Chart patterns can reveal a lot about price behavior. One of the most well-known continuation setups in technical analysis is the bear flag pattern. Traders often look for this formation during downtrends, viewing it as a signal that prices may continue lower after a brief pause.

In this guide, you’ll learn what a bear flag pattern is, how to spot it on a chart, why it forms, and how it can fit into a futures trading strategy. We’ll also cover key indicators to help confirm setups and highlight common mistakes to avoid.

Whether you’re a short-term scalper or swing trader, understanding this pattern can help you stay on the right side of market momentum.

Key Takeaways

- The bear flag pattern is a bearish continuation setup that forms after a sharp price drop, followed by a brief upward or sideways consolidation. It suggests that the downtrend is likely to resume once the pattern completes.

- The pattern reflects weak buyer conviction and strong overall selling pressure, signaling that the market remains bearish despite a temporary pause in price action.

- Bear flags are common in fast-moving markets like futures, where volatility and leverage make trend continuation patterns especially relevant for short-term and swing traders.

- Trading bear flags requires confirmation and risk management, including volume analysis, proper stop placement, and aligning with broader technical indicators to avoid false breakouts.

What Is a Bear Flag Pattern?

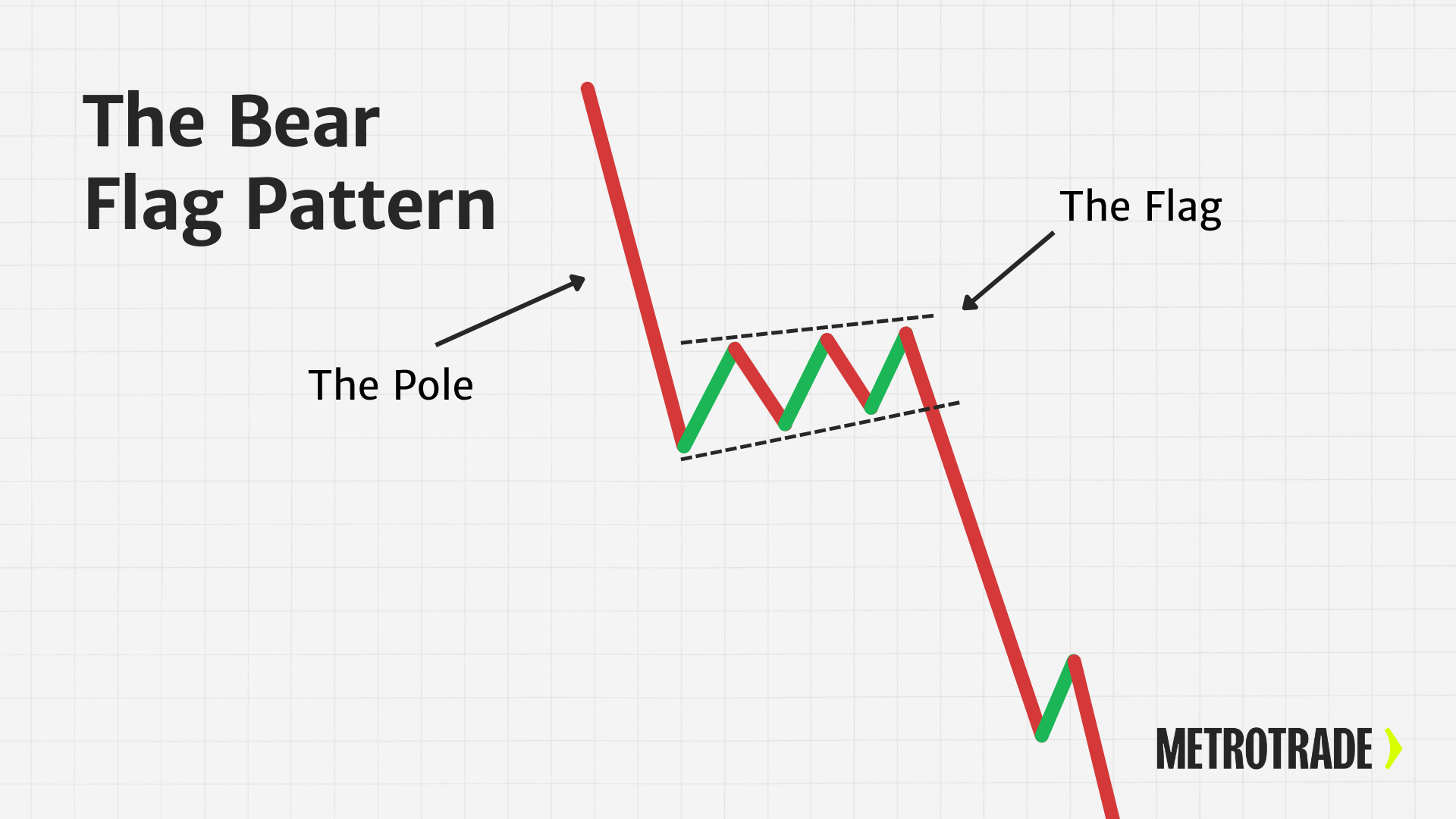

The bear flag pattern is a bearish continuation setup that forms during a downtrend. It starts with a steep price drop (the “flagpole”), followed by a short period of consolidation or upward drift (the “flag”). Once the pattern completes, prices often break down from the flag and continue the previous trend lower.

It’s called a “flag” because the shape resembles an actual flag on a pole: a sharp move down, followed by a small upward channel or rectangle.

Bear flags are commonly seen in futures, stocks, and crypto markets. They’re favored by technical traders looking to enter or add to short positions with a defined risk and reward setup.

Key Features of a Bear Flag

While no pattern is perfect, bear flags tend to share the following traits:

- Flagpole: A sharp drop in price caused by heavy selling or news.

- Flag: A short-term consolidation that drifts upward or sideways, forming a parallel channel.

- Volume: High volume on the flagpole, followed by declining volume during the flag.

- Breakdown: A breakdown below the flag’s lower trendline with renewed selling pressure.

The key idea is that the flag is a temporary pause, not a reversal. Sellers are regrouping before driving prices lower again.

What the Bear Flag Reveals About Trader Psychology

The bear flag pattern isn’t just a visual setup; it reflects how traders are behaving and what they believe about the market. After a strong price drop, most traders recognize that the broader trend is bearish. But during the flag phase, the price temporarily stabilizes or climbs slightly, which can lead to mixed reactions.

Some traders view this as a chance to buy a dip, while others use the pause to reassess or reduce risk. However, volume typically declines during this phase, indicating that buyers aren’t committed and sellers are simply waiting to reenter at better prices. The breakdown that follows confirms that bearish sentiment remains dominant.

Here’s what the pattern tells us about market psychology:

- Sellers remain in control: The sharp drop forming the flagpole shows that bearish momentum is strong and aggressive.

- Buyers are hesitant or short-term: The slow, low-volume rise during the flag suggests a lack of conviction among bulls.

- The market is pausing, not reversing: The consolidation phase often fools inexperienced traders into thinking a reversal is underway.

- Breakdowns tend to trigger renewed selling: Once the flag support breaks, sidelined bears often jump back in, accelerating the move down.

Understanding the emotional dynamics behind the bear flag can help traders avoid getting caught on the wrong side of the trend and prepare for the next leg lower.

Bear Flag vs Bull Flag: Core Differences

Bear flags and bull flags are mirror-image continuation patterns, but they form in opposite market conditions. Here’s how they differ:

- Trend direction: A bear flag forms during a downtrend and signals potential further downside. A bull flag forms during an uptrend and suggests the rally may continue.

- Flagpole behavior: The bear flag’s flagpole is a sharp drop in price, typically on high volume. In contrast, a bull flag’s pole is a strong upward surge.

- Flag formation: Bear flags create a slight upward or sideways channel after the drop. Bull flags form a downward or sideways channel following the rally.

- Breakout direction: Bear flags typically break down below the flag’s support line, resuming the bearish trend. Bull flags break out above resistance, continuing the bullish move.

- Market sentiment: Bear flags indicate temporary buyer exhaustion and sustained bearish pressure. Bull flags show brief profit-taking before buyers regain control.

By learning to distinguish these patterns, traders can align entries with the prevailing trend and avoid mistaking consolidations for reversals.

How to Identify a Bear Flag on a Chart

Here’s how to recognize a bear flag in real time:

- Look for a strong downward move: This should be steep and clear, with little hesitation.

- Identify the consolidation: Prices pause and form a small upward or sideways channel. Draw parallel lines to mark the top and bottom of the flag.

- Watch for a breakdown: The pattern completes when prices fall below the lower trendline of the flag with increased volume.

Bear flags can show up on multiple timeframes. Intraday traders might find them on 5- or 15-minute charts, while swing traders may spot them on hourly or daily charts. In the futures market, bear flags are often seen in contracts like MES, NQ, CL, or BTC during volatile moves.

Chart Example: Bear Flag in Action

Let’s walk through an example using the Micro E-mini S&P 500 (MES):

- Flagpole: MES drops from 4600 to 4540 in under an hour on strong selling volume.

- Flag: The contract retraces slowly to 4555, forming a tight upward channel.

- Breakdown: MES breaks below 4540 again, triggering a continuation move toward 4500.

This structure repeats often in fast-moving markets. The pattern’s power lies in its simplicity: a sharp move, a pause, then continuation.

Entry and Exit Strategy for Bear Flag Setups

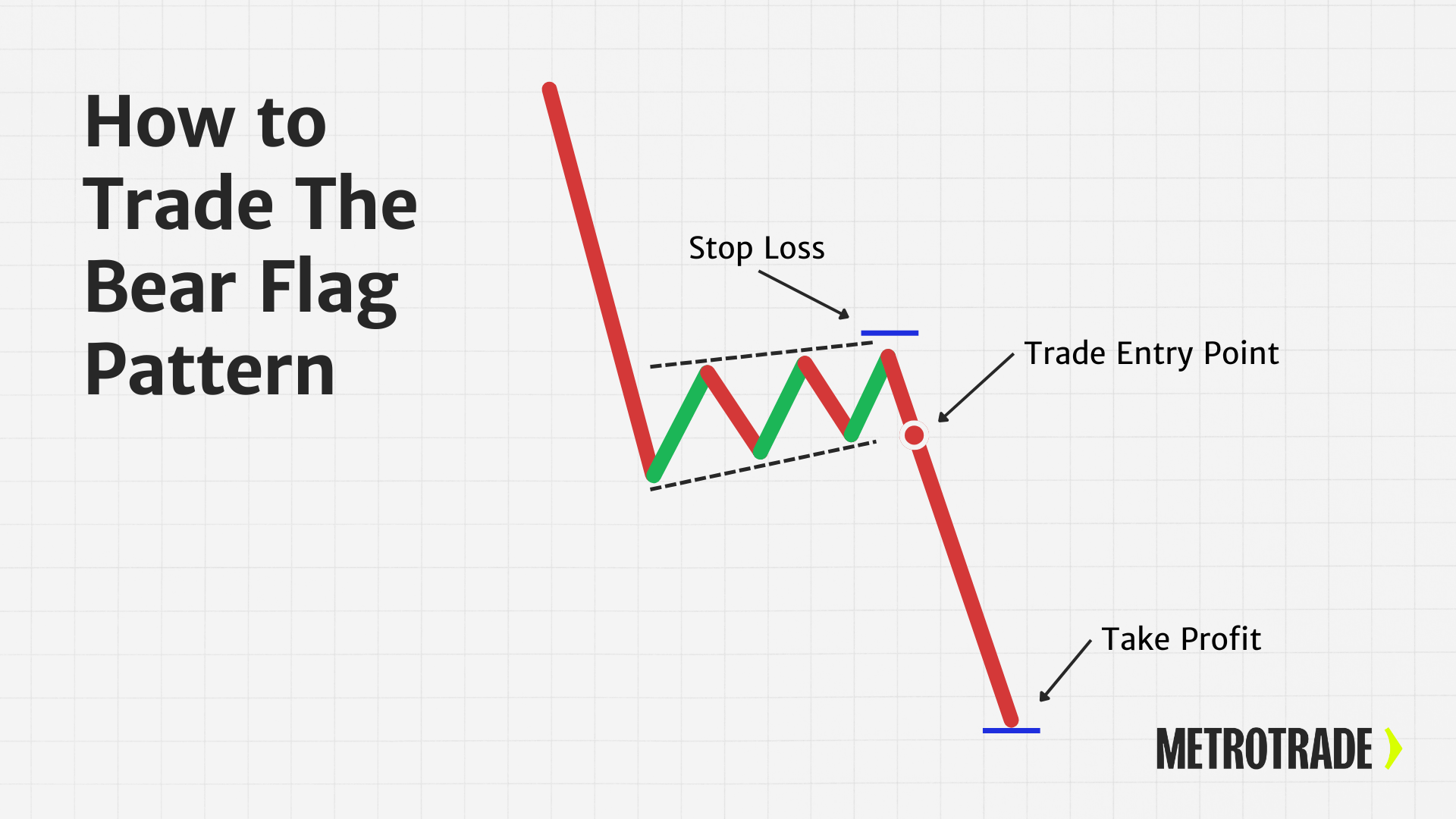

Bear flag setups work best when approached with a clear, rules-based trade plan. Here’s how traders typically structure their trades:

- Entry: Look for confirmation that the pattern is complete, such as declining volume and resistance holding at the top of the flag. Avoid entering while the price is still inside the flag unless you’re using a more aggressive strategy.

- Stop-Loss: Place your stop-loss just above the upper boundary of the flag channel. This protects against failed breakdowns and defines your maximum risk on the trade.

- Trade Entry Point: Enter the trade when the price breaks below the lower flag trendline, ideally on increased volume. Some traders wait for a candle to close below support or for a quick retest before executing.

- Take Profit: Set a profit target by measuring the height of the flagpole and projecting that distance downward from the breakdown point. This helps estimate how far the move may extend if the pattern plays out.

A disciplined entry and exit plan gives you a clear edge, especially in fast-moving markets like futures, where momentum can accelerate quickly after the breakdown.

What the Bear Flag Means for Futures Traders

Futures markets move fast and often trend sharply. That makes them an ideal setting for continuation setups like bear flags.

Why traders like bear flags in futures:

- Volatility: Strong directional moves are common.

- Leverage: A well-timed short trade can lead to amplified gains or losses.

- Liquidity: Popular contracts offer clean technical setups.

Day traders may use bear flags on MES, NQ, or CL for intraday entries. Swing traders might apply them to metals or agricultural futures on 4-hour or daily charts.

Understanding this pattern gives futures traders a tool for timing trend continuation trades with clear structure.

Enhancing Bear Flags with Technical Indicators

While bear flags can be traded using price action alone, some traders use indicators to validate setups:

- Volume: Look for falling volume during the flag and rising volume on the breakdown.

- RSI (Relative Strength Index): Bear flags often occur when RSI retraces to neutral or overbought territory during the flag. This can signal a low-risk short opportunity.

- MACD: A bearish crossover near the breakdown can support your thesis.

- Moving Averages: If the flag forms below a declining 20-period or 50-period moving average, it confirms the bearish trend is intact.

These tools help filter out false breakouts and build confidence in the trade setup.

Common Mistakes When Trading Bear Flags

Avoid these pitfalls when trading the bear flag pattern:

- Jumping in too early: Entering before a breakdown increases the chance of a false signal.

- Forcing the pattern: Not every pullback is a flag. Wait for a clear channel and volume behavior.

- Ignoring market context: Patterns are more reliable in trending markets. Avoid trading them in choppy or sideways conditions.

- Overleveraging: Futures are powerful. Always use stops and size your trades properly.

Success comes from discipline, not just pattern recognition.

Bear Flag Pattern vs Other Bearish Setups

Bear flags are just one of several bearish continuation patterns. Here’s how they compare:

- Descending Triangle: Flat support with lower highs. Less sloped than a flag.

- Rising Wedge: Price compresses upward with converging trendlines. Often more complex.

- Bear Pennant: Similar to a flag, but with converging trendlines instead of parallel ones.

Understanding these distinctions helps avoid confusion and improves chart analysis.

Tools and Platforms to Analyze Bear Flags

You can spot, draw, and analyze bear flag setups directly on the MetroTrader platform, available on both web and mobile. MetroTrader gives you the charting tools you need to identify these continuation formations in real time.

Here’s how MetroTrader supports bear flag analysis:

- Custom timeframes: View charts in 1-minute, 5-minute, 15-minute, hourly, or daily intervals depending on your trading style.

- Drawing tools: Use built-in parallel channels and trendline tools to outline the flagpole and flag boundaries clearly.

- Volume overlays: Apply volume studies to help confirm declining volume during the flag and surging volume during the breakdown.

- Technical indicators: Add RSI, MACD, moving averages, and more to support your bear flag thesis and spot potential entry signals.

Whether you’re trading micro contracts like MES or looking for setups in crude oil, gold, or Bitcoin futures, MetroTrader helps you analyze patterns with precision and speed.

Incorporating Bear Flags into Your Strategy

The bear flag pattern works best when it’s part of a larger trading strategy. Consider these tips:

- Backtest your rules: Look at historical data and test entries, stops, and targets.

- Keep a playbook: Document examples of bear flags that worked (and ones that didn’t).

- Combine with macro or news: Major economic events can trigger or break patterns. Be aware of the context.

Conclusion

The bear flag pattern is a reliable continuation setup that gives traders a structured way to enter short trades during a downtrend. When used properly, it offers a clear entry point, defined risk, and measurable profit target — all critical components of a disciplined trading strategy.

This pattern is especially powerful in fast-moving markets like futures, where trends can develop quickly and extend further than expected. But like any setup, bear flags work best when confirmed by volume, trend indicators, and broader market context.

Ready to put this strategy into action?

Open a live MetroTrader account today and start trading bear flag setups with real-time charts, low margins, and access to the most active futures markets.

FAQs

What is a bear flag pattern in trading?

A bear flag pattern is a chart formation that signals a potential continuation of a downtrend. It forms after a sharp price drop, followed by a brief upward or sideways consolidation before another move lower.

Is the bear flag pattern bullish or bearish?

The bear flag pattern is a bearish continuation pattern. It suggests that the current downtrend is likely to resume after a temporary pause in price action.

What timeframe is best for identifying a bear flag pattern?

Bear flag patterns can appear on any timeframe, but they are most effective on 5-minute, 15-minute, hourly, and daily charts. The best timeframe depends on your trading style and strategy.

How do you confirm a bear flag pattern?

A bear flag is confirmed when price breaks below the lower boundary of the flag channel, ideally on rising volume. Some traders use indicator confirmation, such as RSI or MACD, to support the setup.

How reliable is the bear flag pattern?

The bear flag pattern is generally considered reliable in strong downtrending markets, but no pattern is guaranteed. Its success depends on proper confirmation, risk management, and market conditions.

Can the bear flag pattern be used in futures and crypto markets?

Yes, bear flags are commonly used in both futures and crypto trading. These fast-moving markets often produce clean continuation setups like the bear flag.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.