Profit Off Predictions with Event Contracts

Trade ideas built around daily outcomes.

Event contracts are a simple way to take a position on whether a market will finish above or below a certain level. They’ve become popular in futures markets — and even more so in prediction markets covering sports, politics, and other real-world events.

What are Event Contracts?

Event contracts are short-term trading products that let you speculate on whether a market will close above or below a certain level at the end of the day. They are built around simple yes-or-no questions and settle daily with a fixed payout.

These contracts are listed on regulated exchanges like CME Group and are available across major markets, including:

- Equity Indexes: S&P 500, Nasdaq, and Dow

- Metals: Gold and Silver

- Energy: Crude Oil and Natural Gas

- Crypto & FX: Bitcoin and Euro/USD

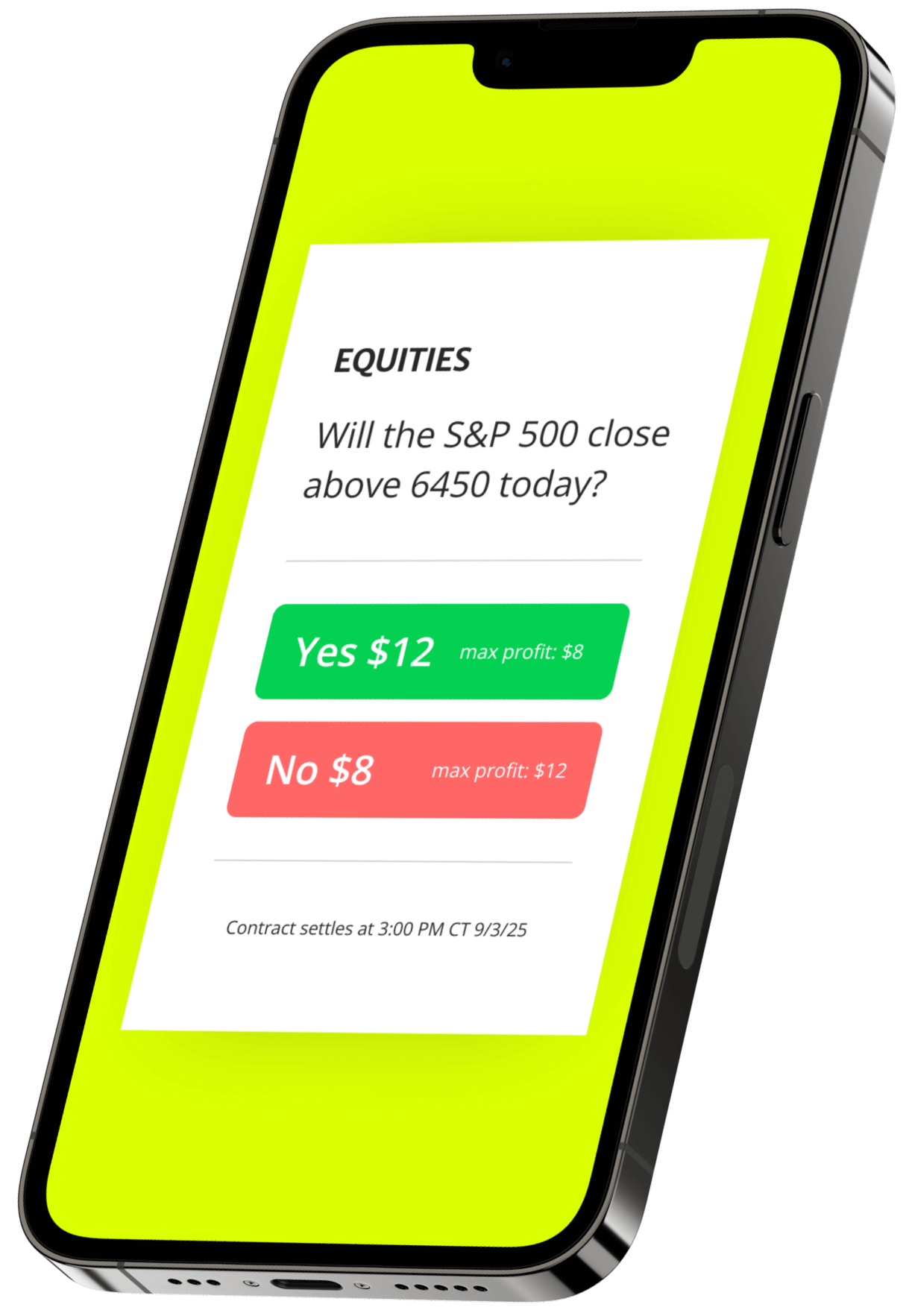

How Event Contracts Work

Choose a Market

Pick from popular futures markets like the S&P 500, gold, crude oil, or natural gas.

Take a Side

Decide whether the market will finish above or below a specific price level by the end of the trading day.

Buy “Yes” or “No”

Purchase a contract for as little as a few dollars. Your maximum loss is the price you pay.

Settle at Expiration

If your prediction is correct, you receive the fixed payout. If not, you lose only your entry cost.

Why Traders Use Event Contracts

Low upfront cost

Event contracts can often be purchased for just a few dollars, making them accessible to traders without requiring a large amount of capital.

Defined risk and reward

Your maximum loss is limited to the price you pay, and your maximum gain is capped at a fixed payout, so you always know the potential outcome before entering a trade.

Short-term opportunities

Because event contracts settle daily, they allow traders to speculate on short-term market moves without holding positions overnight.

Simple structure

With a straightforward yes-or-no format, event contracts are easier to understand than traditional futures contracts, making them appealing to new traders.

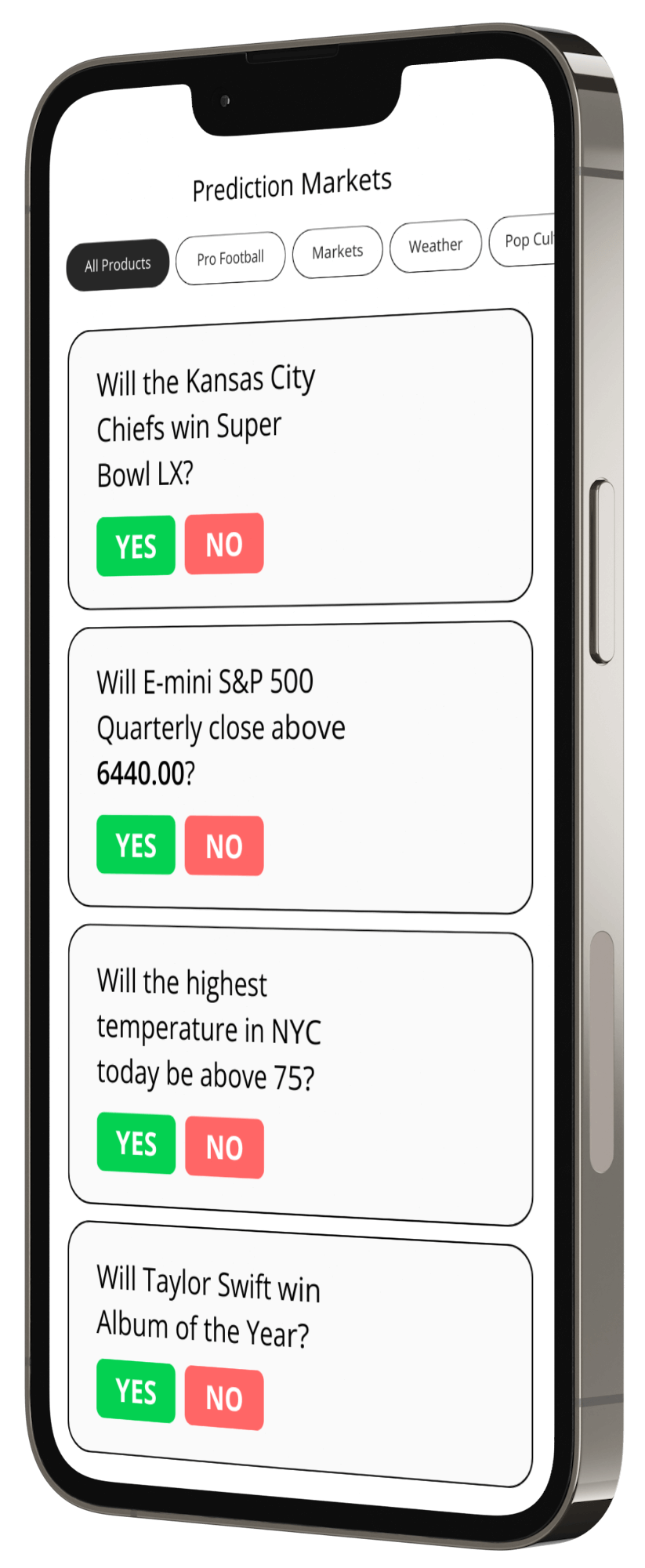

Going Beyond Financial Markets

While CME event contracts focus on financial markets, the same format has expanded into broader prediction markets.

These allow traders to speculate on real-world outcomes, such as:

- Which political candidate will win an election

- Whether a sports team will win a game

- If temperatures will hit a certain level

- The outcome of cultural or entertainment events

Platforms like Kalshi and Polymarket have made prediction markets more accessible, showing how event-style contracts are gaining traction outside of traditional finance.

Frequently Asked Questions

What is an event contract?

An event contract is a short-term yes-or-no trading product that pays a fixed amount if a market finishes above or below a set level at the end of the trading day.

How do event contracts work?

You buy a “Yes” or “No” contract on a market outcome. If your prediction is correct, you receive the fixed payout. If not, your loss is limited to the price you paid for the contract.

What markets offer event contracts?

CME Group lists event contracts in equity indexes, energy, metals, crypto, and FX. Examples include the S&P 500, gold, crude oil, and Bitcoin.

What is the difference between event contracts and futures?

Event contracts are capped, low-cost, daily products with fixed payouts. Futures contracts are larger, margin-based products with more flexibility, deeper liquidity, and the ability to hold longer-term positions.

What is a prediction market?

A prediction market is a platform where participants trade contracts tied to real-world outcomes, such as elections, sports games, or weather events. Prices reflect the market’s collective view of the probability of that outcome.

How are prediction markets different from event contracts?

Event contracts are regulated financial products listed on exchanges like CME, while prediction markets often cover non-financial events and may operate outside traditional financial regulation.

Can you trade sports or politics with event contracts?

No. Event contracts are limited to financial markets like indexes, metals, energy, and currencies. Sports, politics, and entertainment outcomes are typically traded on prediction market platforms instead.

Does MetroTrade offer event contracts or prediction markets?

MetroTrade does not currently offer event contracts or prediction markets. We focus on low-cost futures trading, giving you access to the same underlying financial markets with more trading flexibility.