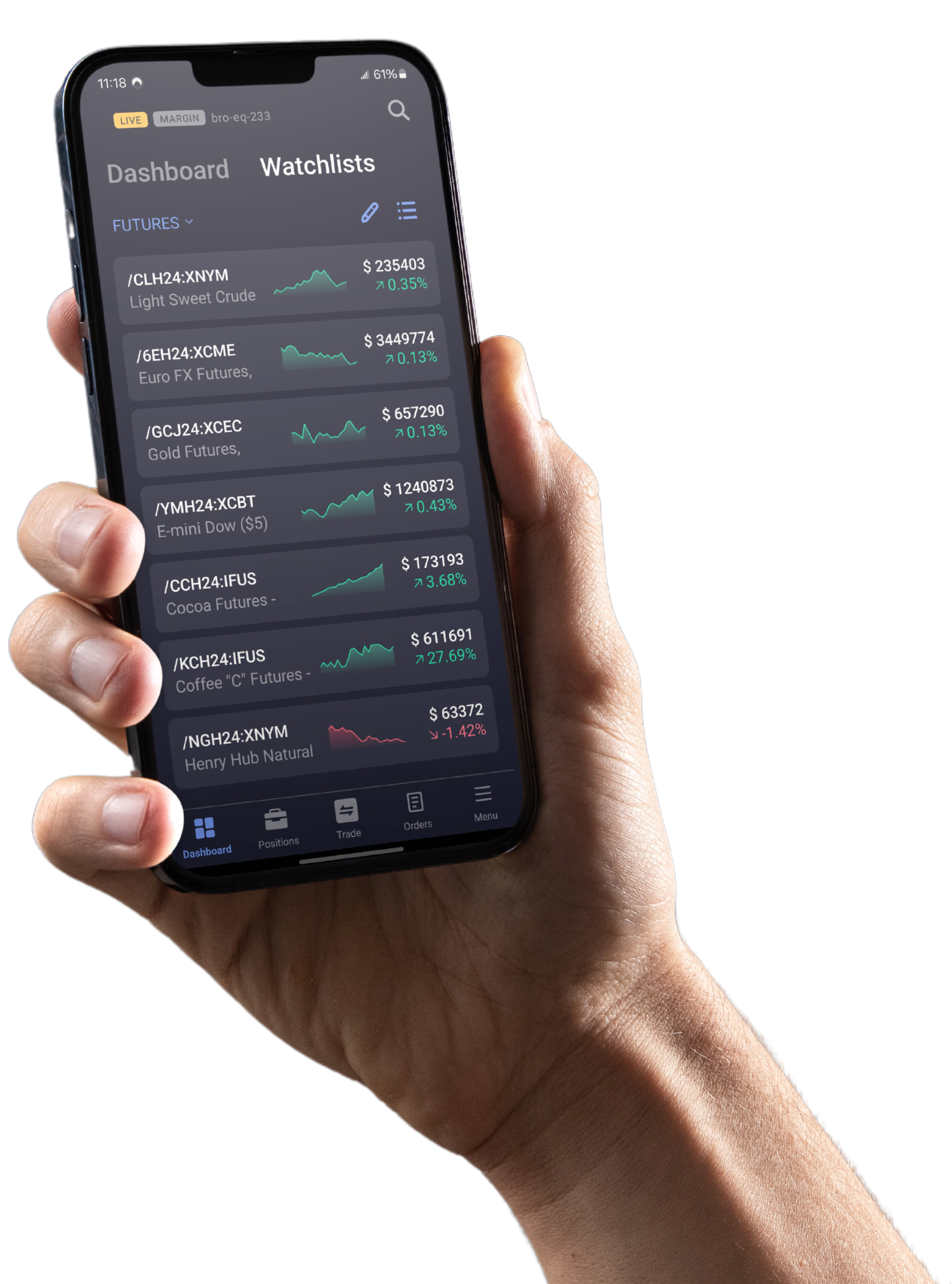

Access Global Markets

Trade Agricultural Futures

What are Agricultural Futures?

Agricultural futures are standardized contracts for physical commodities including corn, soybeans, wheat, cattle, and hogs, delivered at a specified future date and predetermined price.

These markets represent the foundation of modern futures trading, originally developed to help farmers and grain merchants manage seasonal price risk. Today, agricultural futures continue to serve producers seeking price protection and traders analyzing global supply and demand fundamentals. From crop yields affected by weather patterns to livestock production cycles, agricultural futures reflect real-time market assessments of food supply chains. These contracts provide exposure to factors including seasonal growing conditions, global trade flows, and consumption trends.

Grains

Includes contracts like corn and wheat, used globally for food, feed, and production. Highly sensitive to weather and global trade flows.

Oilseeds

Covers soybeans, soybean oil, and soybean meal, essential to plant-based food, livestock feed, and biofuel markets.

Livestock

Includes live cattle and lean hogs. Used to hedge or speculate on meat prices driven by supply chains, feed costs, and consumer demand.

Trade Agricultural Futures

at MetroTrade

Contracts Available

| Code | Product Name | Contract Size | Min. Tick Size | Trading Hours (CST) |

|---|---|---|---|---|

| /ZC | Corn Futures | 5,000 bushels | 0.25¢/bushel = $12.50 | Sun–Fri: 7 PM – 7:45 AM; Mon–Fri: 8:30 AM – 1:20 PM |

| /XC | E-mini Corn Futures | 1,000 bushels | 0.125¢/bushel = $1.25 | Sun–Fri: 7 PM – 7:45 AM; Mon–Fri: 8:30 AM – 1:20 PM |

| /ZW | Chicago SRW Wheat Futures | 5,000 bushels | 0.25¢/bushel = $12.50 | Sun–Fri: 7 PM – 7:45 AM; Mon–Fri: 8:30 AM – 1:20 PM |

| /XW | E-mini Chicago SRW Wheat Futures | 1,000 bushels | 0.00125¢/bushel = $1.25 | Sun–Fri: 7 PM – 7:45 AM; Mon–Fri: 8:30 AM – 1:20 PM |

| /ZS | Soybean Futures | 5,000 bushels | 0.25¢/bushel = $12.50 | Sun–Fri: 7 PM – 7:45 AM; Mon–Fri: 8:30 AM – 1:20 PM |

| /XK | E-mini Soybean Futures | 1,000 bushels | 0.00125¢/bushel = $1.25 | Sun–Fri: 7 PM – 7:45 AM; Mon–Fri: 8:30 AM – 1:20 PM |

| /ZL | Soybean Oil Futures | 60,000 lbs | $0.0001/lb = $6.00 | Sun–Fri: 7 PM – 7:45 AM; Mon–Fri: 8:30 AM – 1:20 PM |

| /ZM | Soybean Meal Futures | 100 short tons | $0.10/ton = $10.00 | Sun–Fri: 7 PM – 7:45 AM; Mon–Fri: 8:30 AM – 1:20 PM |

| /LE | Live Cattle Futures | 40,000 lbs | $0.025/lb = $10.00 | Mon–Fri: 8:30 AM – 1:05 PM |

| /HE | Lean Hog Futures | 40,000 lbs | $0.025/lb = $10.00 | Mon–Fri: 8:30 AM – 1:05 PM |

Access Contracts of All Sizes

Full Size

Full-size futures contracts represent the standard, complete unit of a financial index or commodity in the futures market. These contracts offer larger position sizes and potentially greater profit (or loss) potential, they also require more capital and carry higher risk compared to their E-mini and Micro counterparts.

E-mini

E-minis are a standard futures contract that is broken down into a fractional portion of a financial index. The “E” designates it is traded electronically. When launched in 1997, E-minis were a fraction of the size of pit-traded contracts, but they have come to dominate the futures markets.

Micro E-mini

Trade a slice of CME’s liquid futures markets and get the same capital efficiency as standard E-mini contracts with less upfront financial commitment.

Frequently Asked Questions

What are agricultural futures used for?

Agricultural futures are contracts used to hedge against price volatility in key commodities like corn, wheat, soybeans, and livestock. They allow farmers, producers, and investors to lock in prices ahead of harvest or production.

Who trades agricultural futures?

These contracts are traded by a mix of participants, including farmers, food processors, institutional investors, and speculators, each with different goals such as price protection or profit from market movements.

Are agricultural futures suitable for beginner traders?

While they offer valuable opportunities, agricultural futures can be volatile and influenced by unpredictable events like weather or disease. Beginners should start with strong risk management strategies and consider paper trading or educational platforms before committing real capital.

What factors influence agricultural futures prices?

Prices are heavily influenced by weather patterns, global supply and demand, government policies, seasonal cycles, and geopolitical events that affect trade and crop yields.

How are agricultural futures different from other futures contracts?

Agricultural futures tend to be more affected by natural factors like droughts or disease compared to financial or energy futures, making them uniquely sensitive to short-term shocks in supply.

Do I need to take delivery of the physical commodity?

No, most agricultural futures positions are closed before expiration.

No Minimum Deposit Required

Whether you’re new to futures trading or an experienced trader, we get you on track to begin your trading journey with flexibility. No need for large initial deposits—start with an amount that suits you and grow from there.