Smart trading is not just about chasing profits. It is about managing risk with discipline and consistency. Every trade involves some level of uncertainty, and even a promising setup can lead to a loss. That is why having a simple, reliable risk management rule can help traders stay in the game longer.

The 3-5-7 rule gives traders a structured way to control how much they risk on each trade, how much they expose across their entire portfolio, and how much they aim to make when trades go right. This rule is easy to follow, especially for beginners, and it can be adapted over time as a trader’s experience grows.

In this guide, we will explain how the 3-5-7 rule works, why it matters, and how to use it in real-world trading. You will also learn how to apply it using a free demo account, and how it fits into your overall trading strategy.

Key Takeaways

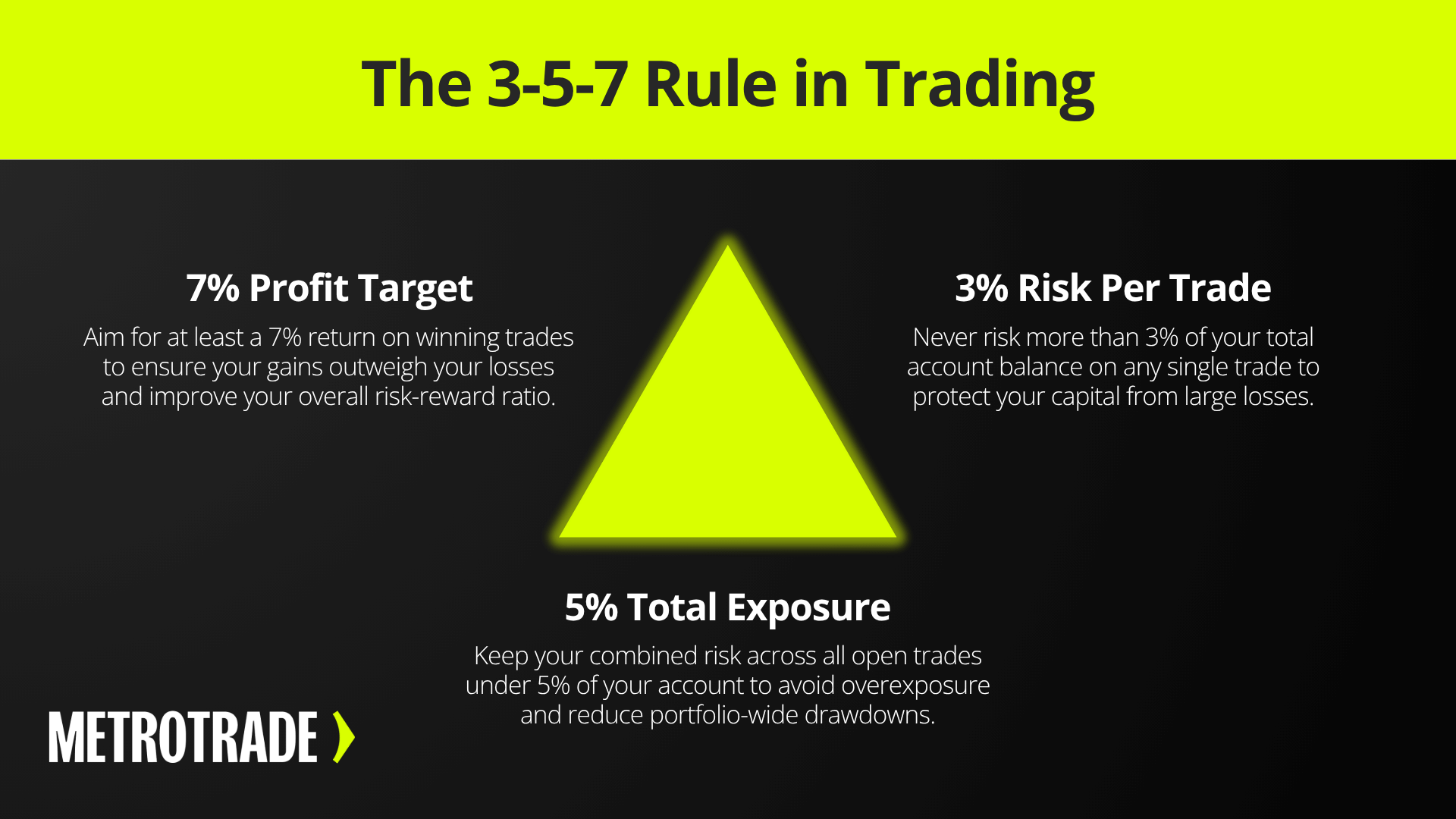

- The 3-5-7 rule is a simple trading risk management strategy. It limits how much you risk per trade (3%), how much you expose across all open trades (5%), and sets a clear target for profit on winners (7%).

- Risking no more than 3% per trade protects your capital. This cap ensures a single loss won’t damage your account and helps you trade more objectively.

- Limiting total exposure to 5% keeps your portfolio balanced. It prevents overcommitment to any single market or trade idea, reducing the impact of correlated losses.

- Targeting at least 7% profit improves your risk-reward ratio. By making your winners larger than your losers, you don’t have to win every trade to grow your account over time.

What Is the 3-5-7 Rule in Trading?

The 3-5-7 rule is a straightforward risk management framework that helps traders limit losses, manage exposure, and focus on high-quality trade setups. It’s designed to bring structure and discipline to the decision-making process, especially in volatile or fast-moving markets like futures.

At its core, the 3-5-7 rule sets three clear boundaries:

- 3%: The maximum amount of your trading capital you should risk on any single trade.

- 5%: The total amount of capital you should have exposed across all open trades at any given time.

- 7%: The minimum profit you should aim to make on your winning trades.

Each number serves a purpose. The 3% rule limits the damage from any single bad trade. The 5% rule protects your portfolio from being too concentrated or overleveraged. The 7% rule keeps your focus on trades with strong potential, helping your winners do more work than your losers.

Unlike complex trading systems or technical models, the 3-5-7 rule does not require advanced math, indicators, or software. It can be applied manually, with a calculator or spreadsheet, or with built-in tools on your trading platform. And because it’s rooted in percentages, it scales easily with your account size, whether you’re trading with $1,000 or $100,000.

Many traders use the 3-5-7 rule as a foundation for more advanced strategies. Others use it as a core system for managing trades across futures, stocks, forex, or crypto. It’s especially helpful for newer traders who are still developing consistency and learning how to protect their capital.

Why the 3-5-7 Rule Matters

Risk is unavoidable in trading. Every trade carries the possibility of loss, no matter how strong the setup looks. What separates successful traders from inconsistent ones isn’t just their ability to find winners, it’s their ability to control risk, protect capital, and maintain discipline over time. That’s where the 3-5-7 rule makes a difference.

This rule matters because it forces structure into your trading. Without a clear framework, it’s easy to fall into emotional patterns: chasing losses, doubling down on bad trades, or overexposing your account when a setup looks “too good to miss.” These behaviors are common, and they often lead to steep drawdowns or account blow-ups.

The 3-5-7 rule helps reduce these risks by setting simple, enforceable limits on:

- How much you can lose on a single trade (3%)

- How much you can have exposed at once (5%)

- How much you aim to gain when a trade goes your way (7%)

This creates a built-in balance between caution and reward. You’re limiting downside while giving yourself room to grow. And because the math is clear from the start, you can plan every trade around defined numbers rather than gut feeling.

Traders often underestimate how much psychology plays into performance. When you know your losses are capped, you’re more likely to stay calm, follow your strategy, and avoid reactive decisions. When you aim for solid profit targets, you avoid settling for small gains that barely move your account forward.

Over time, this kind of consistency compounds. A trader who follows the 3-5-7 rule may not win every trade, but they protect themselves from big setbacks and give their winners enough room to make up for the losers.

In short, the 3-5-7 rule isn’t just about managing numbers. It’s about creating a repeatable system that keeps you focused, rational, and in control, even when markets are unpredictable.

The ‘3’: Risk No More Than 3% Per Trade

The first part of the rule is about how much you can afford to lose on a single trade. The 3% limit means that if the trade goes against you, it should only cost you a small portion of your account.

Why 3%?

- It protects your capital from large hits.

- It keeps you in the game even after a losing streak.

- It forces you to think carefully about stop-loss placement and trade size.

How to Calculate 3% Risk Per Trade

Let’s say you have a $10,000 account.

- 3% of $10,000 is $300

- This means your maximum loss on any one trade should not exceed $300

To calculate position size based on this rule, use this formula:

Position size = Maximum risk ÷ Stop-loss distance

If your stop-loss is 10 points, and you want to risk $300, you would trade 30 contracts if each point is worth $1. Always match your size to your stop-loss and risk tolerance.

The ‘5’: Limit Total Market Exposure to 5%

The second part of the rule controls how much total capital you have exposed at once. Even if each trade follows the 3% rule, having too many trades open can still put your portfolio at risk.

What Does 5% Exposure Mean?

It means you should not have more than 5% of your capital actively at risk across all trades. That includes correlated positions. If one market falls, others may follow, increasing your total loss.

Example:

With a $50,000 account, the most you should have exposed across all trades is $2,500.

This rule encourages diversification and prevents overloading your account with similar trades. It can also stop you from chasing too many opportunities at once.

The ‘7’: Target at Least 7% Profit on Winning Trades

The final part of the rule shifts the focus to profit targets. While it is important to protect capital, it is just as important to make your wins count.

Why Aim for 7%?

- It sets a positive risk-reward ratio

- It keeps you from exiting trades too early

- It balances out losses from failed trades

A common risk-reward setup with the 3-5-7 rule is risking 3% to make 7%, which is slightly more than a 2:1 ratio.

Example:

If you risk $300, you aim to make at least $700 on that trade. This way, even if you only win 4 out of 10 trades, you could still end up profitable.

This mindset avoids the trap of taking small profits while letting losses run. It encourages patience and better trade selection.

Real-Life Example: How the 3-5-7 Rule Works in Practice

Let’s walk through a full scenario using a $10,000 trading account.

Step 1: Set Up a Trade

You identify a strong technical setup on a crude oil futures contract. You decide to risk 3% on the trade.

- 3% of $10,000 = $300

- Your stop-loss is 15 points

- Each point is worth $10

- You trade 2 contracts (15 x $10 x 2 = $300 risk)

Step 2: Check Portfolio Exposure

You have one other trade open in the E-mini S&P 500 with $200 risk. Together, your total exposure is $500.

- $500 ÷ $10,000 = 5%

- You are within the 5% total exposure rule

Step 3: Set Profit Targets

You set a take-profit level that would net a $700 gain on the crude oil trade.

- This is a 7% gain on your total capital

- It creates a risk-reward ratio of a little over 2:1

Result

If the crude oil trade hits your stop, you lose $300. If it hits your take-profit, you make $700. As long as you stay consistent, your wins will outweigh your losses over time.

Tools and Techniques to Help Apply the Rule

Using the 3-5-7 rule effectively means staying organized, prepared, and disciplined. Fortunately, there are plenty of tools and techniques that can help you apply this framework with consistency.

Risk Management Tools

- A position size calculator can help you quickly determine how many contracts or shares to trade based on your stop-loss and 3% risk cap.

- Setting stop-loss and take-profit orders directly in your trading platform ensures you stay within your defined limits without needing to react in real time.

- Keeping a risk log or trading journal helps you track how much exposure you have across trades and how well you’re sticking to the rule.

Trading Platform Features

- Many modern platforms offer features that allow you to monitor total exposure across all open positions in real time.

- You can create alerts that notify you when your total open risk approaches your 5% threshold, helping you avoid overexposure.

- Platforms like MetroTrader give you access to customizable charting and risk-management tools that support strategy development and execution.

Mindset and Habits

- Avoiding revenge trades after a loss helps you stay aligned with the 3% risk rule and keeps your emotions in check.

- Sticking to your 7% profit target reduces the temptation to take profits too early or close a trade out of fear.

- Following a routine that includes pre-trade planning and post-trade review builds long-term discipline and confidence in your system.

Benefits of Using the 3-5-7 Rule

This rule may seem basic, but it supports long-term success in many ways.

- Protects your capital by limiting exposure and drawdowns

- Builds discipline through clear risk rules and profit targets

- Supports consistent decision-making regardless of market conditions

- Improves trade quality by forcing you to prioritize risk-reward setups

Traders who apply this rule often stay more focused, more patient, and more prepared for losses. That mindset can make a big difference over time.

Limitations and Considerations

The 3-5-7 rule is not a one-size-fits-all solution. Like any strategy, it has some limitations:

- It may be too conservative for small accounts or active scalpers.

- It assumes that markets are liquid and easy to enter and exit.

- It does not guarantee success without good trade selection and discipline.

Also, some traders may choose to modify the percentages over time based on their risk tolerance, experience, or account size.

How to Practice the 3-5-7 Rule on a Demo Account

The best way to build confidence using this rule is to test it with zero real money at stake.

Use a Demo Account To:

- Try different trade sizes and stop-loss levels

- Practice applying the 3%, 5%, and 7% limits

- See how your strategy performs over 50 or 100 trades

MetroTrade offers a 30-day free demo account loaded with $5,000 in simulated capital. You can use this to apply the 3-5-7 rule in real market conditions and gain experience before going live.

Should You Use the 3-5-7 Rule?

The 3-5-7 rule is a simple, effective approach to managing risk in trading. It does not rely on complex formulas or advanced tools. Instead, it gives you a reliable framework for making smarter trading decisions and avoiding emotional mistakes.

It works especially well for beginners and intermediate traders who want to improve consistency without overcomplicating their strategy. Even experienced traders can benefit from the discipline this rule creates.

If you want to trade with more structure and confidence, give the 3-5-7 rule a try. Start with a demo account, stay consistent, and adapt the rule as you grow.

FAQs

What is the 3-5-7 rule in trading?

The 3-5-7 rule is a trading risk management strategy that limits risk to 3% of your account per trade, restricts total exposure to 5% across all open positions, and sets a 7% profit target on winning trades. It helps traders control losses and improve long-term consistency.

How do you calculate 3% risk per trade?

To calculate 3% risk per trade, multiply your total account balance by 0.03. For example, if your account has $10,000, your maximum allowed risk on a single trade is $300. Use this number to determine your position size based on your stop-loss level.

Why is limiting total exposure to 5% important?

Limiting total exposure to 5% reduces the risk of large portfolio drawdowns if multiple trades go against you. It encourages diversification, prevents overleveraging, and protects your account from concentrated losses in correlated markets.

What does a 7% profit target mean in trading?

A 7% profit target means aiming for gains that are at least 7% of your total account size on winning trades. This helps ensure your winners are large enough to cover multiple small losses, improving your overall risk-reward ratio and profitability.

Is the 3-5-7 rule good for beginner traders?

Yes, the 3-5-7 rule is ideal for beginner traders because it sets clear risk limits and profit goals. It encourages discipline, protects capital, and provides a simple framework that can be used across different markets like futures, stocks, and forex.

Can futures traders use the 3-5-7 rule?

Yes, futures traders can apply the 3-5-7 rule by adjusting contract size, setting stop-loss and take-profit levels, and monitoring total portfolio exposure. The rule works well for intraday and swing trading strategies across futures markets.

The content provided is for informational and educational purposes only and should not be considered trading, investment, tax, or legal advice. Futures trading involves substantial risk and is not suitable for every investor. Past performance is not indicative of future results. You should carefully consider whether trading is appropriate for your financial situation. Always consult with a licensed financial professional before making any trading decisions. MetroTrade is not liable for any losses or damages arising from the use of this content.