmation from indicators), traders may enter long positions.

What traders look for:

- Strong bullish momentum before the gap

- Price retracement back into the gap zone

- Rejection candles or bullish engulfing patterns near the gap

- Entry long with stop loss just below the gap or recent swing low

- Take profit at the next resistance or prior high

These setups are popular among price action and ICT traders because they represent spots where institutional buyers may re-enter the market.

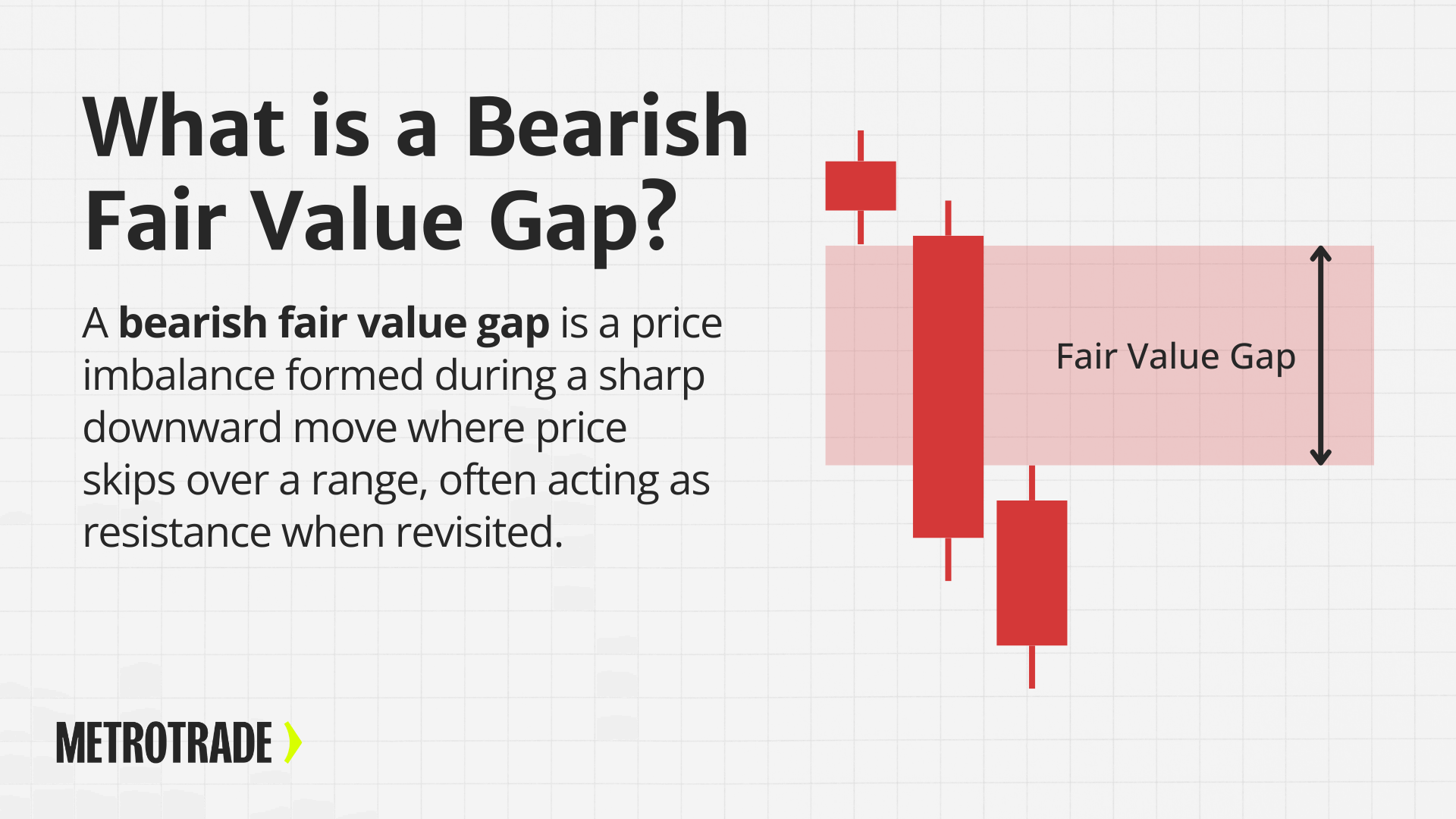

Bearish Fair Value Gap

A bearish fair value gap forms in a strong downward move when sellers drive the price lower with force. This leaves behind a gap between the low of Candle A and the high of Candle C, showing that buyers didn’t participate at that level.

This gap zone is seen as an imbalance to the upside—one that price might return to before dropping again.

Why it matters:

Bearish fair value gaps are often used as resistance zones. When the price climbs back into the gap and fails to push through, it may indicate that selling pressure is returning.

What traders look for:

- Strong bearish move leading into the gap

- Price retracement into the gap zone

- Bearish rejection candles or patterns (like shooting stars or bearish engulfing)

- Entry short with stop loss above the gap or recent swing high

- Take profit at the next support or prior low

This type of setup is commonly used in downtrending markets and aligns with strategies focused on market inefficiencies and order flow.

Fair Value Gap vs. Other Chart Gaps

Fair value gaps are often confused with other types of gaps and price zones on a chart. While they may look similar at first glance, each gap type reflects different market behavior. Here’s how fair value gaps compare to other common chart gaps:

Fair Value Gap vs. Liquidity Gap

A fair value gap is a price imbalance caused by aggressive buying or selling that skips over certain price levels, usually during a strong trending move. It’s a visual cue that the market didn’t trade efficiently at that level.

A liquidity gap, on the other hand, refers to a lack of available buy or sell orders at a specific price. This can happen during volatile news events or off-hours trading when market depth is thin. Liquidity gaps often result in sharp price jumps and slippage, especially in low-volume markets.

Key difference:

Fair value gaps are based on price action and structure. Liquidity gaps are based on market depth and order book data.

Fair Value Gap vs. Traditional Chart Gap

In stock trading and some futures markets, traditional chart gaps occur when there’s a break between one candle’s close and the next candle’s open, with no trading in between. These gaps often appear after hours or between trading sessions.

Fair value gaps, by contrast, usually form within an active session and don’t rely on session breaks. They result from strong momentum moves where price fails to overlap with a previous candle’s range.

Key difference:

Traditional chart gaps are time-based (usually overnight), while fair value gaps are momentum-based and form intraday.

Fair Value Gap vs. Order Block

An order block is a zone on the chart where large institutional buy or sell orders have previously entered the market. These areas often act as support or resistance and can signal future price reactions.

While fair value gaps highlight where price moved too fast, order blocks show where price stalled or consolidated before making a large move. Some traders use both together to identify high-probability trade zones.

Key difference:

Fair value gaps show a lack of trading; order blocks show concentrated trading activity.

Fair Value Gap vs. Breakaway and Exhaustion Gaps

In technical analysis, breakaway gaps happen at the start of a new trend or breakout, while exhaustion gaps happen near the end of a trend when momentum fades. These are more common in equity markets and are often used in classic gap-trading strategies.

Fair value gaps can appear in similar locations but aren’t tied to those specific market phases. Instead, they’re purely based on price action imbalances and can occur during any stage of a trend.

Key difference:

Breakaway and exhaustion gaps are trend-specific patterns. Fair value gaps can occur in any market phase and focus on skipped price levels.

Why Fair Value Gaps Matter in Trading

Fair value gaps are more than just price gaps. They function as clues about how efficiently the market traded at a given level. Here’s why they matter:

- Retracement Zones: Price often pulls back to “fill” the gap before continuing its trend.

- Liquidity Clues: Gaps often mark areas where traders left unfilled orders.

- Trade Entries: Traders look for price to return to the gap for lower-risk entries.

- Momentum Signals: When price leaves a large gap, it signals urgency or imbalance.

Fair value gaps are especially popular among price action traders and those following ICT principles, who believe these gaps represent unfinished business in the market.

How Traders Use Fair Value Gaps in Their Strategy

Fair value gaps aren’t just patterns to memorize, they’re tools that can fit into a well-rounded trading strategy. Here’s how traders incorporate them when planning entries, exits, and risk management.

Entry Signals

The most common way to trade a fair value gap is to wait for price to retrace into the gap after a strong move and then look for confirmation before entering.

Traders typically look for:

- A retracement into the gap zone, not just near it

- A bullish or bearish rejection candle within the gap (e.g., hammer, shooting star)

- A shift in structure on a lower timeframe (e.g., break of a minor high or low)

- Volume confirmation, such as increased activity near the gap

Rather than blindly entering when the price touches the gap, experienced traders wait for signs that the market is respecting the level.

Stop Loss Placement

Fair value gaps offer clear zones for managing risk. If the price violates the gap zone with strong momentum, it may invalidate the setup.

Common stop placement methods include:

- Just beyond the gap: For example, if trading a bullish gap, place the stop just below the gap’s lower boundary

- Beyond a recent structural point, Such as a swing low (for longs) or swing high (for shorts) near the gap

- Using ATR-based stops: Some traders use the average true range to size stops based on recent volatility

The key is to place the stop where the trade thesis is clearly invalidated—not too tight, but not too far either.

Target Selection

Fair value gaps are often used to catch trend continuation, so many traders aim for logical price targets once the trade is triggered.

Common target approaches include:

- The next swing high or low is a near-term target

- A previous support or resistance level

- An opposing fair value gap in the other direction

- Fibonacci extensions (e.g., 1.618) measured from the impulse move

Some traders scale out at multiple targets to lock in gains while giving the remainder room to run.

Confluence Factors

Traders rarely use fair value gaps in isolation. The strongest setups come when FVGs align with other key technical levels or tools.

Examples of effective confluence:

- Trendlines or channels intersecting the gap zone

- Horizontal support or resistance at or near the gap

- A Fibonacci retracement level lining up with the gap

- Indicators like RSI, MACD, or VWAP confirm momentum

When multiple signals point to the same area, it increases the likelihood of a high-probability trade.

Risk Management

Like any trading concept, fair value gaps must be used within a broader risk framework. No setup is perfect, and not all gaps get filled.

Sound risk practices include:

- Only risking a small portion of capital per trade (commonly 1–2%)

- Using defined stop losses based on structure or volatility

- Avoiding overtrading by being selective with gap setups

- Backtesting FVG strategies across different timeframes and markets

- Practicing on a demo account to refine entries and exits without financial risk

Used properly, fair value gaps can help traders find structure in chaotic markets, but only when paired with discipline and risk control.

Examples of Fair Value Gaps in Action

Let’s walk through a real-world example:

Bullish Setup:

- On the 15-minute chart of E-mini NASDAQ futures (NQ), price breaks out with two large bullish candles.

- The second candle leaves a gap between its low and the high of the first.

- Price retraces back into this gap and forms a bullish rejection candle.

- A trader enters long, placing a stop just below the gap and targeting the prior high.

Bearish Setup:

- On the 1-hour Crude Oil (CL) chart, price falls sharply, creating a bearish FVG.

- Price later retraces into the gap and fails to break above it.

- A short trade is taken with a stop above the gap and a target near the next support.

By using FVGs with confirmation, traders aim to increase their probability of catching trend continuations at good risk-reward levels.

Tools and Platforms for Spotting Fair Value Gaps

Fair value gaps can be spotted manually on candlestick charts or with the help of drawing tools and visual indicators. Over time, many traders train their eyes to see these imbalances quickly, but having the right tools makes it easier to practice and refine your strategy.

How to Spot Fair Value Gaps Manually

To identify a fair value gap on a chart:

- Look for a three-candle move with strong momentum in one direction

- Check if the high of Candle A and the low of Candle C do not overlap (or vice versa in bearish setups)

- If there’s a visible gap between those two wicks, mark that zone with a rectangle

- Monitor how price behaves when it re-enters that area

Spotting FVGs manually encourages deeper chart awareness and improves your understanding of price behavior.

Use MetroTrader’s Built-In Charting and Drawing Tools

MetroTrader gives you everything you need to mark up fair value gaps with ease:

- Interactive candlestick charts with multiple timeframes

- Drawing tools like rectangles, horizontal lines, and zones to highlight gap areas

- The ability to save and analyze indicator setups as you test FVG strategies

Whether you’re trading live or using a demo account, MetroTrader’s charting tools make it simple to identify, track, and learn from fair value gap setups in real time.

Start Trading Futures Today

Start your live trading application and begin with margins as low as $80 per contract.

Pros and Cons of Trading with Fair Value Gaps

Like any technical concept, fair value gaps come with both advantages and limitations. Understanding both sides can help you decide when and how to use them in your trading plan.

Pros

- Offers a clear structure for trade entries: Fair value gaps define logical zones for watching price action, making it easier to plan low-risk entries.

- Works across multiple timeframes and markets: Traders can spot FVGs on everything from intraday charts to daily or weekly setups.

- Fits well with price action and smart money strategies: Fair value gaps are commonly used in ICT and institutional-style trading approaches.

- Encourages disciplined trading: Marking and waiting for the price to revisit a gap can help avoid impulsive trades and improve patience.

Cons

- Not all fair value gaps get filled: Some gaps may remain open for long periods or never be revisited at all.

- Requires additional confirmation: Gaps alone aren’t signals. Traders still need to use confluence and context to avoid false entries.

- Subjective identification for new traders: It takes time and experience to spot high-probability fair value gaps consistently.

- Can lead to overtrading if misused: Traders who chase every gap on every chart may end up forcing trades and straying from their plan.

Common Mistakes Traders Make with Fair Value Gaps

Many new traders misuse fair value gaps. Here are common pitfalls:

- Entering Every Gap: Not all gaps are trade-worthy. Use confirmation.

- Ignoring Market Structure: A gap against the trend is riskier.

- Poor Risk Management: Entering without stops or defined risk-reward

- Overtrading: Hunting for gaps on every chart leads to noise and burnout

- Misidentifying Gaps: Confusing fair value gaps with other chart patterns

Being patient and disciplined is key. Use FVGs as part of a broader strategy, not a magic signal.

Conclusion

Fair value gaps can be powerful tools when used correctly. They highlight areas of price imbalance where the market may come back to find equilibrium. Traders who understand how to identify and apply fair value gaps often gain better entries and clearer structure in their setups.

But like all strategies, FVGs work best when combined with other tools, trend analysis, and strong risk management. If you’re serious about improving your trading, practice spotting fair value gaps on historical charts—or better yet, on a simulated trading platform!

Try Spotting Fair Value Gaps on MetroTrader

Want to test what you’ve learned? MetroTrader’s free 30-day demo account lets you explore futures markets in real time with no risk. Spot fair value gaps, practice entries, and build your skills with real market data.

FAQs: Fair Value Gaps in Trading

What is a fair value gap in trading?

A fair value gap in trading is a price imbalance on a candlestick chart where the market moves so quickly that it skips over a price range without any overlap between candles. This creates a visible gap that traders often watch for potential retracements or reversals.

How do you identify a fair value gap on a chart?

You can identify a fair value gap by spotting a three-candle pattern where the first and third candles do not overlap. In a bullish setup, the high of the first candle is below the low of the third candle. In a bearish setup, the low of the first candle is above the high of the third candle.

Do fair value gaps always get filled?

No, fair value gaps do not always get filled. While price often revisits these imbalanced zones to restore equilibrium, strong trends or major news events can cause gaps to remain open for long periods.

Is a fair value gap the same as a liquidity gap?

A fair value gap is not the same as a liquidity gap. Fair value gaps are based on price action and show areas of inefficiency, while liquidity gaps occur when there are not enough buy or sell orders at a certain price level, often seen in thinly traded or volatile markets.

What timeframes are best for spotting fair value gaps?

Fair value gaps can appear on any timeframe, but many traders focus on 15-minute, 1-hour, or 4-hour charts. Higher timeframes generally produce more reliable FVG zones that align with broader market trends.

What indicators help with fair value gap trading?

Traders use drawing tools or custom indicators to highlight fair value gaps automatically. FVG setups often work best when combined with other forms of technical analysis such as support and resistance levels, Fibonacci retracements, or trend confirmation tools.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.